Investors Still Aren't Entirely Convinced By Alignment Healthcare, Inc.'s (NASDAQ:ALHC) Revenues Despite 25% Price Jump

Alignment Healthcare, Inc. (NASDAQ:ALHC) shareholders have had their patience rewarded with a 25% share price jump in the last month. The last 30 days bring the annual gain to a very sharp 92%.

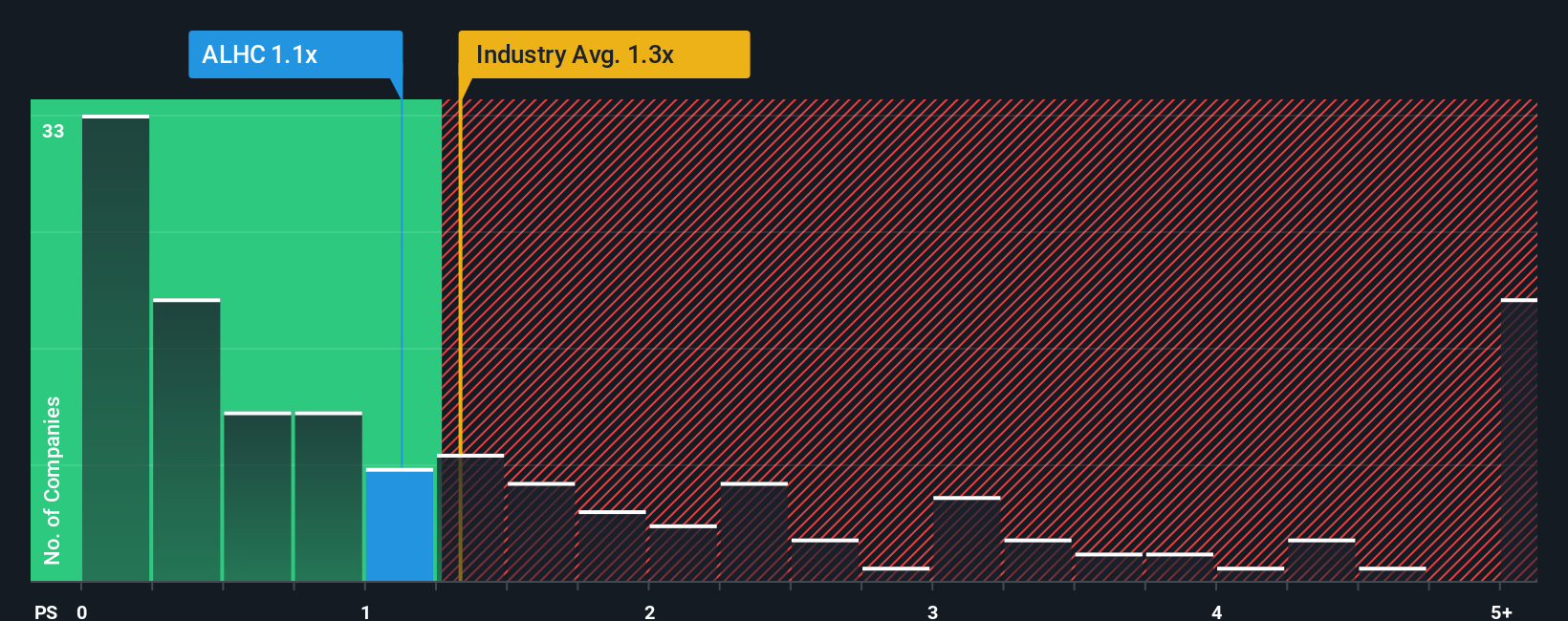

Although its price has surged higher, you could still be forgiven for feeling indifferent about Alignment Healthcare's P/S ratio of 1.1x, since the median price-to-sales (or "P/S") ratio for the Healthcare industry in the United States is also close to 1.3x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Alignment Healthcare

What Does Alignment Healthcare's P/S Mean For Shareholders?

Recent times have been advantageous for Alignment Healthcare as its revenues have been rising faster than most other companies. One possibility is that the P/S ratio is moderate because investors think this strong revenue performance might be about to tail off. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Keen to find out how analysts think Alignment Healthcare's future stacks up against the industry? In that case, our free report is a great place to start.How Is Alignment Healthcare's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Alignment Healthcare's is when the company's growth is tracking the industry closely.

If we review the last year of revenue growth, the company posted a terrific increase of 47%. The strong recent performance means it was also able to grow revenue by 165% in total over the last three years. Accordingly, shareholders would have definitely welcomed those medium-term rates of revenue growth.

Shifting to the future, estimates from the eleven analysts covering the company suggest revenue should grow by 27% each year over the next three years. Meanwhile, the rest of the industry is forecast to only expand by 5.9% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that Alignment Healthcare's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What Does Alignment Healthcare's P/S Mean For Investors?

Its shares have lifted substantially and now Alignment Healthcare's P/S is back within range of the industry median. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Looking at Alignment Healthcare's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. When we see a strong revenue outlook, with growth outpacing the industry, we can only assume potential uncertainty around these figures are what might be placing slight pressure on the P/S ratio. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

There are also other vital risk factors to consider before investing and we've discovered 1 warning sign for Alignment Healthcare that you should be aware of.

If you're unsure about the strength of Alignment Healthcare's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal