Eastern Bankshares (EBC): Taking a Fresh Look at Valuation After Recent Share Price Pullback

Eastern Bankshares (EBC) has quietly outperformed many regional peers, with the stock up about 12% over the past year and roughly 21% across the past 3 years, despite some recent weekly weakness.

See our latest analysis for Eastern Bankshares.

Despite a recent 1 week share price pullback, Eastern Bankshares still shows constructive momentum, with a roughly 8 percent 1 month share price return and solid double digit multi year total shareholder returns suggesting confidence in its growth and risk profile.

If EBC has you rethinking where the next steady compounder might come from, this could be a good moment to explore fast growing stocks with high insider ownership.

With earnings growing faster than revenue and shares still trading below analyst targets, the key question now is whether Eastern Bankshares is quietly undervalued, or if the market is already pricing in its next leg of growth.

Most Popular Narrative Narrative: 13.6% Undervalued

With Eastern Bankshares last closing at $18.79 against a narrative fair value of $21.75, the story centers on how aggressive growth assumptions bridge that gap.

The successful merger with Cambridge Trust and its integration into Eastern Bankshares creates a stronger organization with enhanced service offerings, which is expected to drive future revenue and earnings growth, particularly in the Greater Boston, Eastern Massachusetts, and New Hampshire markets.

Curious how expected double digit top line growth, surging margins and a sharply lower future earnings multiple can still point to upside, not excess optimism? Read on.

Result: Fair Value of $21.75 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, elevated reserves for office loans and recent GAAP net losses from merger charges highlight how credit quality issues or integration hiccups could quickly challenge this upside case.

Find out about the key risks to this Eastern Bankshares narrative.

Another Way to Look at Value

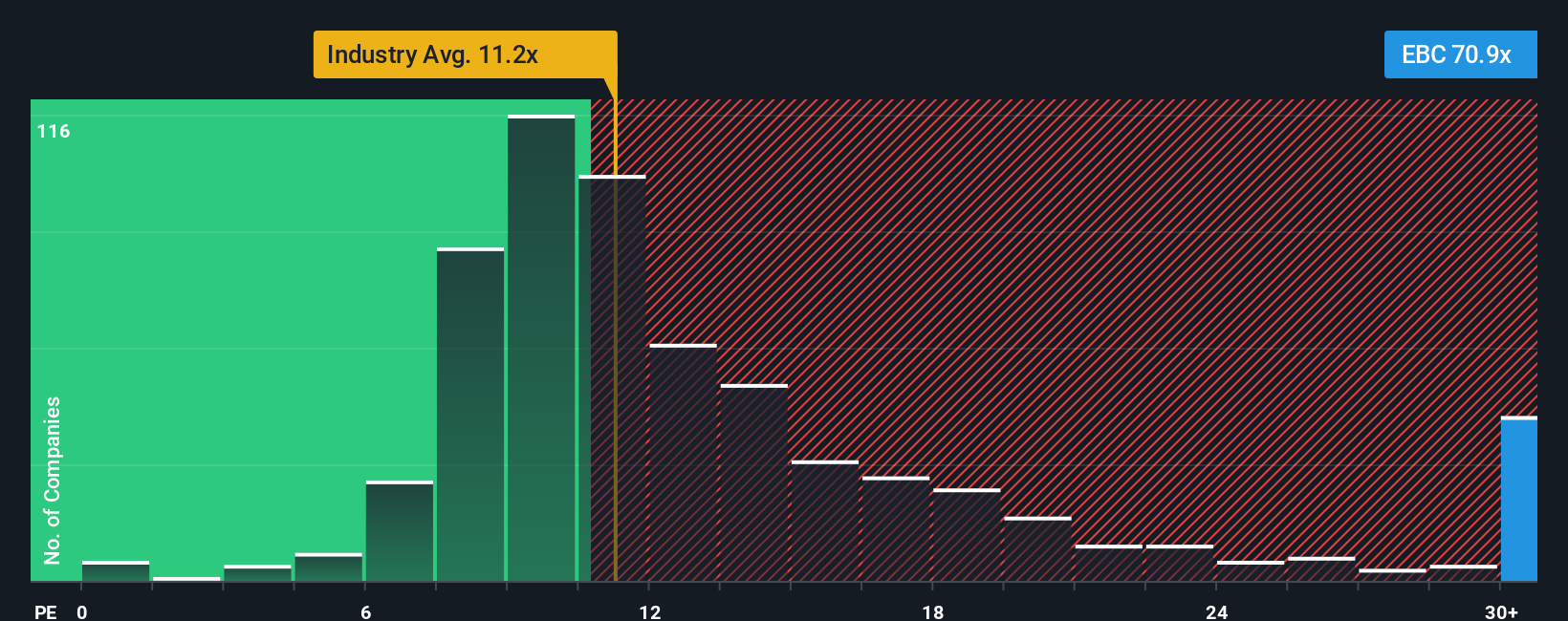

On simple earnings metrics, Eastern Bankshares looks anything but cheap. Its current P E of 90.5 times towers over both the US banks average of 12 times and peers at 15.3 times. It also sits well above a fair ratio of 38.7 times, raising the risk that any slip in growth could hit the share price hard.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Eastern Bankshares Narrative

If you see the numbers differently or would rather dive into the figures yourself, you can build a complete view in minutes with Do it your way.

A great starting point for your Eastern Bankshares research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If Eastern Bankshares has sharpened your curiosity, do not stop here, your next standout opportunity could be waiting in the screener before the crowd notices.

- Capture early momentum in high potential names by scanning these 3624 penny stocks with strong financials before they hit the mainstream radar.

- Position yourself for the next wave of intelligent automation with these 25 AI penny stocks powering breakthroughs across industries.

- Lock in stronger risk reward setups by targeting these 914 undervalued stocks based on cash flows where current prices trail long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal