Alphamab Oncology (SEHK:9966): Assessing Valuation After New Breakthrough Therapy and IND Milestones

Alphamab Oncology (SEHK:9966) just cleared two important regulatory hurdles, with US breakthrough therapy status for JSKN003 and China IND acceptance for JSKN027, tightening investor focus on how these ADC assets might reshape its valuation.

See our latest analysis for Alphamab Oncology.

The latest catalysts come after a powerful run, with the share price last closing at HK$10.91 and a year to date share price return of 218.08 percent. The 5 year total shareholder return of negative 27.56 percent shows how early this turnaround still is.

If Alphamab has you rethinking what is possible in oncology, it could be a good moment to explore other specialised opportunities across healthcare stocks.

With the shares now trading well above the average analyst target but still showing a large modelled intrinsic discount, is Alphamab a rare mispriced growth play, or are markets already baking in blue sky from its ADC pipeline?

Price-to-Earnings of 41.1x: Is it justified?

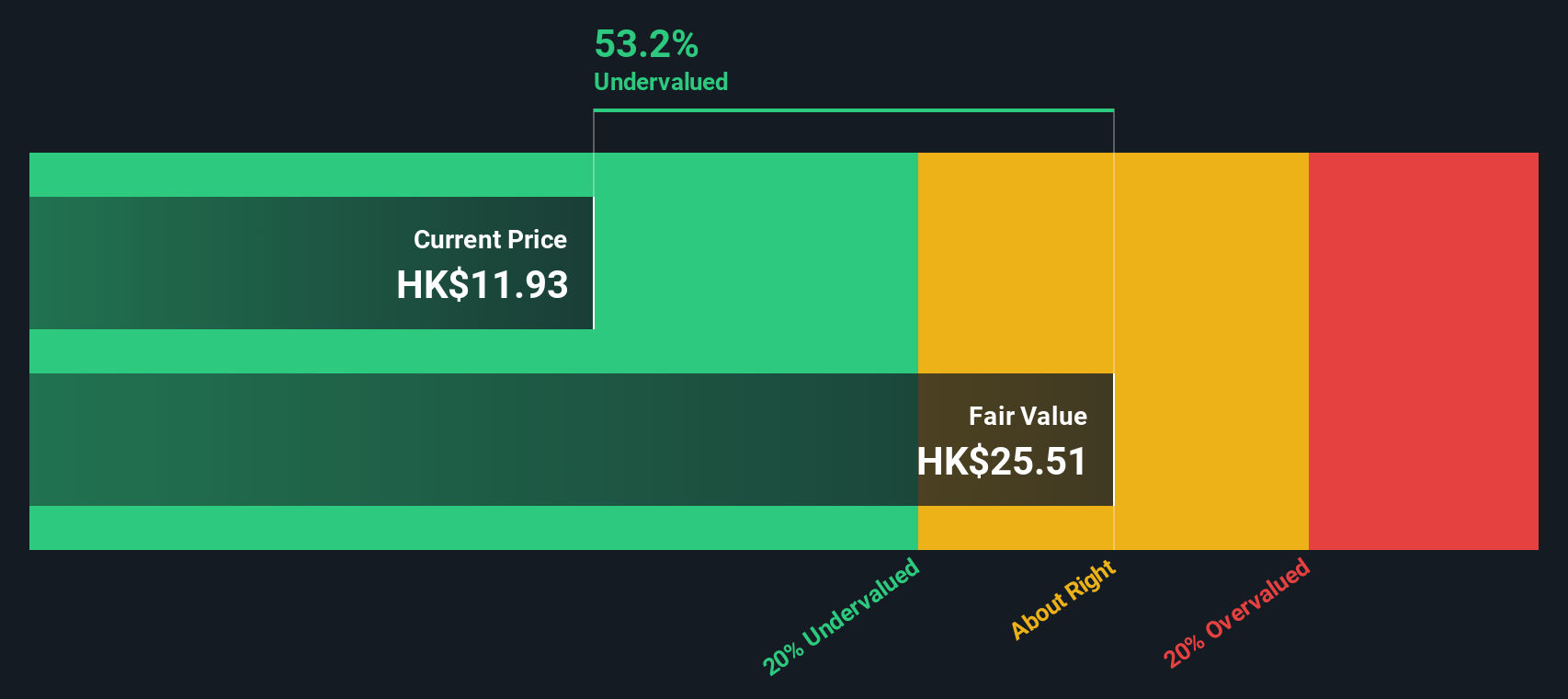

Our DCF model estimates a fair value of HK$25.75 for Alphamab, versus the last close at HK$10.91, implying the shares look materially undervalued on cash flow assumptions even as the market assigns a rich earnings multiple.

The SWS DCF model projects Alphamab's future cash flows, then discounts them back to today's money to capture the time value of cash and execution risk. For a recently profitable biotech with accelerating revenue and a growing oncology portfolio, this approach can better reflect long run potential than near term earnings alone.

Set against that, the stock trades on a price to earnings ratio of 41.1x, high in absolute terms but slightly below the 43.7x peer average. This suggests investors are paying a premium for current profits that is roughly in line with comparable names. The tension between a seemingly demanding earnings multiple and a deep modelled intrinsic discount underlines how much of Alphamab's valuation hinges on the durability of its new profitability and the scalability of its ADC driven growth story.

Compared with the broader Asian biotech industry, where the average price to earnings multiple stands at 38.7x, Alphamab's 41.1x still signals that the market is willing to ascribe above sector earnings expectations, even after the recent rally. That premium, while not extreme versus peers, leaves less room for disappointment if revenue growth or profitability were to falter.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 41.1x (ABOUT RIGHT)

However, setbacks in late stage trials or slower than expected uptake for lead oncology assets could quickly compress Alphamab's premium valuation and dampen sentiment.

Find out about the key risks to this Alphamab Oncology narrative.

Another View: Cash Flows Point to Deeper Value

While the current 41.1x earnings multiple looks full, our DCF model is more optimistic, suggesting fair value around HK$25.75, or roughly 137 percent above the latest price. Is the market underpricing Alphamab's future cash flows, or is the model too generous on execution?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Alphamab Oncology for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Alphamab Oncology Narrative

If you see the story differently or want to stress test the numbers with your own assumptions, you can build a custom view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Alphamab Oncology.

Ready for more high conviction ideas?

Do not stop at one opportunity; use the Simply Wall St screener now to uncover fresh stocks that match your strategy before the market catches on.

- Capture potential mispricings early by targeting these 914 undervalued stocks based on cash flows that still trade at meaningful discounts to their cash flow strength.

- Ride powerful secular trends by focusing on these 25 AI penny stocks positioned at the heart of the artificial intelligence boom.

- Lock in stronger income streams by zeroing in on these 13 dividend stocks with yields > 3% that can boost your portfolio's yield potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal