Ciena (CIEN) Is Up 5.4% After Raising 2026 Revenue Outlook on AI Network Momentum – Has The Bull Case Changed?

- Ciena Corporation reported past fourth-quarter 2025 revenue of US$1.35 billion, up from US$1.12 billion a year earlier, while quarterly net income fell to US$19.49 million; for the full year, revenue rose to US$4.77 billion and net income increased to US$123.34 million.

- Alongside these results, Ciena issued guidance calling for first-quarter 2026 revenue of US$1.35 billion to US$1.43 billion and full-year 2026 revenue of US$5.70 billion to US$6.10 billion, reinforcing its growing role in AI-driven network infrastructure after the Nubis acquisition and Scaleacross launch.

- We’ll now examine how this stronger 2026 revenue outlook, particularly the US$5.70–US$6.10 billion full-year target, reshapes Ciena’s investment narrative.

These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Ciena Investment Narrative Recap

To be comfortable owning Ciena, you need to believe that AI-driven demand for high-capacity optical networks will keep translating into sustained revenue growth with improving profitability. The new FY2026 revenue outlook of US$5.70–US$6.10 billion supports that growth story in the near term, but also sharpens the key risk: Ciena’s reliance on a concentrated set of hyperscale and cloud customers, where any slowdown or shift in spend could quickly pressure results.

Among recent developments, Ciena’s raised FY2026 growth outlook, underpinned by hyperscaler demand and new AI-focused offerings like Scaleacross, is most relevant here. It ties directly to the short term catalyst of large, multi-year AI network buildouts, while at the same time increasing Ciena’s exposure to cycles in data center and cloud infrastructure spending, now that residential broadband has been de-emphasized.

Yet behind this stronger AI-driven growth story, investors should be aware that...

Read the full narrative on Ciena (it's free!)

Ciena's narrative projects $6.5 billion revenue and $590.5 million earnings by 2028. This requires 12.5% yearly revenue growth and about a $449.6 million earnings increase from $140.9 million today.

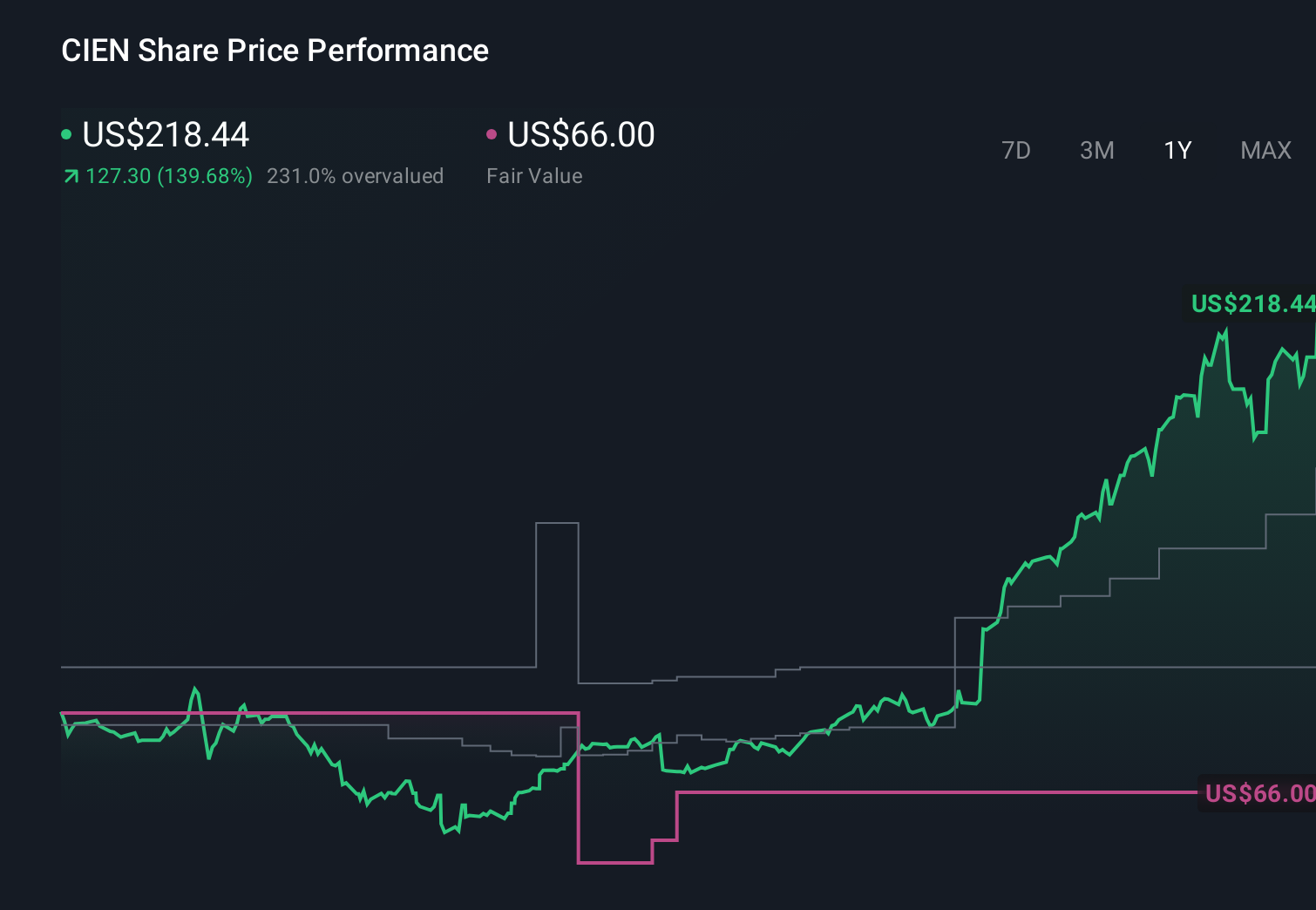

Uncover how Ciena's forecasts yield a $167.00 fair value, a 27% downside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community fair value estimates for Ciena span roughly US$68 to US$167, showing how far apart individual views can be. Against this, Ciena’s heavier tilt toward AI and cloud networking concentrates both its growth opportunity and its exposure to any pullback in hyperscaler spending, so it is worth weighing several perspectives before deciding how that trade off fits your portfolio.

Explore 6 other fair value estimates on Ciena - why the stock might be worth as much as $167.00!

Build Your Own Ciena Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Ciena research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Ciena research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Ciena's overall financial health at a glance.

Contemplating Other Strategies?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- Find companies with promising cash flow potential yet trading below their fair value.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal