Assessing Capital Clean Energy Carriers (CCEC)’s Valuation After LNG Fleet Expansion and Vessel Sale Strategy Shift

Capital Clean Energy Carriers (CCEC) just sold 13 container vessels and lined up fresh financing to grow its LNG fleet, signaling a clear pivot toward energy transition shipping that could reshape its long term earnings mix.

See our latest analysis for Capital Clean Energy Carriers.

The market seems to be warming to that shift, with a roughly 15% year to date share price return and a strong five year total shareholder return above 200 percent. This suggests longer term momentum remains firmly intact despite recent volatility.

If this LNG focused pivot has you rethinking where growth and alignment sit, it could be a good moment to explore fast growing stocks with high insider ownership as potential next candidates for your watchlist.

With earnings still growing, a double digit revenue clip, and the share price trading at a discount to analyst targets, investors now face a key dilemma: is CCEC a mispriced LNG transition play, or is the market already baking in that future growth?

Most Popular Narrative Narrative: 18.8% Undervalued

With Capital Clean Energy Carriers last closing at $20.96, the most followed narrative implies a higher fair value, hinging on robust multi year growth assumptions.

The analysts have a consensus price target of $25.8 for Capital Clean Energy Carriers based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $30.0, and the most bearish reporting a price target of just $22.0.

Want to see what kind of revenue trajectory and margin profile could justify that potential upside, and why the future earnings multiple stretches above today? The full narrative unpacks the growth math behind that confidence, and the assumptions that could make or break this fair value story.

Result: Fair Value of $25.80 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, lingering dependence on floating rate debt and uncertain employment for new specialized vessels could quickly undermine the current undervaluation thesis.

Find out about the key risks to this Capital Clean Energy Carriers narrative.

Another Angle on Valuation

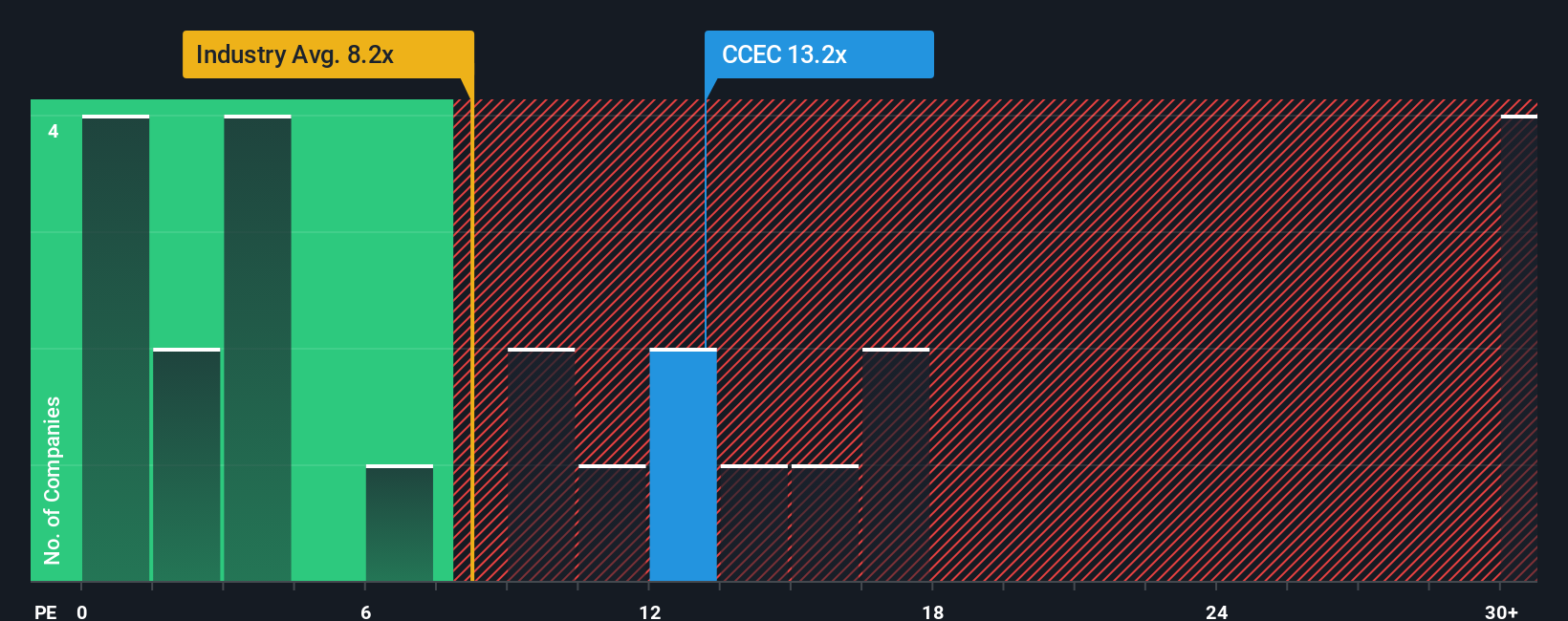

While the consensus narrative sees CCEC as about 18.8 percent undervalued, our earnings based lens is less generous. At 8.2 times earnings, CCEC trades well above peers on 4.6 times, yet below its 9.5 times fair ratio. This leaves investors weighing potential upside against the risk of a de rating.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Capital Clean Energy Carriers Narrative

If this perspective does not fully match your view, or you prefer to dig into the numbers yourself, you can build a custom narrative in just a few minutes, Do it your way

A great starting point for your Capital Clean Energy Carriers research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with CCEC, you risk missing other powerful setups, so put Simply Wall Street’s screener to work and stay ahead of the next move.

- Capture mispriced opportunities by running through these 914 undervalued stocks based on cash flows that combine solid fundamentals with attractive valuations before the market fully catches on.

- Capitalize on the AI wave by scanning these 25 AI penny stocks packed with companies building real revenue from automation, data intelligence, and next generation software.

- Lock in income potential by reviewing these 13 dividend stocks with yields > 3% that offer stronger yields while still maintaining balance sheet discipline and room for growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal