Praxis Precision Medicines (PRAX) Valuation After FDA-Backed EMBRAVE3 Redesign for Elsunersen

Praxis Precision Medicines (PRAX) just cleared a key regulatory hurdle, wrapping up a Type C meeting with the FDA that reshapes its EMBRAVE3 trial for elsunersen into a leaner single arm design.

See our latest analysis for Praxis Precision Medicines.

The news around EMBRAVE3 lands on top of a powerful run, with Praxis delivering a roughly 44 percent 1 month share price return and a staggering 546 percent 3 month share price return, while its 1 year total shareholder return above 250 percent suggests momentum is very much building rather than fading.

If this kind of regulatory progress has you rethinking your watchlist, it could be a good moment to explore other innovative healthcare stocks that might be setting up for similar multi year reratings.

With Praxis now trading at a steep premium to its recent past but still below consensus targets, investors face a key question: is the rally just getting started, or has the market already priced in future growth?

Price to Book Ratio of 19.9x: Is it justified?

Praxis Precision Medicines last closed at $272.92, and its 19.9 times price to book valuation signals investors are paying a steep premium versus peers.

The price to book ratio compares a company’s market value to its accounting net assets. This metric is often used in biotech where current earnings can be deeply negative but the market may still ascribe substantial value to pipelines, platforms and future optionality.

In Praxis’ case, the 19.9 times multiple indicates the market is already assigning significant worth to its central nervous system pipeline and potential future cash generation, despite the company remaining unprofitable and carrying a negative return on equity today. This sets a high bar for future execution to sustain this valuation level.

The contrast is notable, with Praxis trading at roughly 19.9 times book value compared with about 2.6 times for the broader US biotech industry and 8.5 times for its closest peers. This means investors are accepting a valuation that sits far above sector norms based on expectations that differ from the broader group.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book ratio of 19.9x

However, setbacks in pivotal trials or delays in elsunersen and other CNS programs could quickly compress valuation and challenge the recent rerating.

Find out about the key risks to this Praxis Precision Medicines narrative.

Another View, DCF Paints a Very Different Picture

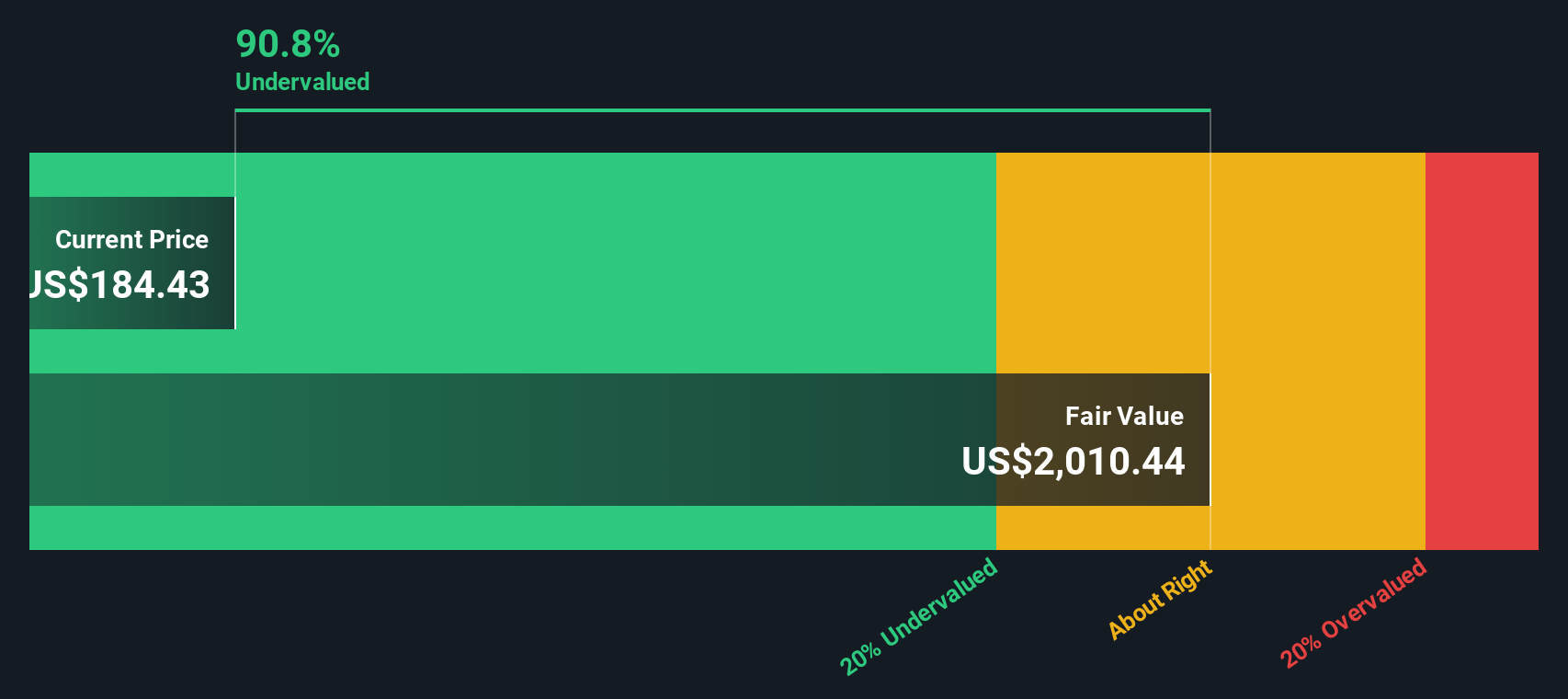

While the 19.9 times price to book ratio indicates Praxis is expensive versus peers, our DCF model suggests the stock might actually be deeply undervalued, with the current $272.92 share price trading about 90.8 percent below an estimated fair value of roughly $2,966.10.

This gap reflects how sensitive DCF is to strong growth assumptions, such as forecast annual revenue growth of 77.1 percent and rapid progress toward profitability. If those forecasts slip, the DCF upside could shrink fast. If Praxis executes, however, today’s premium book valuation may still be too low.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Praxis Precision Medicines for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Praxis Precision Medicines Narrative

If you see the numbers differently or want to dig into the forecasts yourself, you can build a personalized view in just minutes, Do it your way.

A great starting point for your Praxis Precision Medicines research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Do not stop at a single success story. Use the Simply Wall St Screener to uncover fresh opportunities before the crowd notices and position your portfolio ahead.

- Capture early stage momentum by targeting these 3624 penny stocks with strong financials that pair smaller market caps with robust underlying fundamentals.

- Capitalize on the AI transformation by focusing on these 25 AI penny stocks positioned at the intersection of data, automation and scalable software models.

- Seek reliable cash returns with these 13 dividend stocks with yields > 3% that combine attractive yields with sustainable payout ratios and solid financials.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal