Investors Appear Satisfied With Lordos Hotels (Holdings) Public Limited's (CSE:LHH) Prospects As Shares Rocket 28%

Lordos Hotels (Holdings) Public Limited (CSE:LHH) shares have had a really impressive month, gaining 28% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 92% in the last year.

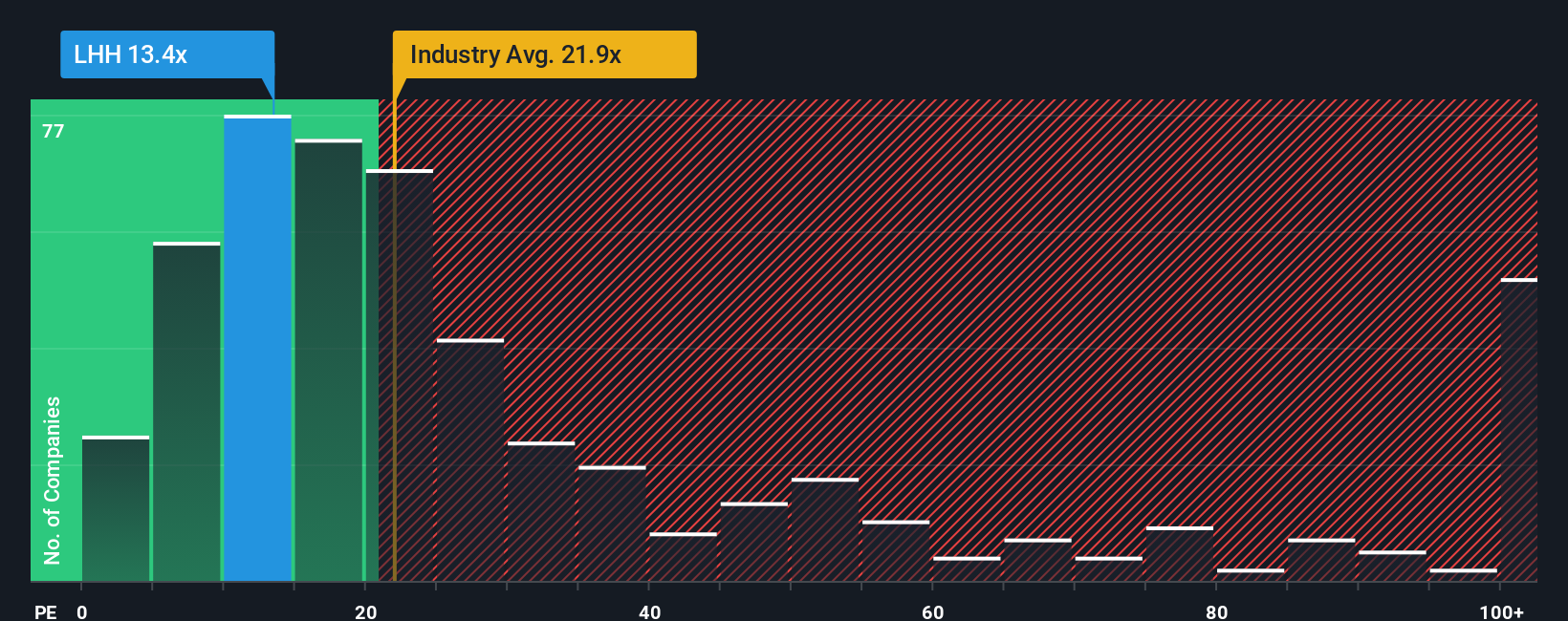

After such a large jump in price, Lordos Hotels (Holdings) may be sending very bearish signals at the moment with a price-to-earnings (or "P/E") ratio of 13.4x, since almost half of all companies in Cyprus have P/E ratios under 8x and even P/E's lower than 4x are not unusual. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

It looks like earnings growth has deserted Lordos Hotels (Holdings) recently, which is not something to boast about. One possibility is that the P/E is high because investors think the benign earnings growth will improve to outperform the broader market in the near future. If not, then existing shareholders may be a little nervous about the viability of the share price.

Check out our latest analysis for Lordos Hotels (Holdings)

How Is Lordos Hotels (Holdings)'s Growth Trending?

In order to justify its P/E ratio, Lordos Hotels (Holdings) would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered virtually the same number to the company's bottom line as the year before. Still, the latest three year period has seen an excellent 166% overall rise in EPS, in spite of its uninspiring short-term performance. So we can start by confirming that the company has done a great job of growing earnings over that time.

Weighing that recent medium-term earnings trajectory against the broader market's one-year forecast for expansion of 23% shows it's noticeably more attractive on an annualised basis.

With this information, we can see why Lordos Hotels (Holdings) is trading at such a high P/E compared to the market. Presumably shareholders aren't keen to offload something they believe will continue to outmanoeuvre the bourse.

What We Can Learn From Lordos Hotels (Holdings)'s P/E?

The strong share price surge has got Lordos Hotels (Holdings)'s P/E rushing to great heights as well. Generally, our preference is to limit the use of the price-to-earnings ratio to establishing what the market thinks about the overall health of a company.

We've established that Lordos Hotels (Holdings) maintains its high P/E on the strength of its recent three-year growth being higher than the wider market forecast, as expected. Right now shareholders are comfortable with the P/E as they are quite confident earnings aren't under threat. If recent medium-term earnings trends continue, it's hard to see the share price falling strongly in the near future under these circumstances.

You need to take note of risks, for example - Lordos Hotels (Holdings) has 2 warning signs (and 1 which is a bit unpleasant) we think you should know about.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal