Marubeni (TSE:8002): Assessing Valuation After a Powerful Multi‑Year Share Price Run

Recent performance puts Marubeni in focus

Marubeni (TSE:8002) has quietly delivered a strong run lately, with the stock up about 15% over the past month and roughly doubling over the past year, inviting a closer look at what is driving sentiment.

See our latest analysis for Marubeni.

That recent 15.5% 1 month share price return sits on top of an 83.1% year to date share price gain and a 100.8% 1 year total shareholder return, suggesting momentum is still firmly on Marubeni’s side as investors re rate its prospects.

If Marubeni’s surge has you rethinking what else might be gaining traction, this is a good moment to explore fast growing stocks with high insider ownership for other potential standouts.

With Marubeni now trading almost exactly in line with analyst targets after a powerful multi year run and only modest earnings growth, investors must ask: is there still a buying opportunity here, or is future growth already priced in?

Price to earnings of 12.5x: Is it justified?

On a price to earnings ratio of 12.5 times at the last close of ¥4,344, Marubeni screens modestly valued versus the broader Japanese market but looks pricier than many direct Trade Distributor peers.

The price to earnings multiple compares the company’s share price with its per share earnings and is a common yardstick for businesses like Marubeni that generate consistent profits across diversified operations.

Marubeni’s 12.5 times multiple sits below the overall Japan market’s 14.2 times, implying investors are not paying a market premium for each yen of earnings. Yet it trades above the 10.1 times sector average, signaling the market is willing to ascribe a richer tag than many Trade Distributors even though its forecast earnings growth of about 1.3 percent annually lags the broader Japanese market.

When set against an estimated fair price to earnings ratio of 21.1 times from our regression based fair ratio framework, the current 12.5 times still looks significantly lower than the level the market could migrate toward if sentiment and fundamentals converge.

Explore the SWS fair ratio for Marubeni

Result: Price-to-earnings of 12.5x (UNDERVALUED)

However, Marubeni’s sprawling commodity-exposed portfolio and modest earnings growth mean shifts in global demand or pricing could quickly challenge today’s upbeat valuation.

Find out about the key risks to this Marubeni narrative.

Another view on value

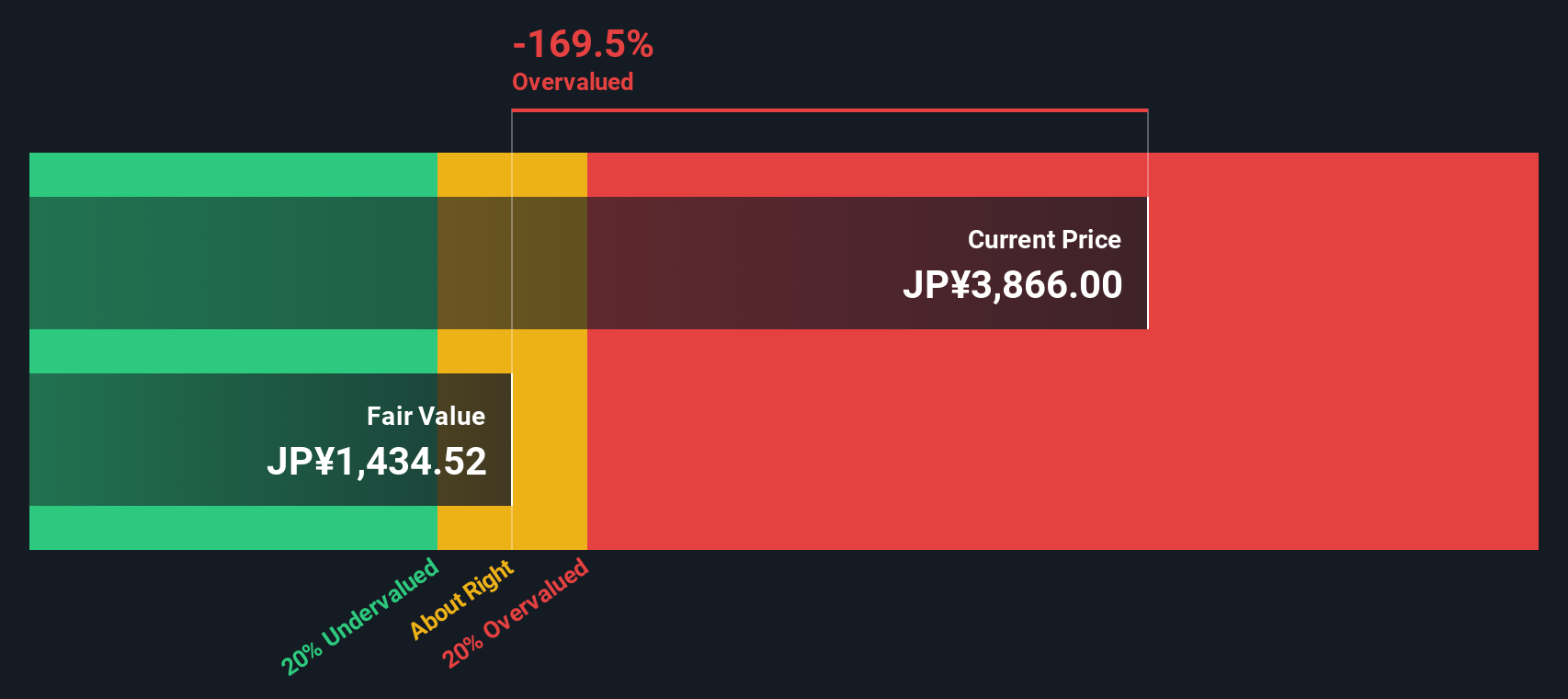

Our DCF model paints a very different picture, suggesting Marubeni’s shares at ¥4,344 sit well above an estimated fair value of about ¥1,866, pointing to an overvalued stock. When one method implies upside and another flags downside, which signal should investors lean on?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Marubeni for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Marubeni Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalised view in just minutes: Do it your way.

A great starting point for your Marubeni research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

If Marubeni has sharpened your focus, do not stop here. Use the Simply Wall Street Screener to pinpoint your next high conviction opportunity before others move.

- Capitalize on market mispricing by targeting companies trading below their intrinsic value through these 914 undervalued stocks based on cash flows. This can help you position yourself ahead of a potential re rating.

- Ride the wave of innovation by screening for companies at the forefront of transformational technology with these 25 AI penny stocks before their growth stories become mainstream.

- Strengthen your income strategy by pinpointing reliable payers using these 13 dividend stocks with yields > 3% so you can focus on yields that many investors may overlook.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal