Choice Hotels (CHH) Valuation Check After Argus Downgrade and Contrasting Bullish Analyst Views

Choice Hotels International (CHH) is back in the spotlight after Argus Research shifted its rating to hold, a move that cuts against recent upbeat coverage emphasizing the company’s long term growth story.

See our latest analysis for Choice Hotels International.

The move from Argus comes after a volatile stretch for Choice Hotels International, with a recent 1 month share price return of 10.41 percent helping to partially offset a steep year to date share price decline of 31.56 percent. This suggests near term momentum is improving even as the longer term total shareholder return remains weak.

If this kind of mixed momentum has you rethinking your watchlist, it could be a good moment to explore fast growing stocks with high insider ownership as potential fresh ideas.

With analysts split between a rare 5 star undervaluation call and a fresh hold downgrade, is Choice Hotels quietly trading below its true potential, or is the market already baking in every ounce of future growth?

Most Popular Narrative: 9.9% Undervalued

With the narrative fair value near $108 versus a last close of $96.96, the current share price sits below the long term blueprint being modeled.

Strong international expansion, including new direct franchising in Canada, a master franchising deal in China targeting 10,000 rooms, and increased presence in EMEA and South America, is set to capture rising global travel demand from growing middle class populations, driving outsized future revenue and EBITDA growth relative to historical expectations.

Curious how this global push translates into that higher price tag? The narrative quietly leans on aggressive revenue scaling, slimmer margins, and a richer future earnings multiple. Want to see exactly how those levers combine to justify the gap?

Result: Fair Value of $108 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent travel softness and slower RevPAR recovery, especially across midscale and international markets, could derail those ambitious expansion and earnings assumptions.

Find out about the key risks to this Choice Hotels International narrative.

Another Angle on Value

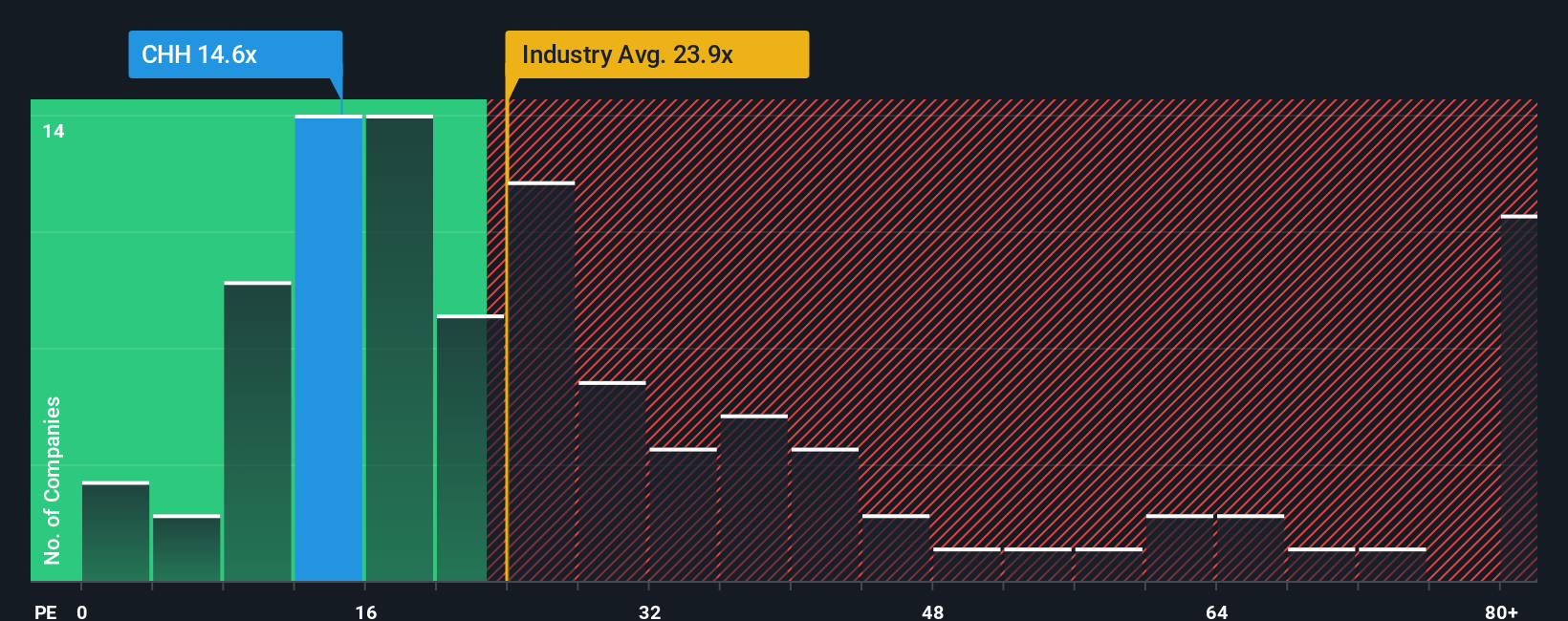

While the narrative model suggests Choice Hotels is about 9.9 percent undervalued, traditional valuation paints a different picture. At 11.7 times earnings, the stock trades far below the US Hospitality industry at 23.5 times and peers at 28.4 times, and under the 14.8 times fair ratio our models point to.

That discount could signal a margin of safety, or it might reflect real concerns about debt, earnings quality, and lackluster long term returns. Is the market mispricing a resilient franchisor, or is it simply refusing to pay up until growth and balance sheet risks clear?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Choice Hotels International for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Choice Hotels International Narrative

If you see the story differently or want to test your own assumptions against the numbers, you can build a custom view in minutes, Do it your way.

A great starting point for your Choice Hotels International research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider a few fresh angles for your watchlist using screeners that surface opportunities you may not want to overlook.

- Explore potential mispricings by scanning these 914 undervalued stocks based on cash flows, where strong cash flow analysis suggests securities may be trading below their intrinsic worth.

- Position yourself ahead of structural shifts in medicine by targeting these 29 healthcare AI stocks, which are transforming diagnostics, treatment decisions, and hospital efficiency.

- Seek dependable cash returns by focusing on these 13 dividend stocks with yields > 3%, combining attractive yields with the fundamentals needed to support ongoing payouts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal