A Look at Techtronic Industries (SEHK:669) Valuation as It Winds Down HART to Refocus on Core Brands

Techtronic Industries (SEHK:669) just announced it will wind down its HART business by the end of 2025, keeping the brand but doubling down on Milwaukee and Ryobi in a clear push toward higher margin growth.

See our latest analysis for Techtronic Industries.

The decision to exit HART comes after a choppy stretch, with a 30 day share price return of 9.29 percent but a year to date share price return of negative 8.66 percent, while the three year total shareholder return remains modestly positive.

If this kind of portfolio reshaping has you rethinking where growth might come from next, it could be worth exploring fast growing stocks with high insider ownership as potential fresh ideas beyond Techtronic.

With HART winding down but Milwaukee and Ryobi still growing, analysts see upside versus today’s price. Yet recent share weakness raises the real question: is Techtronic a bargain now, or is future growth already priced in?

Most Popular Narrative Narrative: 16.8% Undervalued

Based on the most followed narrative, Techtronic’s fair value of HK$110.32 sits well above the last close at HK$91.80, putting the HART exit into a broader long term context.

The accelerating global shift toward battery powered, cordless, and low emission tools aligns directly with Techtronic's innovation roadmap and ecosystem strategy, strengthening recurring revenue streams and enhancing customer lock in, which is expected to lift both top line growth and gross margins over the long term.

Want to see the full playbook behind this valuation? The story hinges on ambitious revenue compounding, rising margins, and a richer earnings multiple. Curious which assumptions really move the needle?

Result: Fair Value of $110.32 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside assumes smooth execution, while retailer concentration and intensifying cordless tool competition could quickly challenge both margin expansion and growth expectations.

Find out about the key risks to this Techtronic Industries narrative.

Another Angle on Value

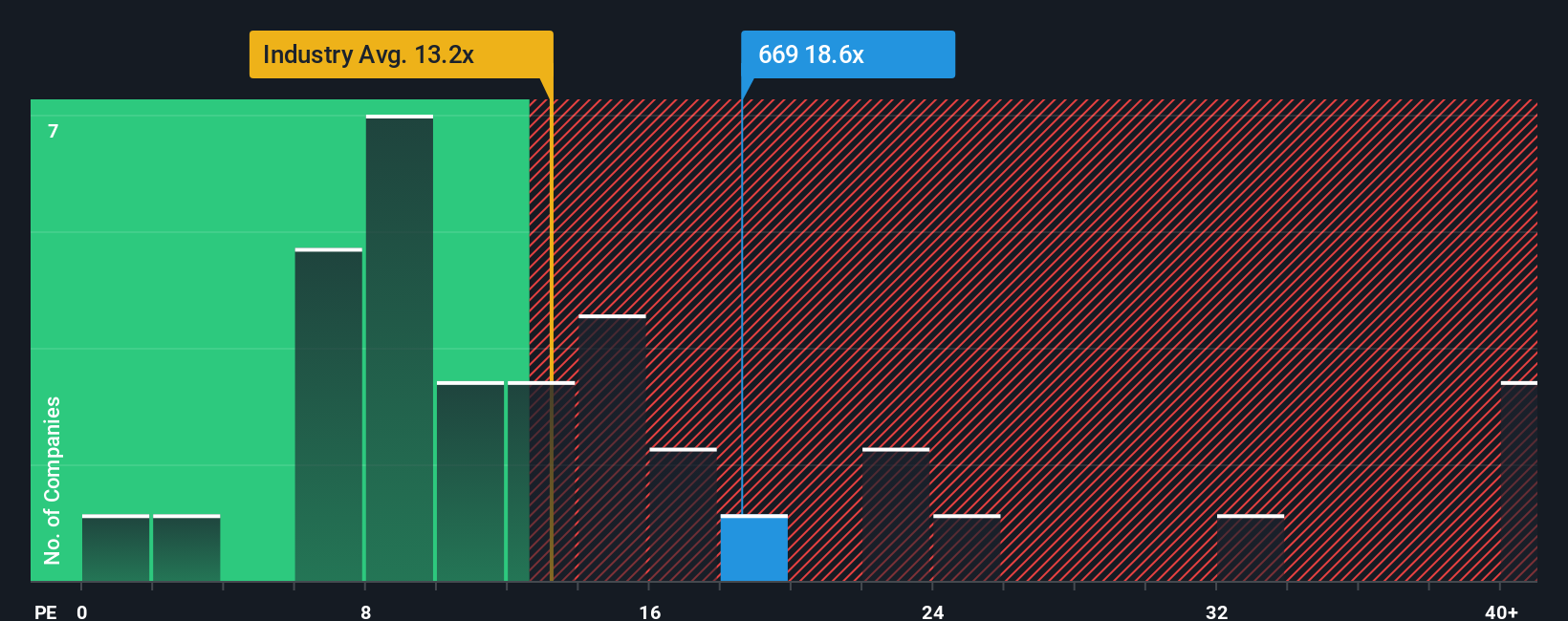

While narratives and analyst targets suggest Techtronic is 16.8 percent undervalued, its 18x price to earnings looks steep beside peers at 12.2x and a fair ratio of 13.6x. That gap signals real de rating risk if growth stumbles. Are investors being paid enough to ignore it?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Techtronic Industries Narrative

If you see the numbers differently or simply prefer to dig into the data yourself, you can build a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Techtronic Industries.

Ready for more investment ideas?

Before the market runs ahead without you, put our tools to work and uncover fresh opportunities that match your strategy, risk appetite, and return goals.

- Capture potential mispricings by acting on these 914 undervalued stocks based on cash flows that our models flag as trading below their projected cash flow strength.

- Tap into powerful themes by targeting these 25 AI penny stocks positioned to benefit from structural shifts in automation and intelligent software.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that can help you build reliable cash returns alongside capital growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal