RadNet (RDNT) Valuation Check After Short-Seller Critique and Raymond James’ Defense of Its AI Story

RadNet (RDNT) has been on a rollercoaster after Hunterbrook Capital’s short report hammered the stock, only for Raymond James to step in and defend the company, remaining positive on its long term outlook.

See our latest analysis for RadNet.

Against that backdrop, RadNet’s share price has whipsawed but is still up solidly on a year to date basis. Its exceptional three year total shareholder return suggests the long term momentum story is intact despite near term volatility.

If this kind of tug of war between growth expectations and risk is on your radar, it may be worth scanning comparable healthcare names through healthcare stocks.

With shares still up this year, a three year return above 300 percent, and Wall Street targets sitting almost 20 percent higher than today’s price, is RadNet now a mispriced opportunity, or is future growth already fully baked in?

Most Popular Narrative Narrative: 16.4% Undervalued

With RadNet last closing at $76.68 against a narrative fair value near $92.50, the story assumes meaningful upside from today’s levels.

Ongoing investments in AI powered imaging solutions (e.g., DeepHealth, See Mode, iCAD) are materially increasing center throughput, boosting capacity utilization, and driving more high margin advanced procedures, directly enhancing both revenue growth and EBITDA margins as adoption scales through 2026.

Curious how a business that is still loss making today gets credit for future profitability, richer margins, and a premium earnings multiple usually reserved for market darlings? The narrative leans on ambitious revenue compounding, sharply higher margins, and a punchy future valuation multiple to bridge that gap. Want to see the exact growth and profit roadmap behind that price?

Result: Fair Value of $92.50 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, significant upfront AI and digital health spending, along with reimbursement or volume setbacks, could quickly squeeze margins and challenge those upbeat long term assumptions.

Find out about the key risks to this RadNet narrative.

Another View: Market Ratios Tell A Richer Story

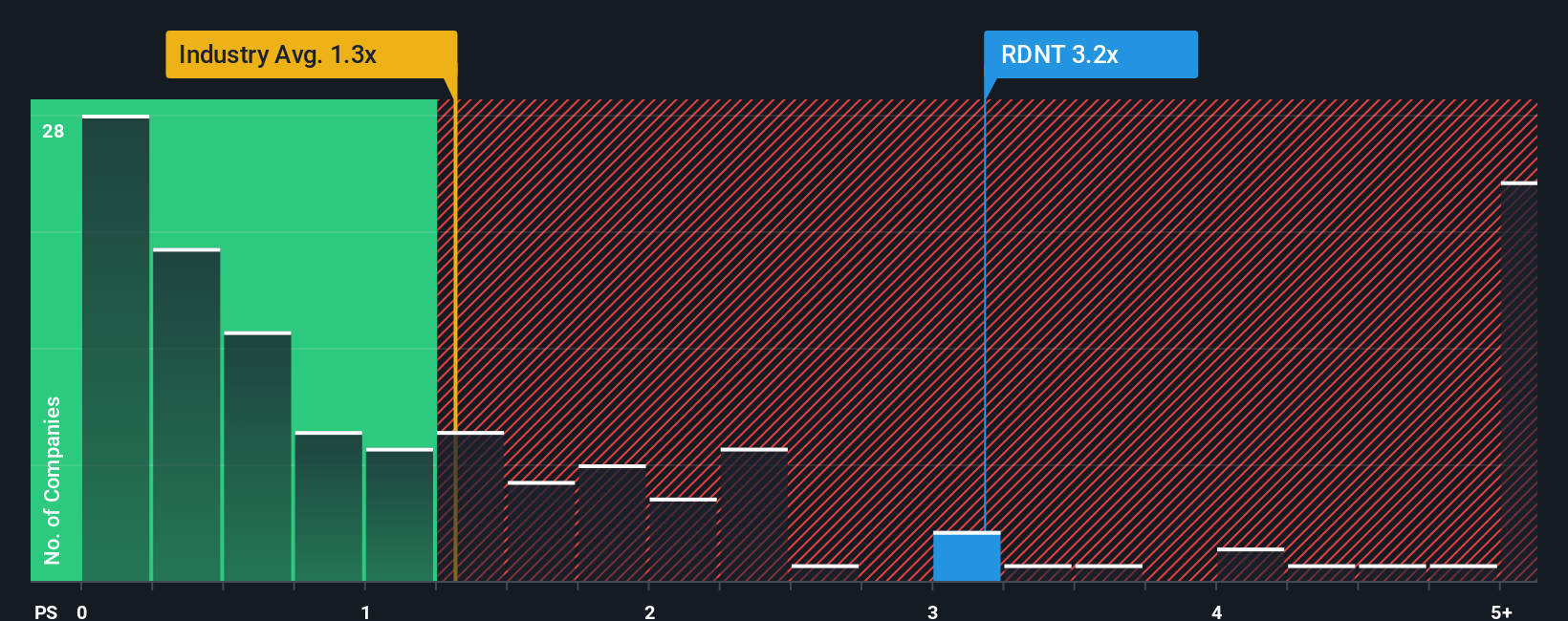

While the AI driven narrative suggests upside, the market’s own numbers are cooler. RadNet trades on a price to sales ratio of 3 times, far richer than the US Healthcare industry at 1.3 times, peers at 1.1 times, and a fair ratio of just 0.9 times. If sentiment turns, could that premium unwind faster than the growth materializes?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own RadNet Narrative

If you are not fully aligned with this view, or enjoy digging into the numbers yourself, you can build a custom narrative in just minutes, Do it your way.

A great starting point for your RadNet research is our analysis highlighting 1 key reward and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

RadNet might be compelling, but do not stop there. Use the Simply Wall Street Screener now to uncover your next edge before everyone else catches on.

- Capture momentum early by following these 25 AI penny stocks as innovation in machine learning and automation reshapes entire industries and creates fresh growth leaders.

- Identify potential value by scanning these 914 undervalued stocks based on cash flows where strong cash flows and sensible prices can tilt the odds in your favor.

- Strengthen your income stream with these 13 dividend stocks with yields > 3% and pinpoint companies offering attractive yields supported by solid fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal