Does Tourmaline (TSX:TOU) CEO Share Buying Quietly Reframe the Stock’s Long-Term Risk‑Reward Profile?

- On December 18, 2025, Tourmaline Oil CEO Mike Rose bought 2,500 common shares on a direct ownership basis at CA$59.987 per share, increasing his personal stake in the company.

- This insider purchase can be viewed as a meaningful signal of management’s confidence, often drawing closer investor attention to the company’s long-term direction.

- We’ll now explore how the CEO’s recent insider share purchase could influence Tourmaline Oil’s existing investment narrative and risk profile.

The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

Tourmaline Oil Investment Narrative Recap

To own Tourmaline Oil, you need to believe in the long term case for Canadian natural gas, supported by export growth and disciplined capital returns despite recent share price softness. Mike Rose’s CA$59.987 per share insider purchase does not materially change the near term catalyst, which still centers on how effectively Tourmaline converts its growing production into sustainable free cash flow, or the biggest current risk, which is prolonged weakness and volatility in North American gas prices.

The recent affirmation of the quarterly CA$0.50 per share base dividend for payment on December 31, 2025 is the most relevant backdrop to this insider buy, as it highlights the company’s current capital return stance at a time when earnings growth has been modest and gas price risk remains elevated. Taken together, a steady dividend commitment and increased CEO ownership can draw attention to how well Tourmaline balances payout ambitions with the cash flow pressure that could come from...

Read the full narrative on Tourmaline Oil (it's free!)

Tourmaline Oil's narrative projects CA$10.6 billion revenue and CA$2.7 billion earnings by 2028. This requires 34.3% yearly revenue growth and about a CA$1.2 billion earnings increase from CA$1.5 billion today.

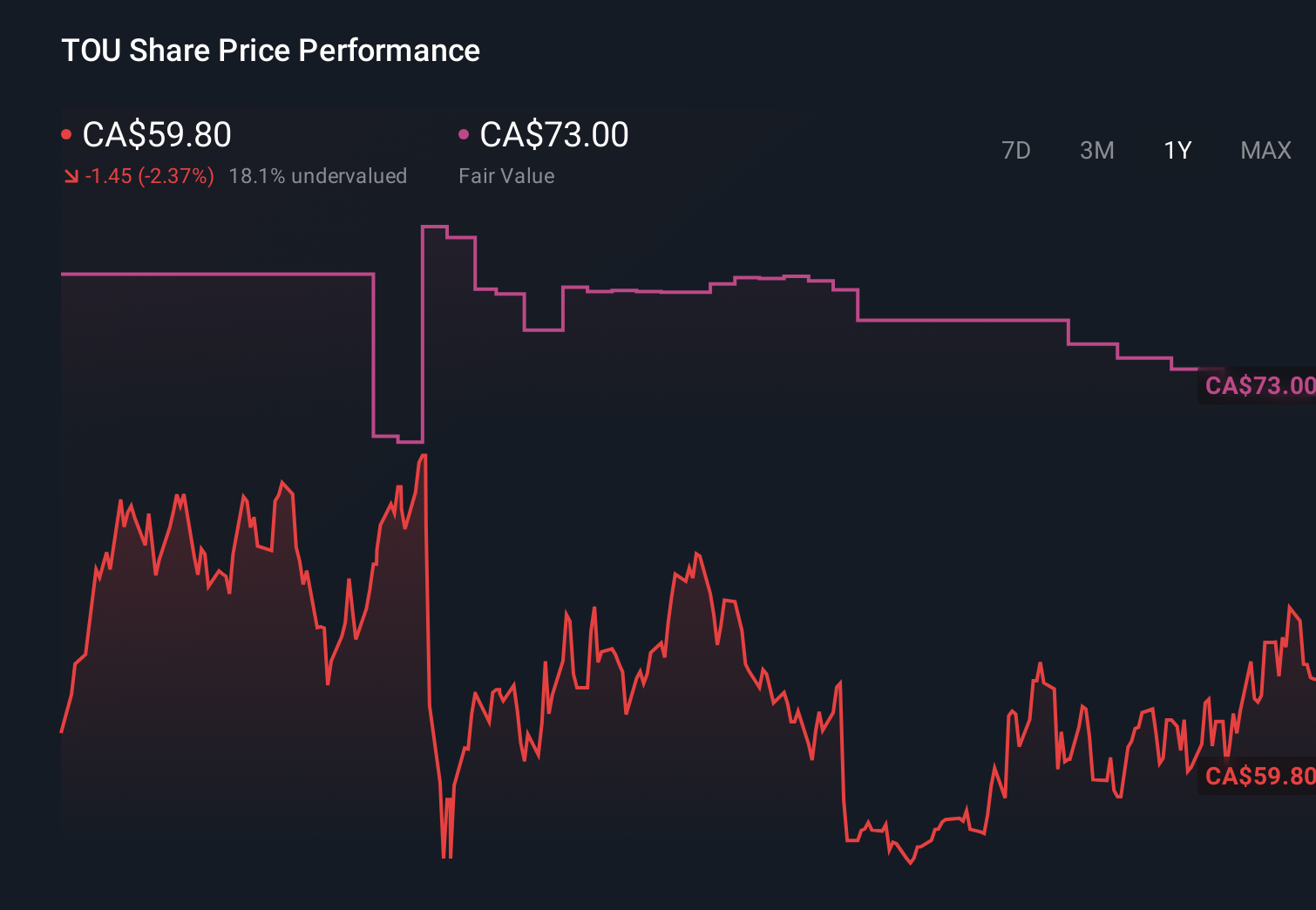

Uncover how Tourmaline Oil's forecasts yield a CA$73.00 fair value, a 22% upside to its current price.

Exploring Other Perspectives

Six members of the Simply Wall St Community currently estimate Tourmaline’s fair value between CA$72 and CA$148.30, reflecting a wide span of individual expectations. When you set those views against Tourmaline’s sensitivity to prolonged soft North American gas prices, it becomes clear why many investors are comparing several different valuation and risk scenarios before making up their mind.

Explore 6 other fair value estimates on Tourmaline Oil - why the stock might be worth over 2x more than the current price!

Build Your Own Tourmaline Oil Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Tourmaline Oil research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Tourmaline Oil research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Tourmaline Oil's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- AI is about to change healthcare. These 29 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 34 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal