Klarna (KLAR) Valuation Check After Recent Share Price Weakness and Ongoing Losses

Klarna Group (KLAR) shares have been drifting after a weak past 3 months, and that slide now has investors asking whether the company’s improving growth profile justifies stepping in at current levels.

See our latest analysis for Klarna Group.

The latest $30.78 share price may look subdued after a sharp 90 day share price return of negative 28.44 percent and weak year to date performance, but that pullback follows brisk revenue and earnings momentum that has investors reassessing both growth potential and risk.

If Klarna’s reset has you rethinking your exposure to fintech, this could be a useful moment to scan fast growing stocks with high insider ownership for other fast moving ideas backed by committed insiders.

With the shares now trading well below analyst targets but still anchored to a lossmaking profile, investors face a familiar dilemma: is Klarna undervalued after this reset or already pricing in its next leg of growth?

Price to Sales of 3.6x: Is it justified?

Klarna Group is trading on a price to sales ratio of 3.6 times at the latest close of $30.78, a premium to the wider US diversified financials space.

The price to sales multiple compares the company’s market value to its annual revenue, a useful lens for fast growing, still lossmaking fintech and payments platforms where earnings are not yet a steady guide.

For Klarna, a 3.6 times sales tag implies investors are already baking in strong topline expansion and future margin improvement, even though the business remains unprofitable today and carries a negative return on equity.

That premium looks more demanding when set against the 2.6 times price to sales average across the US diversified financials industry, although it does line up more closely with a 3.7 times peer group average. This suggests the market is pricing Klarna roughly in line with its closest comparables rather than the broader sector.

See what the numbers say about this price — find out in our valuation breakdown.

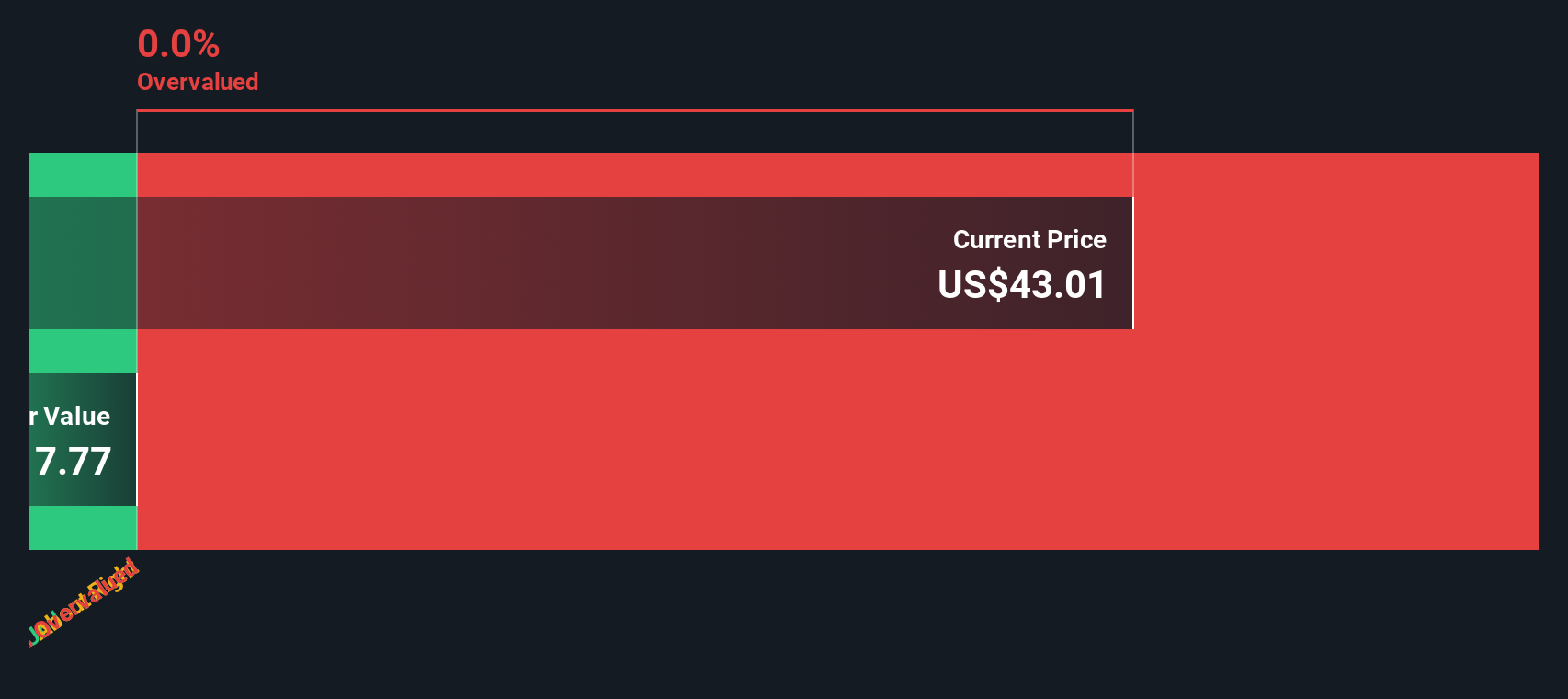

Result: Price-to-Sales of 3.6x (OVERVALUED)

However, Klarna’s persistent losses and premium valuation leave little room for error if revenue growth cools or regulation tightens around buy now, pay later models.

Find out about the key risks to this Klarna Group narrative.

Another View: SWS DCF Flags a Bigger Problem

While the 3.6 times sales tag already looks rich, our DCF model is even harsher, implying fair value closer to $1.76, far below the current $30.78 price and pointing to material overvaluation. Are investors leaning too heavily on growth hopes and ignoring cash flow reality?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Klarna Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 914 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Klarna Group Narrative

If you see Klarna differently, or would rather dig into the numbers yourself, you can craft a personalized view in just minutes: Do it your way.

A good starting point is our analysis highlighting 2 key rewards investors are optimistic about regarding Klarna Group.

Ready for your next investing move?

Before you move on, lock in your edge by checking fresh opportunities on the Simply Wall St Screener, so the next big move does not pass you by.

- Capitalize on mispriced potential by targeting companies screened as these 914 undervalued stocks based on cash flows and position yourself before sentiment catches up.

- Ride powerful innovation trends by focusing on these 25 AI penny stocks that could reshape entire industries over the coming decade.

- Strengthen your income stream with these 13 dividend stocks with yields > 3% that may boost your portfolio’s cash returns while markets remain unpredictable.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal