Is Rigetti Still Attractive After a 2774% Three Year Surge?

- If you are wondering whether Rigetti Computing is still worth considering after its huge run, or if the easy money has already been made, this article will walk through the numbers in plain English.

- The stock has cooled off recently, with shares down 8.0% over the last week and 6.7% over the last month. Even so, they are still up 18.8% year to date, an eye catching 153.6% over the past year, and a massive 2774.4% over three years.

- Behind those swings, Rigetti has remained in the spotlight as investors debate how quickly quantum computing will move from early stage technology to real world commercial demand. Headlines around funding, partnerships, and industry momentum have helped fuel changing expectations about its long term potential and risk.

- Despite that excitement, Rigetti currently scores just 0/6 on our valuation checks. Next we will unpack what different valuation methods say about the stock and then finish with a more nuanced way to think about its true worth.

Rigetti Computing scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Rigetti Computing Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow (DCF) model estimates what a company is worth today by taking its expected future cash flows and discounting them back to their value in today’s dollars. It is essentially a way of asking what those future dollars are worth right now.

Rigetti Computing is currently burning cash, with last twelve month Free Cash Flow of about $60 million in the red. Analysts expect this to turn around sharply, with projected Free Cash Flow of roughly $112 million by 2029, and Simply Wall St then extrapolates further growth in the following years based on that improving trend. All figures are in $.

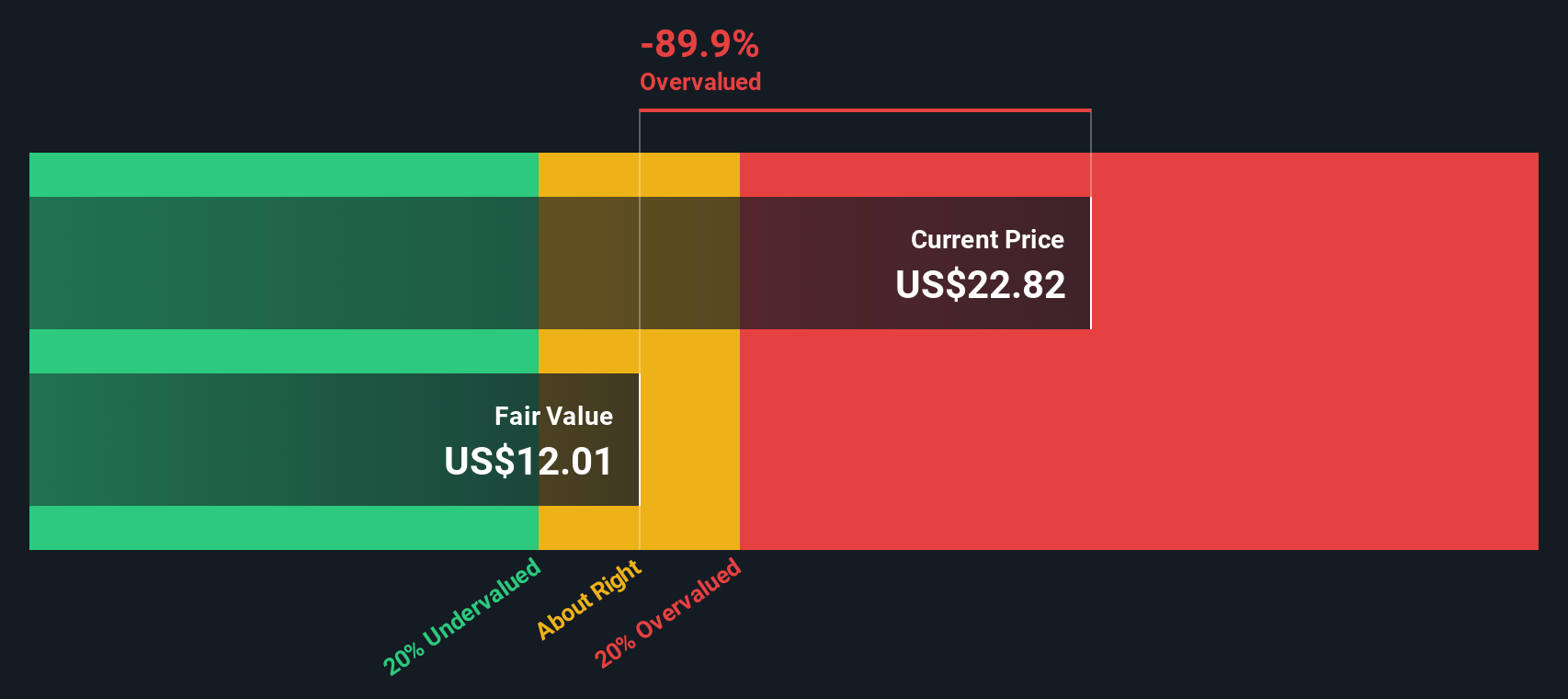

When these projected cash flows are discounted back using a 2 Stage Free Cash Flow to Equity model, the resulting intrinsic value is estimated at about $12.01 per share. Compared with the current share price, the model suggests the stock is roughly 97.8% above its fair value, implying that expectations built into the price are extremely optimistic.

Result: OVERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Rigetti Computing may be overvalued by 97.8%. Discover 914 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Rigetti Computing Price vs Book

For many profitable, established companies, the price to book ratio is a useful way to check whether investors are paying a reasonable amount for each dollar of net assets. In general, higher growth and lower risk can justify a higher normal or fair multiple, while slower growth or higher uncertainty tends to pull that fair multiple down.

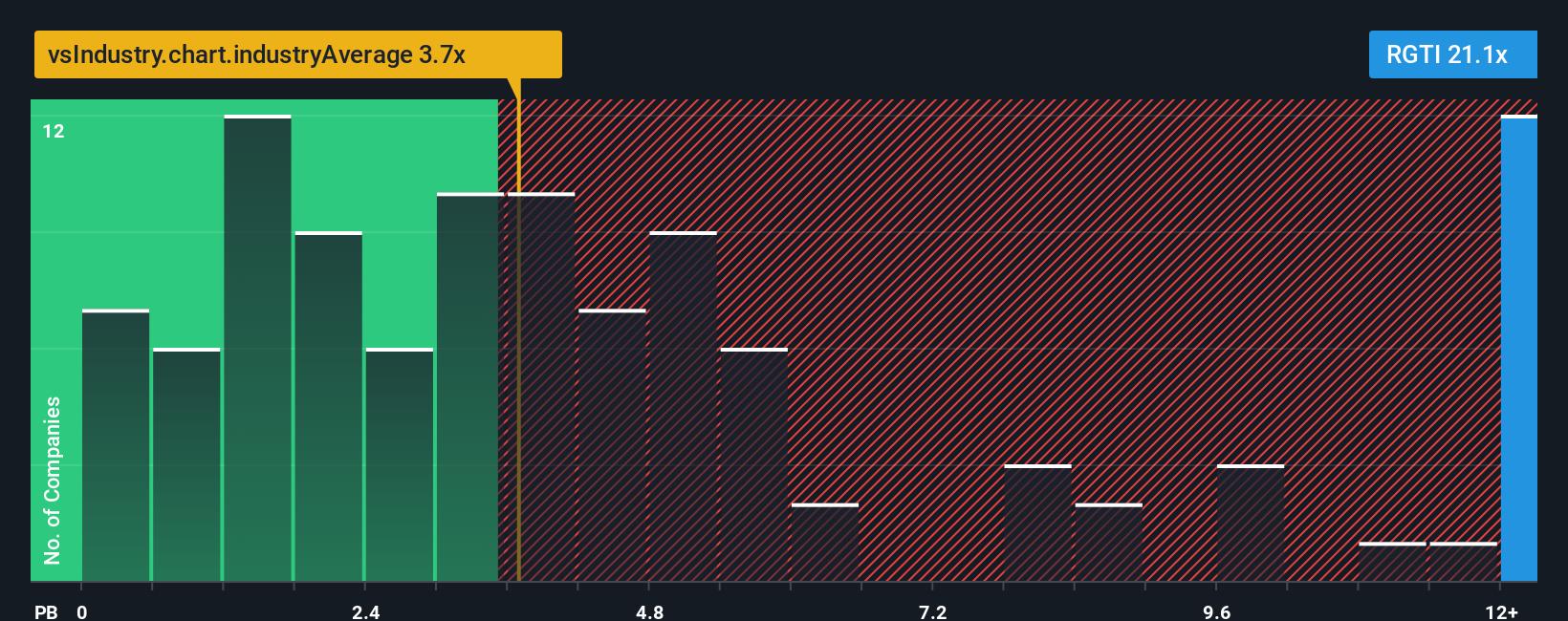

Rigetti currently trades at about 21.09x book value, which is far richer than both the broader Semiconductor industry average of roughly 3.65x and the peer group average of around 6.79x. That signals investors are pricing in exceptionally strong future progress relative to the assets on its balance sheet.

Simply Wall St’s Fair Ratio is a proprietary view of what Rigetti’s price to book multiple should be, after adjusting for its specific growth outlook, risk profile, profit margin, industry and market cap. This makes it a more tailored benchmark than a simple comparison to industry or peer averages, which can be distorted by companies at very different stages of maturity. In Rigetti’s case, the current 21.09x multiple sits well above where the Fair Ratio would be expected, indicating that the stock price already embeds a lot of optimism.

Result: OVERVALUED

PB ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1466 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Rigetti Computing Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is simply your story about a company written into the numbers, where you set your assumptions for Rigetti Computing’s future revenue, earnings and margins, and link them to a clear estimate of fair value. On Simply Wall St’s Community page, used by millions of investors, Narratives make this process easy and accessible, guiding you from the company’s story, to a financial forecast, and then to a fair value that you can compare directly with today’s share price to decide whether to buy, hold or sell. Because Narratives update dynamically when new information like earnings reports or major news arrives, your view of Rigetti’s fair value can evolve automatically as the facts change. For example, one Rigetti Narrative might assume rapid commercialization and assign a very high fair value, while another might expect slower adoption and assign a much lower fair value, illustrating how different investors can reasonably see the same stock in very different ways.

Do you think there's more to the story for Rigetti Computing? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal