Domino’s (DPZ): Assessing Valuation After a Recent 8% One-Month Share Price Gain

Domino's Pizza (DPZ) has quietly outperformed the broader market over the past month, with shares gaining around 8% as investors warm to its steady revenue and earnings growth despite a choppy consumer backdrop.

See our latest analysis for Domino's Pizza.

That recent 1 month share price return of roughly 8% has helped Domino's claw back some earlier weakness, and with a 1 year total shareholder return of about 3% the overall trend still looks like steady, if unspectacular, momentum rather than a breakout move.

If Domino's has you thinking about dependable consumer names, it could be worth broadening your watchlist and exploring fast growing stocks with high insider ownership as potential next ideas.

With revenue and earnings still growing at a solid mid single digit clip, and the share price sitting around 15% below the average analyst target, is Domino's quietly offering value, or is the market already baking in its future gains?

Most Popular Narrative: 13.1% Undervalued

With Domino's last closing at $431.51 against a narrative fair value near $496.65, the narrative frames today’s price as a discounted entry anchored in steady, compounding growth.

The analysts have a consensus price target of $509.241 for Domino's Pizza based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $594.0, and the most bearish reporting a price target of just $340.0.

Curious what kind of revenue runway, margin lift and future earnings multiple are needed to bridge today’s price to that higher fair value? The full narrative outlines a focused set of compounding growth assumptions, a modest margin improvement and a relatively strong future valuation multiple that might be unexpected. Want to see exactly how those moving parts stack up over time?

Result: Fair Value of $496.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, slower international expansion and softer global pizza demand could cap Domino's growth and challenge the assumptions behind its current undervaluation narrative.

Find out about the key risks to this Domino's Pizza narrative.

Another Angle on Value

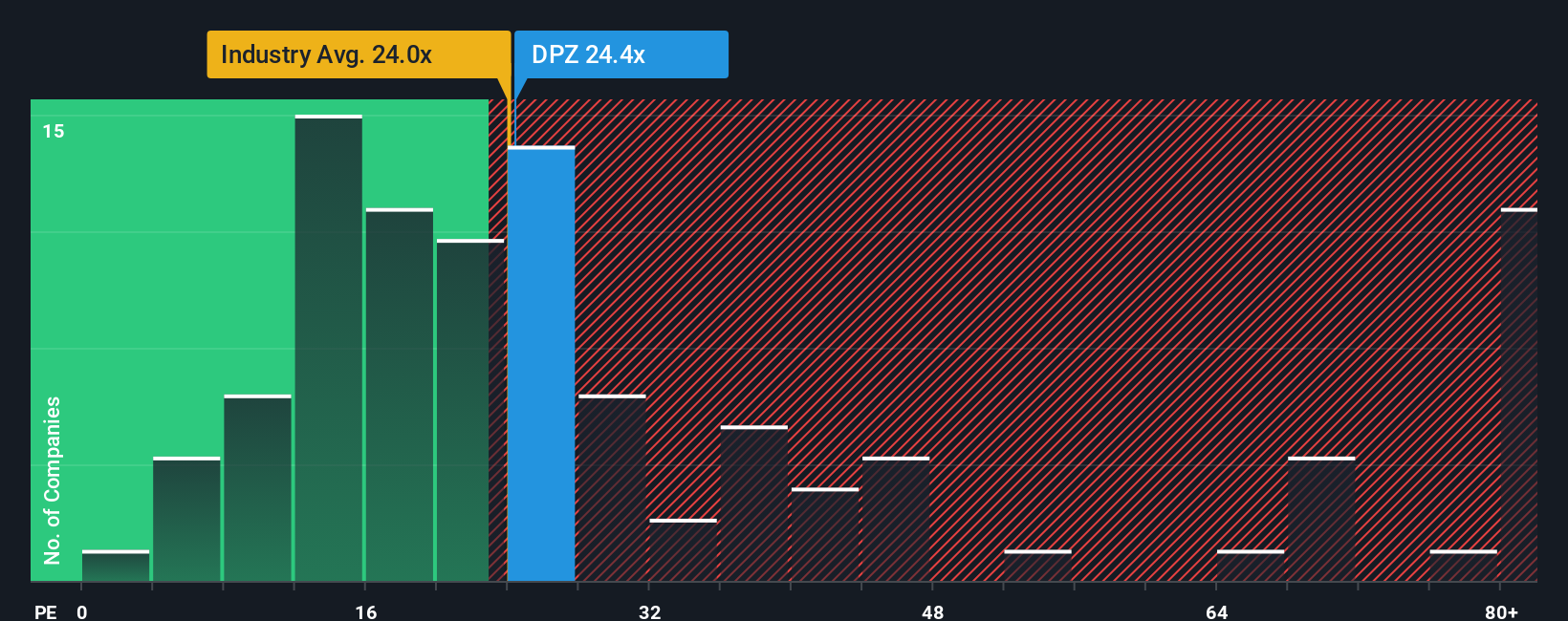

Step away from the narrative fair value, and the picture shifts. On earnings, Domino's trades at about 24.7 times, richer than the US hospitality group at 23.5 times and above a fair ratio near 20.8 times, which hints at valuation risk if growth or sentiment cool.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Domino's Pizza Narrative

If this view does not quite fit your take, or you prefer digging into the numbers yourself, you can craft a complete narrative in just a few minutes: Do it your way.

A great starting point for your Domino's Pizza research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop at Domino's, you could miss bigger opportunities. Keep pushing your edge with focused screeners that surface strong, actionable ideas in minutes.

- Capture potential bargains early by scanning these 914 undervalued stocks based on cash flows that the market may be overlooking despite healthy fundamentals.

- Capitalize on powerful themes in automation and machine learning through these 25 AI penny stocks positioned for structural, long term growth.

- Boost your income stream by targeting these 13 dividend stocks with yields > 3% that still pass sensible quality checks.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal