GeneDx (WGS) Valuation Check as JAMA Highlights GUARDIAN Newborn Genomic Screening Study

GeneDx Holdings (WGS) just saw its GUARDIAN newborn genomic screening study highlighted in JAMA’s Research of the Year, a credibility boost that could quietly reshape how investors view its long term growth runway.

See our latest analysis for GeneDx Holdings.

The recognition has landed while momentum is already strong, with GeneDx’s share price up 76% year to date and an 81% total shareholder return over the last year, signaling investors are steadily repricing its growth story.

If this kind of genomics driven upside has your attention, it could be a good time to explore other healthcare names using our healthcare stocks as a starting point.

Yet, with shares already surging, robust revenue and earnings growth, and analysts still seeing upside to fair value, are markets underestimating GeneDx’s long term potential or rapidly catching up to its genomic newborn screening opportunity?

Most Popular Narrative Narrative: 14.8% Undervalued

Compared to the last close of $140.44, the most followed narrative pegs GeneDx’s fair value closer to the mid 160s. This frames the recent rally as only a partial catch up.

Fair Value Estimate has risen moderately, increasing from about $158.44 to roughly $164.78 per share. This reflects higher confidence in GeneDx’s long term outlook.

Want to see what is hiding behind that higher confidence? The narrative leans on powerful growth assumptions and richer margins that could redefine what fair value means here.

Result: Fair Value of $164.78 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, if reimbursement pressure persists or pediatric adoption is slower than expected, today’s growth assumptions could be quickly challenged and the implied upside could narrow.

Find out about the key risks to this GeneDx Holdings narrative.

Another Lens on Value

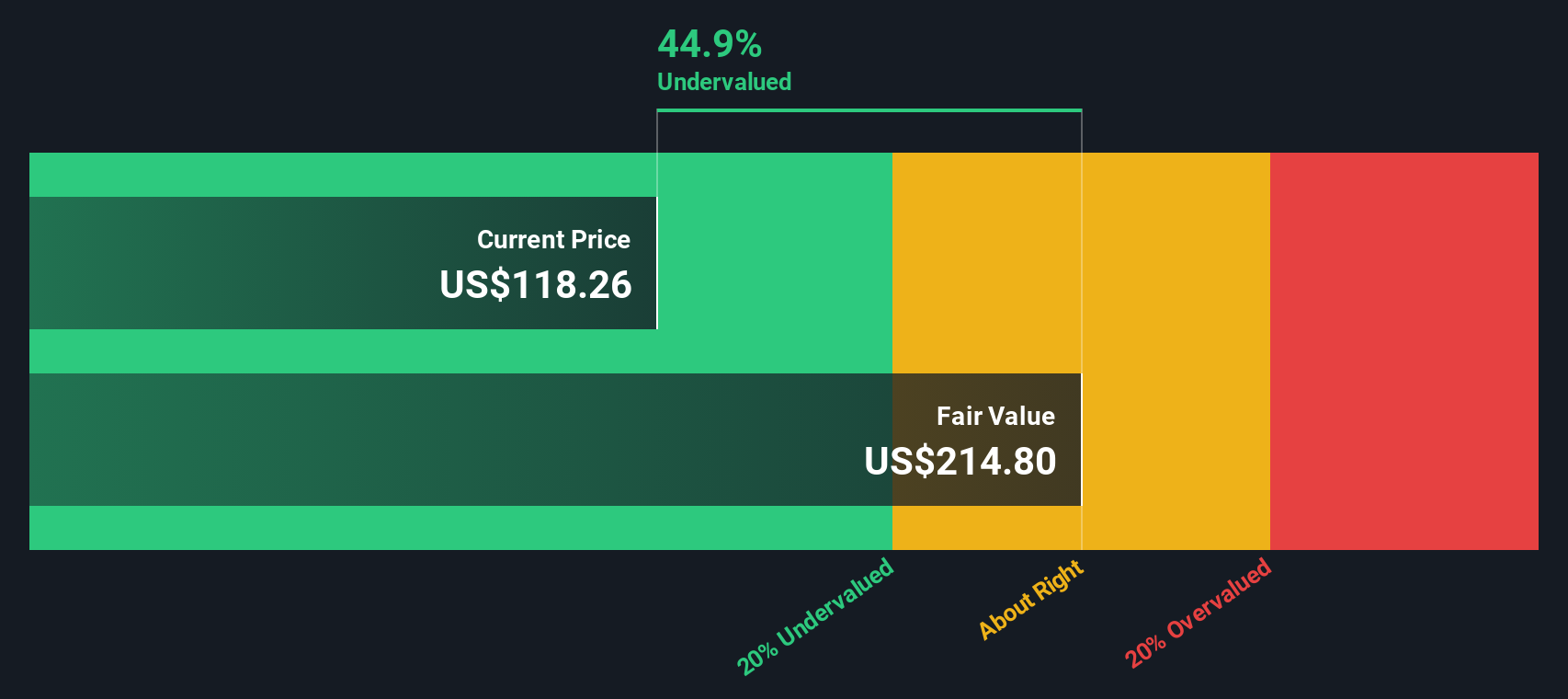

While the narrative and analyst targets suggest GeneDx is modestly undervalued, our SWS DCF model is far more optimistic. It indicates the shares trade about 44.6 percent below an intrinsic value near $253.46. Is the market overly cautious on newborn genomics, or are DCF assumptions too generous?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own GeneDx Holdings Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes: Do it your way.

A great starting point for your GeneDx Holdings research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, consider your next opportunity by using the Simply Wall Street Screener to uncover focused stock ideas that match your strategy.

- Explore potential market mispricings by scanning these 913 undervalued stocks based on cash flows that may appear attractively priced based on discounted cash flows.

- Analyze powerful technology trends by filtering for these 25 AI penny stocks that are positioned at the forefront of AI adoption and related revenue streams.

- Support your income strategy by focusing on these 13 dividend stocks with yields > 3% that may suit long term, yield focused portfolios.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal