BWX Technologies (BWXT): Reassessing Valuation After Commercial Nuclear Growth, Kinectrics Integration and Record Backlog

Recent commentary around BWX Technologies (BWXT) has zeroed in on its accelerating Commercial Operations. The Kinectrics integration, microreactor work, and medical isotopes are reinforcing already solid government backed earnings and lifting investor confidence.

See our latest analysis for BWX Technologies.

The share price has cooled slightly with a 1 month share price return of minus 1.9 percent. However, a powerful year to date share price return of 58.3 percent and a 3 year total shareholder return above 200 percent suggest momentum is broadly still building as investors reassess BWX Technologies nuclear growth runway and risk profile at around 176 dollars per share.

If BWX Technologies has put nuclear back on your radar, it is worth seeing what else is gaining traction across aerospace and defense stocks right now.

With earnings growing double digits, a record backlog, and the stock still trading at a material discount to analyst targets, is BWX Technologies quietly undervalued, or is the market already factoring in every watt of future nuclear growth?

Most Popular Narrative Narrative: 19.8% Undervalued

According to clillz, BWX Technologies fair value sits noticeably above the last close, framing today’s price as an entry point rather than a peak.

With over 80% of revenues coming from government operations, BWXT is set to maintain, or potentially grow, its revenue from government spending and contracts issued by the current administration. Building on the government contracts and spending, BWXT continues the expansion of commercial operations with the help of the Kinectrics acquisition, and increases in demand for medical isotopes only add bonus points to their revenue diversification.

Curious how this story gets to a higher fair value than today’s price? The narrative focuses on accelerating revenue, expanding margins, and a punchy future earnings multiple. Want to see which assumptions do the heavy lifting in that calculation? Dive in to unpack the full valuation playbook.

Result: Fair Value of $220 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, shifts in defense budgets or renewed regulatory skepticism on nuclear safety could quickly derail growth assumptions that power this undervaluation thesis.

Find out about the key risks to this BWX Technologies narrative.

Another View: Market Ratios Flash Caution

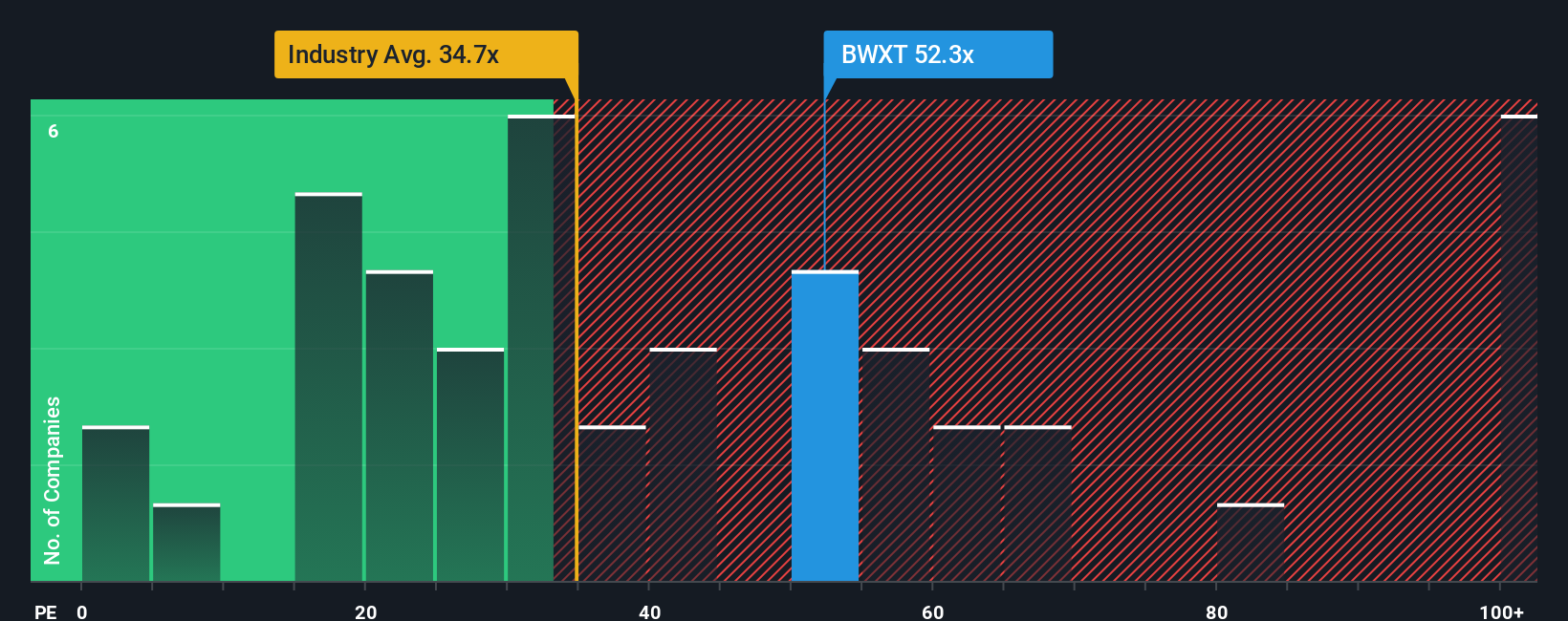

Our ratio based lens is far less generous. At about 52.5 times earnings against an industry average of 36.5 times and a fair ratio of 30.3 times, BWX Technologies looks richly priced, which raises the question of how much upside is really left in the tank.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BWX Technologies Narrative

If you see things differently or want to stress test the numbers yourself, you can build a personalized BWX Technologies thesis in minutes. Do it your way.

A great starting point for your BWX Technologies research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Do not stop with one opportunity. Broaden your watchlist and uncover fresh angles on the market using targeted stock screeners tailored to different strategies.

- Boost your hunt for quality by reviewing these 914 undervalued stocks based on cash flows that pair strong fundamentals with attractive prices the market has not fully recognized yet.

- Supercharge your growth focus with these 25 AI penny stocks, where cutting edge innovation and emerging business models could support the next wave of market leaders.

- Strengthen your income stream through these 13 dividend stocks with yields > 3%, pinpointing businesses that combine dependable payouts with the potential for long term capital appreciation.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal