Is It Too Late To Consider Blackstone Mortgage Trust After Its Recent 22.6% Share Price Rally?

- If you are wondering whether Blackstone Mortgage Trust is still worth buying after its recent run, or if the easy money has already been made, you are not alone.

- The stock is up 22.6% over the last year and 13.2% year to date, with a strong 9.6% gain in the past month even after a small 1.6% pullback this week.

- Recent moves have been driven largely by shifting expectations around interest rates and commercial real estate credit risk, as investors reassess which mortgage REITs can navigate this cycle most smoothly. Headlines have focused on the health of office and mixed use property loans and how well capitalized lenders like Blackstone Mortgage Trust are positioned if credit conditions tighten again.

- Despite that optimism, Blackstone Mortgage Trust currently scores just 0 out of 6 on our undervaluation checks. In what follows, we will look at what traditional valuation methods indicate about the stock and then finish with a more nuanced way to think about its value.

Blackstone Mortgage Trust scores just 0/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Blackstone Mortgage Trust Excess Returns Analysis

The Excess Returns model asks a simple question: does Blackstone Mortgage Trust generate returns on shareholders’ equity that comfortably exceed its cost of equity capital, and for how long can that continue? It then values the stock by projecting those excess returns on the company’s equity base and discounting them back into today’s dollars.

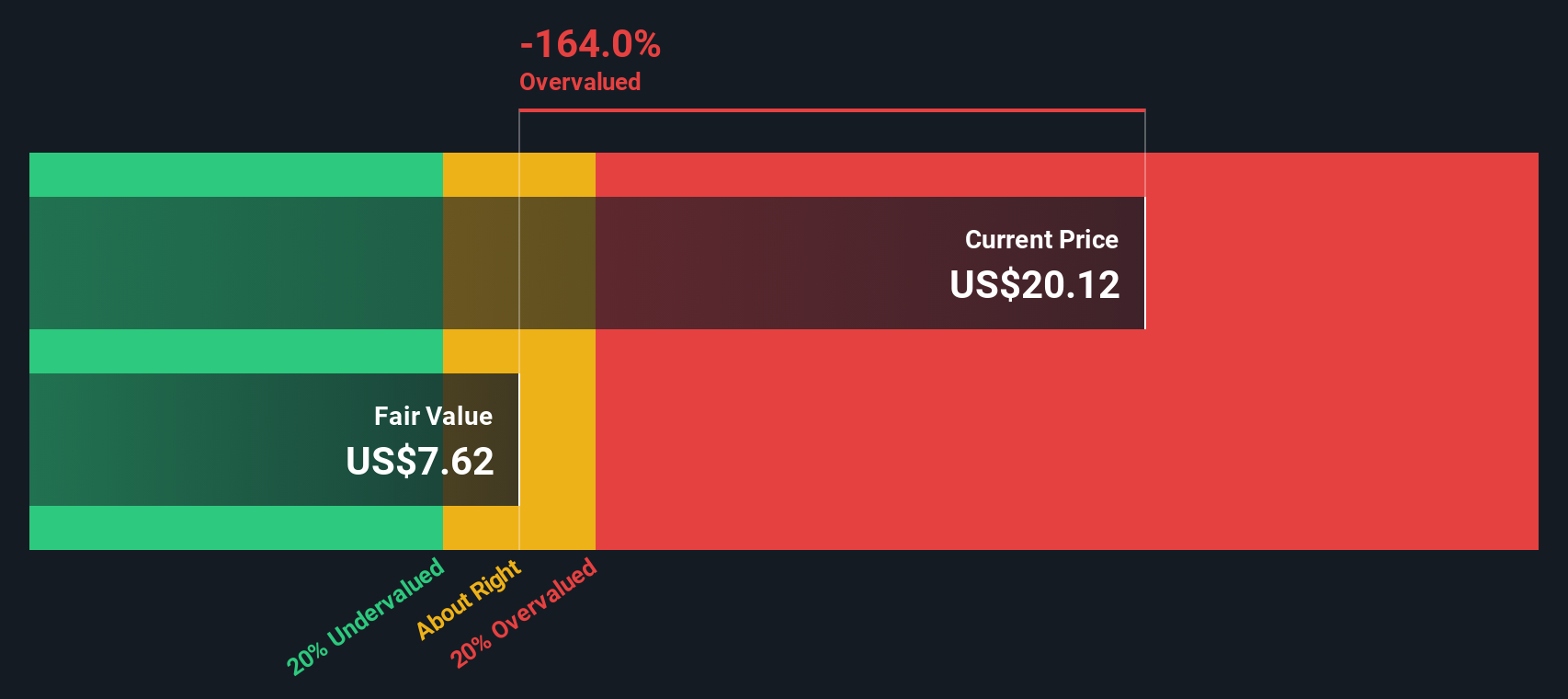

For Blackstone Mortgage Trust, the model starts with a Book Value of $20.84 per share and a Stable EPS of $1.06 per share, based on weighted future return on equity estimates from four analysts. Against this, the Cost of Equity is estimated at $1.72 per share, implying an Excess Return of $-0.66 per share and an Average Return on Equity of 5.12%. Stable Book Value is projected at $20.66 per share, using estimates from five analysts.

Because expected returns fall short of the required cost of equity, the Excess Returns framework arrives at an intrinsic value that is 164.0% below the current share price. On this basis, the stock screens as significantly overvalued rather than reasonably priced.

Result: OVERVALUED

Our Excess Returns analysis suggests Blackstone Mortgage Trust may be overvalued by 164.0%. Discover 916 undervalued stocks or create your own screener to find better value opportunities.

Approach 2: Blackstone Mortgage Trust Price vs Earnings

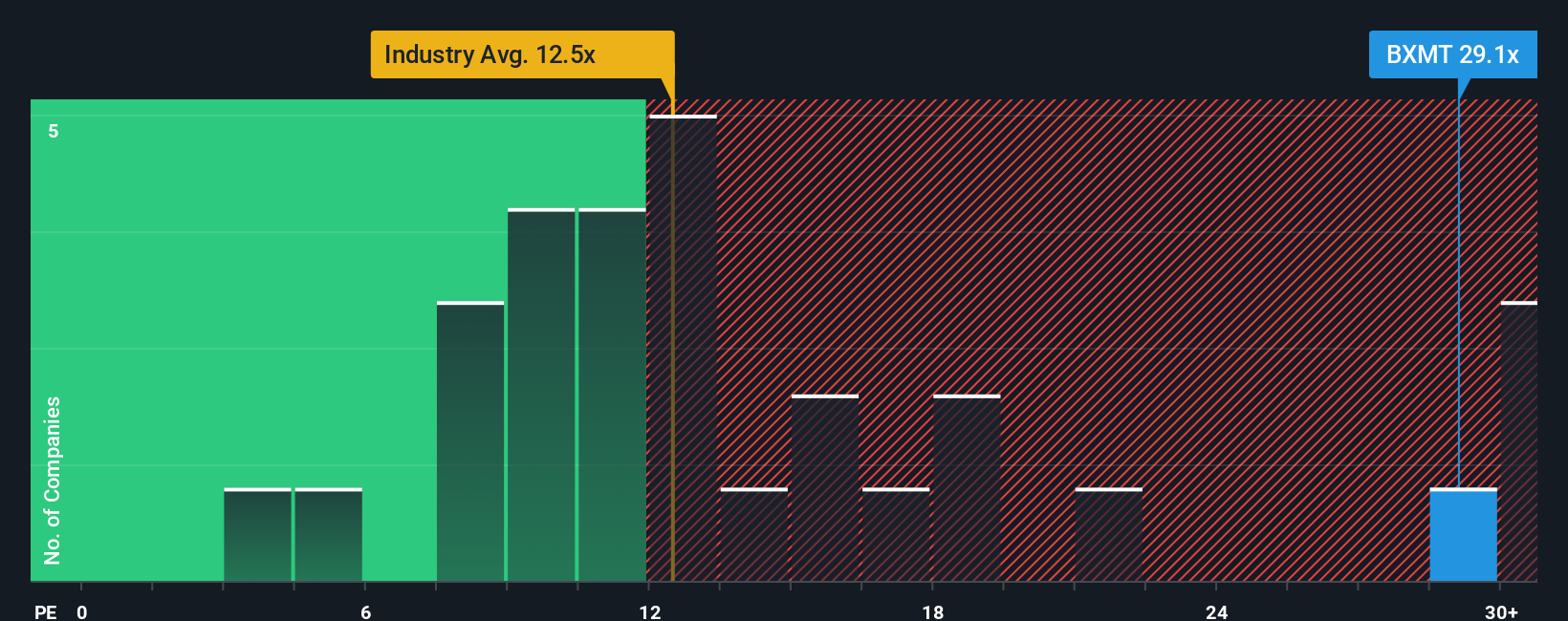

For profitable companies like Blackstone Mortgage Trust, the price to earnings (PE) ratio is a useful way to gauge how much investors are willing to pay for each dollar of current earnings. In broad terms, faster growth and lower risk usually justify a higher PE, while slower growth or higher risk call for a lower, more cautious multiple.

Blackstone Mortgage Trust currently trades on a PE of 31.78x, which is well above both the Mortgage REITs industry average of about 13.07x and the peer group average of roughly 12.15x. To move beyond these blunt comparisons, Simply Wall St estimates a proprietary “Fair Ratio” of 17.88x for Blackstone Mortgage Trust. This Fair Ratio reflects the company’s specific earnings growth outlook, its risk profile, profit margins, industry positioning and market capitalization. This makes it a more tailored benchmark than simple peer or sector averages.

Comparing the current 31.78x PE to the 17.88x Fair Ratio suggests the market is paying a premium that is difficult to justify on fundamentals alone, pointing to a stock that looks overvalued on this metric.

Result: OVERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1465 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Blackstone Mortgage Trust Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Simply Wall St provides these on the Community page as an easy tool used by millions of investors to connect a company’s story with a financial forecast and then with a fair value estimate.

A Narrative is your structured story about a company, where you spell out why revenue, earnings and margins might move the way you expect. You then translate that view into forecasts and a fair value that you can directly compare to today’s share price to help decide whether to buy, hold or sell.

Because Narratives on Simply Wall St are dynamic, they automatically update when new information arrives, such as fresh earnings results or major news. This helps your fair value view keep pace with the real world rather than staying frozen at the time you first ran the numbers.

For Blackstone Mortgage Trust, for example, one investor might build a bullish Narrative around successful resolution of impaired loans and rapid redeployment into higher quality credits, and arrive at a fair value near the most optimistic analyst target of $23.0. A more cautious investor may focus on tariff uncertainty, impaired assets and margin risk, leading to a fair value closer to $19.0.

Do you think there's more to the story for Blackstone Mortgage Trust? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal