Does Elevance Health’s 2025 Valuation Reflect Its Cash Flow Growth Potential?

- Wondering if Elevance Health is quietly turning into a value opportunity after a rough patch? This article will walk you through whether the current price really makes sense.

- The stock closed at $340.69 recently and, while it is down 5.1% over the last week and 6.9% year to date, it has climbed 7.7% over the past month and is still up 18.1% over five years, which hints at a recovery story that is still unfolding.

- Recent headlines around Elevance have focused on its ongoing push into integrated healthcare services and its strategy to sharpen cost controls across its insurance operations. Both of these factors shape how investors are reassessing the stock. At the same time, broader sector chatter about regulation and healthcare spending has added a layer of uncertainty that helps explain some of the recent volatility.

- On our 6 point valuation checklist, Elevance Health scores a strong 5 out of 6, suggesting it screens as undervalued on most traditional metrics. Next we will break down the standard valuation approaches, while saving an even more insightful way to think about its value for the end of the article.

Approach 1: Elevance Health Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model projects a company’s future cash flows and then discounts them back into today’s dollars to estimate what the entire business is worth right now.

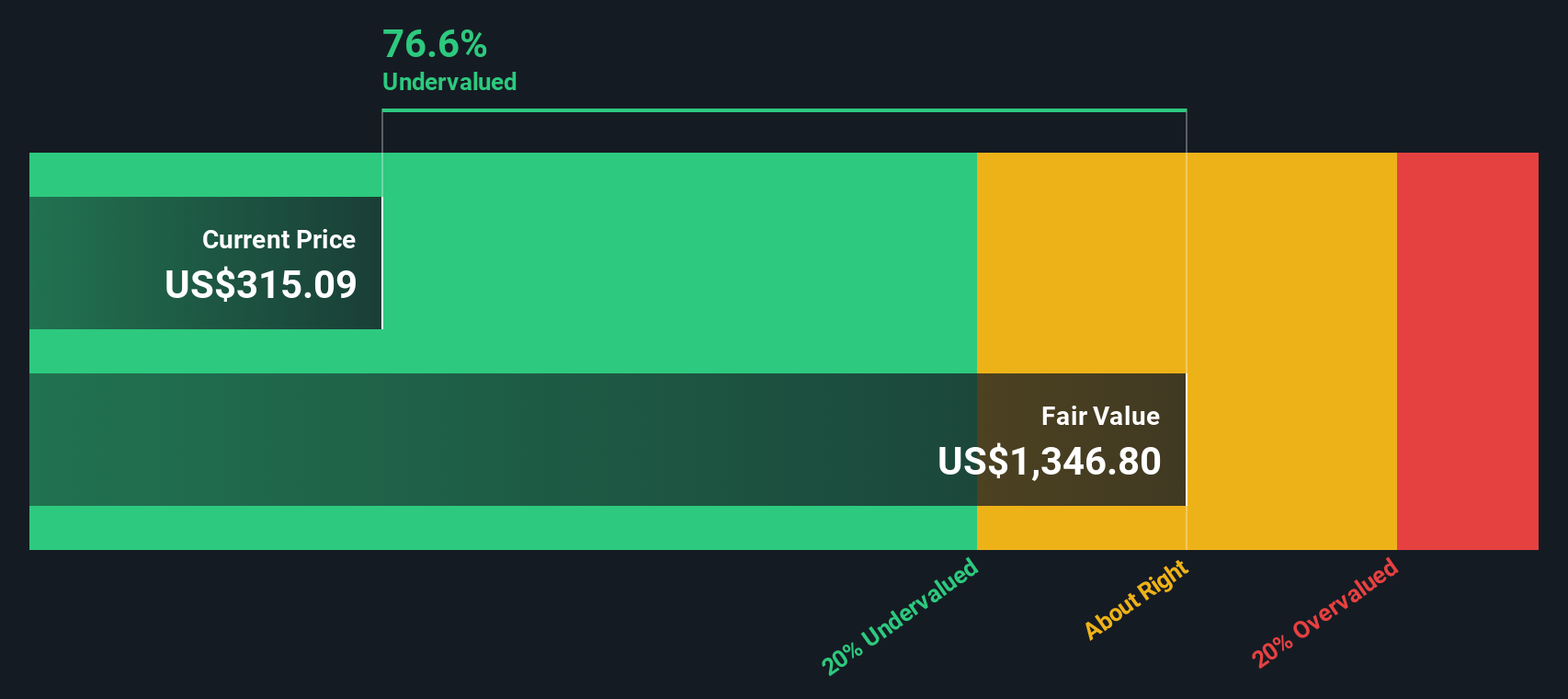

For Elevance Health, the latest twelve month Free Cash Flow stands at about $3.6 Billion. Analysts expect this to rise steadily, with Simply Wall St’s 2 Stage Free Cash Flow to Equity model extending those forecasts so that projected Free Cash Flow reaches roughly $8.7 Billion by 2029 and continues growing into the next decade.

When all of those future cash flows are discounted back to today, the model arrives at an intrinsic value of about $1,082 per share. Compared with the recent share price of roughly $341, the DCF implies the stock is trading at a 68.5% discount to its estimated fair value. This indicates a potentially wide margin of safety for long term investors who place weight on the modeled cash flow trajectory.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Elevance Health is undervalued by 68.5%. Track this in your watchlist or portfolio, or discover 917 more undervalued stocks based on cash flows.

Approach 2: Elevance Health Price vs Earnings

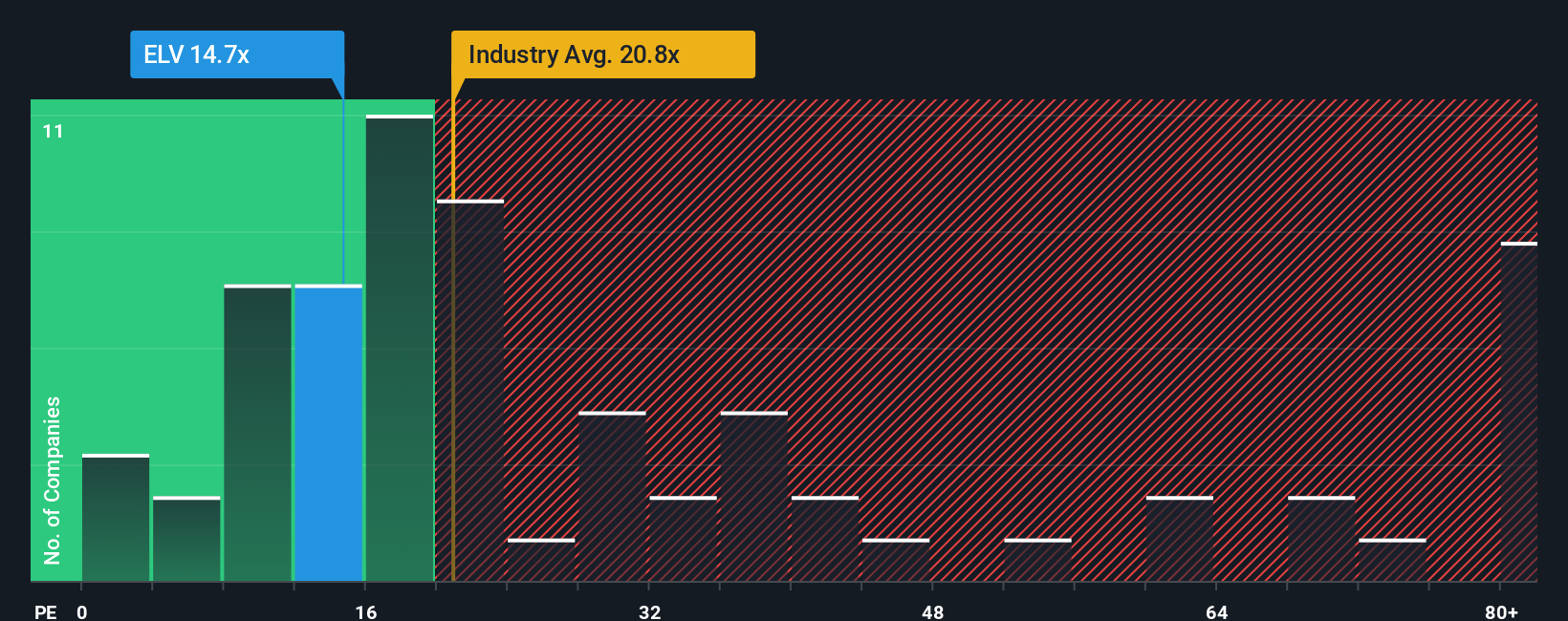

For a mature, profitable business like Elevance Health, the price to earnings ratio is a useful yardstick because it links what investors pay today to the profits the company is already generating. In general, faster growing, less risky companies can justify a higher PE multiple, while slower growth or elevated risk should translate into a lower, more conservative PE.

Elevance Health currently trades on a PE of about 13.7x. That is well below the broader Healthcare industry average of roughly 23.6x and also cheaper than the peer group average of around 23.3x, which already signals a valuation gap. Simply Wall St’s Fair Ratio framework goes a step further by estimating what PE the company deserves, given its earnings growth outlook, profit margins, risk profile, industry positioning and size in the market. This makes it more tailored than a simple comparison to peers or sector averages, which can be skewed by outliers.

On this Fair Ratio basis, Elevance Health is estimated to warrant a PE of about 32.6x, far above its current 13.7x multiple, pointing to the shares being priced at a substantial discount to their fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1465 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Elevance Health Narrative

Earlier we mentioned that there is an even better way to understand valuation. Let us introduce you to Narratives, a simple way to turn your view of Elevance Health into a story backed by numbers, where you set assumptions for future revenue, earnings, margins and a fair value, and then see how that story stacks up against today’s share price.

Do you think there's more to the story for Elevance Health? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal