Evaluating Grab (NasdaqGS:GRAB) After Infermove Deal and Upgraded FY2025 Revenue and EBITDA Guidance

Grab Holdings (GRAB) just doubled down on automation, buying Chinese robotics startup Infermove while also lifting its 2025 revenue and Adjusted EBITDA guidance, a one-two move that sharpens the stock’s efficiency and profitability story.

See our latest analysis for Grab Holdings.

That backdrop helps explain why, even with a 1 year total shareholder return of 0.61 percent and a much stronger 3 year total shareholder return of 50.76 percent, the 90 day share price return of negative 22.85 percent suggests momentum has cooled as investors reassess execution risks and what they are willing to pay for Grab’s longer term automation and superapp ambitions.

If you are watching how Grab is leaning into automation and platforms, it could be a good moment to explore other high growth tech and AI names via high growth tech and AI stocks and see what else fits your watchlist.

With shares trading at a near 34 percent discount to intrinsic value and analysts still modeling double digit growth, investors face a key question: Is Grab a mispriced automation winner, or is the market already baking in its next leg of expansion?

Most Popular Narrative Narrative: 39.9% Undervalued

BlackGoat’s narrative pins Grab’s fair value well above the last close of $4.93, framing today’s price as a substantial gap to long term potential.

I assume a 20% CAGR in revenue over the next five years, driven by rising digital adoption in Southeast Asia, Grab’s ecosystem expansion, and deeper monetisation of payments and financial services.

By year five, I project net profit margins of around 15% (up from 3.6%), supported by operating leverage at scale, tighter incentive discipline, and incremental contribution from Ads and Fintech.

Curious how steady double digit top line growth, rising margins, and a premium earnings multiple combine into that punchy upside case? Want to see the exact roadmap behind this valuation call?

Result: Fair Value of $8.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution remains critical, with thin GAAP margins and regulatory uncertainty around potential GoTo consolidation, both capable of derailing this undervaluation thesis.

Find out about the key risks to this Grab Holdings narrative.

Another Angle on Valuation

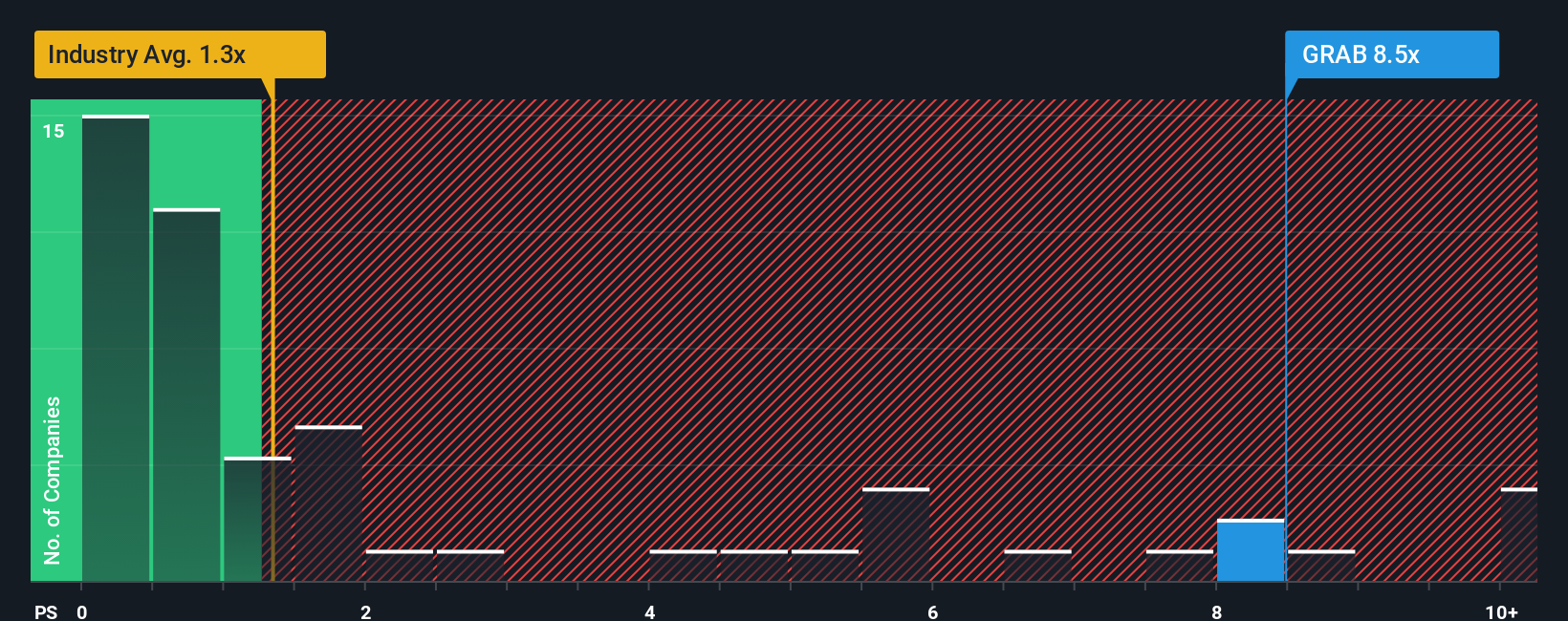

Step away from narrative assumptions and Grab suddenly looks far less cheap. Its price to sales ratio sits around 6.2 times versus a 1.1 times sector average and a 2.8 times fair ratio, meaning investors are already paying a heavy premium for growth execution.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Grab Holdings Narrative

If you see things differently or want to dive into the numbers yourself, you can build a custom Grab thesis in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Grab Holdings.

Looking for more investment ideas?

Grab is only one piece of the puzzle, and if you stop here you could miss out on other compelling opportunities shaping the next leg of market returns.

- Capture potential multi-baggers early by scanning these 3615 penny stocks with strong financials for smaller companies with strong fundamentals that the broader market has not fully priced in yet.

- Position yourself at the heart of the AI revolution by using these 25 AI penny stocks to pinpoint businesses turning cutting edge technology into durable revenue growth.

- Explore potential value ahead of the crowd by targeting these 917 undervalued stocks based on cash flows that may offer strong cash flow upside before sentiment fully shifts.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal