How Much You’d Have If You Bet $10,000 on Palantir Stock in January and 1 Key PLTR Catalyst to Watch in 2026

Palantir (PLTR) has been one of the most explosive stocks of the year.

From a low of $63.40, Palantir exploded to a high of about $207.52 for a return of about 229% a share. That means for every $10,000 risked on PLTR since January, you had the opportunity to walk away with about $32,900 in less than a year.

Now back to $191, investors are being handed another opportunity for further upside.

Partnering with Nvidia (NVDA) and CenterPoint Energy (CNP), the three launched Chain Reaction, which could be a massive catalyst for Palantir. Here’s why.

The AI Race Is Now All About Power

As artificial intelligence models become larger and more complex, the challenge is no longer limited to software development. Instead, the ability to supply sufficient electricity, computing capacity, and infrastructure is emerging as a key issue for growth.

In fact, as noted in a Palantir press release, “The bottleneck to AI innovation is no longer algorithms; it is power and compute. America is at an inflection point in the energy infrastructure buildout, and it requires software built for an entirely different scale.”

While algorithms are essential, there are limits we need to overcome when it comes to AI development. In fact, some of those very limits to building faster, far more capable artificial intelligence include massive amounts of electricity, compute power, memory, and networks, coupled with infrastructure challenges, such as getting enough power to data centers.

Unfortunately, current, explosively growing demands are quickly outpacing what traditional systems were designed to handle.

Power Demand from AI Data Centers Could Grow 30-Fold

Analysts at Deloitte expect AI data centers to place a significant strain on U.S. power grids. In fact, the firm argues that electricity demand from AI data centers could grow dramatically by the mid-2030s, increasing from just a few gigawatts today to well over 100 gigawatts.

“By 2035, Deloitte estimates that power demand from AI data centers in the United States could grow more than thirtyfold, reaching 123 gigawatts, up from 4 gigawatts in 2024. AI data centers can require dramatically more energy per square foot than traditional data centers. For example, a five-acre data center augmenting central processing units with specialized graphics processing units might see its energy usage increase from 5 to 50 megawatts,” they added.

The Chain Reaction platform aims to streamline how power is generated, distributed, and delivered to AI data centers. CenterPoint Energy plans to use the software to speed up access to electricity, while Nvidia will leverage the platform to support the deployment of its AI infrastructure across the U.S.

That alone is a substantial growth opportunity for Palantir, which is now at the center of one of the most critical challenges facing AI development growth.

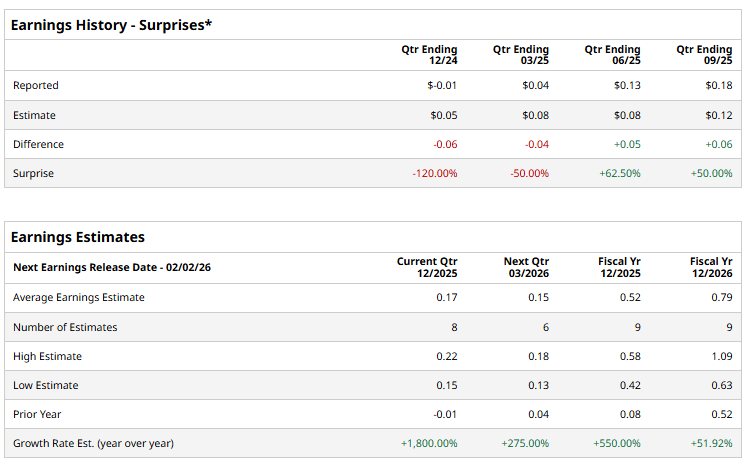

Earnings Haven’t Been Too Shabby Either

In its most recent quarter, Palantir’s EPS of $0.21 beat estimates by $0.04. Revenue of $1.18 billion, up 62.6% year over year, beat by $90 million.

Moving forward, the company expects Q4 revenue to come in between $1.327 billion and $1.331 billion, which is above estimates for $1.19 billion. For the full year, it expects revenue to come in between $4.396 billion and $4.4 billion, which is up from a prior forecast of $4.14 billion to $4.15 billion. It’s also above analyst estimates of $4.17 billion.

In short, Palantir is a powerhouse stock you may want to buy and hold for the long term. With AI and the need for power, I’d use any weakness as an opportunity to buy more.

On the date of publication, Ian Cooper did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal