Target (TGT) Valuation Check After FDA Warning on Recalled Infant Formula and Compliance Concerns

Target (TGT) just landed in the regulatory spotlight after the FDA issued a public warning, saying recalled ByHeart infant formula linked to a multistate botulism outbreak was still being sold and even promoted in its stores.

See our latest analysis for Target.

The FDA warning lands at a tricky moment for Target, with the share price at $99.05 after a strong 1 month share price return of 15.07 percent. However, the 1 year total shareholder return is a much weaker negative 21.34 percent, suggesting near term momentum is improving even as the long term story and execution risks still need to be rebuilt.

If this kind of regulatory shock has you reassessing retail risk, it may be worth exploring fast growing stocks with high insider ownership as a way to find aligned owner operators with stronger growth momentum.

With shares still down sharply over the past year and trading at a substantial intrinsic value discount, has Target now become a contrarian bet on an eventual turnaround, or is the market rightly discounting its future growth?

Most Popular Narrative Narrative: 2.6% Overvalued

Target's narrative fair value of $96.52 sits just below the recent $99.05 close, framing a tight debate over how much recovery is already priced in.

The analysts have a consensus price target of $103.688 for Target based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $82.0.

Curious how modest revenue growth, thinner future margins and a lower earnings multiple can still argue for upside from here, despite a cautious reset in expectations? The narrative lays out a precise earnings path, a deliberate de rating in valuation and a discount rate that quietly does the heavy lifting in the fair value math.

Result: Fair Value of $96.52 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, execution could surprise positively if Target's owned brands and higher margin digital initiatives scale faster. This could lift growth and cushion margins beyond current assumptions.

Find out about the key risks to this Target narrative.

Another Lens on Value

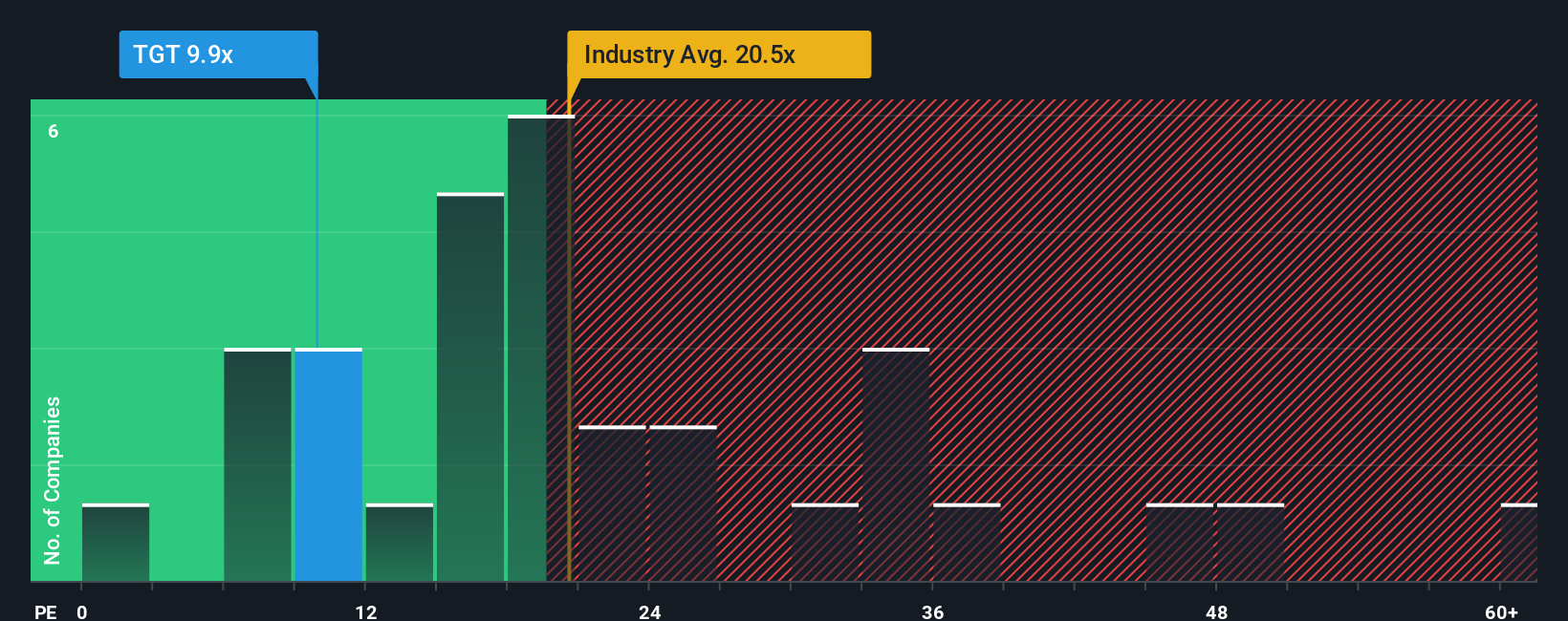

Step away from narratives and analyst targets and the plain earnings ratio tells a different story. At 11.9 times earnings, Target trades well below peers at 28.4 times and our fair ratio of 19.6 times, hinting at either a bargain or a value trap in the making.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Target Narrative

If you see the story differently, or would rather interrogate the numbers firsthand, you can craft a personalized view in minutes using Do it your way.

A great starting point for your Target research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for your next investing move?

Do not stop at one opportunity. Use the Simply Wall Street Screener to uncover fresh ideas that fit your strategy before the market moves without you.

- Capture early momentum by targeting fast movers using these 3616 penny stocks with strong financials before they appear on everyone else's radar.

- Capitalize on structural growth by scanning these 29 healthcare AI stocks powering breakthroughs at the intersection of medicine and algorithms.

- Lock in potential mispricings by filtering for these 918 undervalued stocks based on cash flows that the market has yet to fully recognize.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal