Rockwool (CPSE:ROCK B) Valuation Check After Recent 8% Share Price Rebound

Rockwool (CPSE:ROCK B) has quietly turned a corner in the past month, with the stock up about 8% even as its year to date performance and 1 year returns remain in the red.

See our latest analysis for Rockwool.

That recent 1 month share price return of just over 8% has only partially offset a weak year to date share price return and slightly negative 1 year total shareholder return, so the move looks more like early momentum than a full trend change.

If Rockwool’s shift has you rethinking your watchlist, this could be a good moment to explore fast growing stocks with high insider ownership for other under the radar opportunities with strong backing from insiders.

With earnings still growing modestly and the share price trading at a small discount to analyst targets, investors now face a key question: Is Rockwool quietly undervalued, or are markets already pricing in all its future growth?

Most Popular Narrative: 11.5% Undervalued

With Rockwool last closing at DKK221.40 and the most followed narrative pointing to fair value around DKK250, the gap hinges on specific growth and margin assumptions.

Ongoing and near term capacity expansions in key growth markets (U.S., Romania, India, West Coast U.S., France), including new electrified production lines, position Rockwool to capitalize on surging demand from tighter building codes and energy efficiency mandates. This is described as supporting both top line growth and higher utilization driven margin leverage over the medium

to long term.

Curious how moderate growth forecasts, steady margins and a re rated earnings multiple can still add up to a double digit upside case? The most popular narrative carefully stacks long term revenue expansion, stable profitability and shrinking share count into one cohesive valuation story. Want to see which assumptions really move the fair value needle here? Read on to unpack the full logic behind that DKK250 estimate.

Result: Fair Value of $250.06 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macro uncertainty, delayed projects, and slower margin recovery could easily derail the upbeat capacity and energy efficiency driven upside case.

Find out about the key risks to this Rockwool narrative.

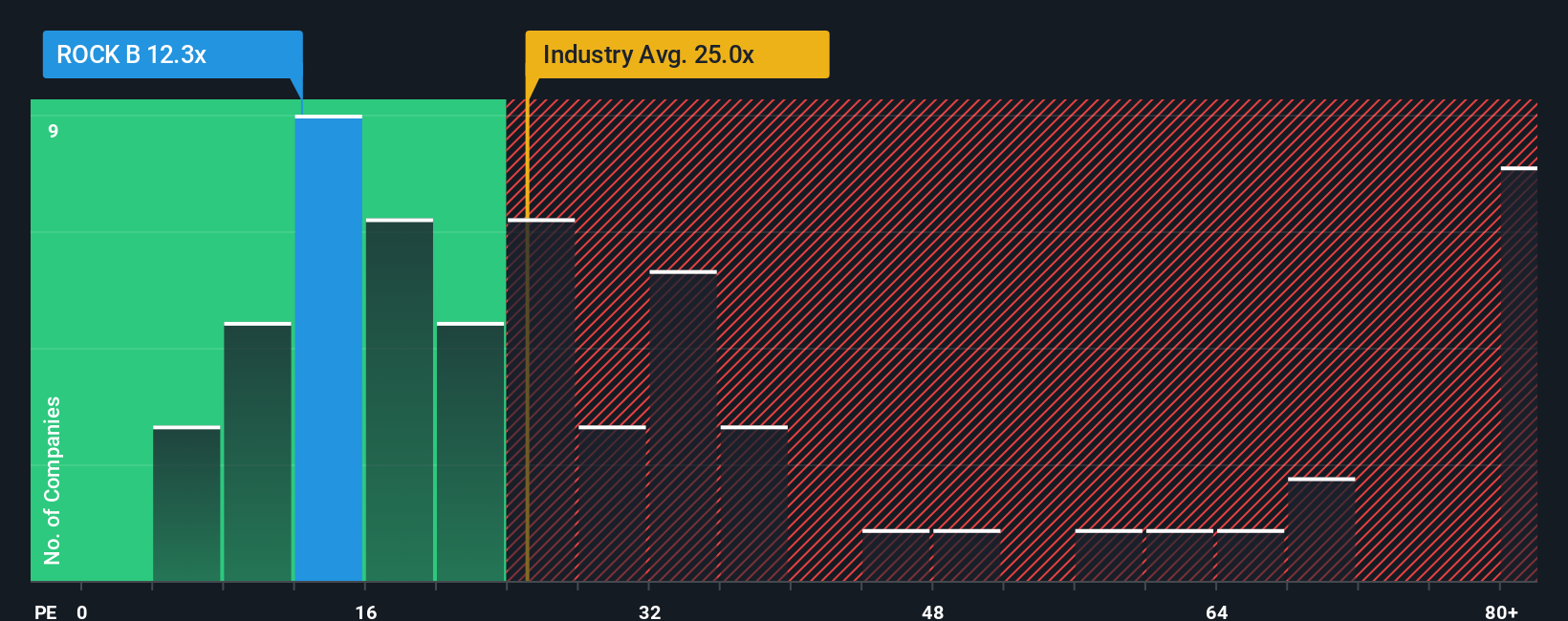

Another View: Earnings Ratio Sends a Different Signal

Our price to earnings lens paints a less bullish picture. At 12.6x earnings, Rockwool looks cheap versus peers at 21.2x and a fair ratio of 14.9x, but that discount could simply reflect slower growth and tighter margins rather than a clear bargain. Is this value or a value trap in the making?

See what the numbers say about this price — find out in our valuation breakdown.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Rockwool for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Rockwool Narrative

If this perspective does not quite fit your view, or you prefer hands on research, you can build a personalized Rockwool thesis in just minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Rockwool.

Ready for your next investing move?

Rockwool might be just one piece of your strategy, so now is the moment to scan the market and explore your next potential opportunities.

- Explore early stage potential with these 3610 penny stocks with strong financials and uncover smaller companies that could grow beyond their current market valuations.

- Position yourself at the forefront of intelligent automation by using these 29 healthcare AI stocks to research companies working on transforming diagnosis, treatment, and hospital efficiency.

- Strengthen your income strategy through these 13 dividend stocks with yields > 3%, focusing on businesses offering dividend yields that can play a role in long term returns.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal