Persistent Insider Selling Might Change The Case For Investing In Yelp (YELP)

- In mid-December 2025, Yelp’s Chief Financial Officer David Schwarzbach sold 13,500 company shares, adding to a year-long pattern of insider sales with no corresponding insider purchases.

- This steady stream of insider selling activity may influence how investors interpret leadership confidence in Yelp’s prospects, especially alongside mixed operational signals.

- We’ll now examine how this pattern of insider selling could influence Yelp’s existing investment narrative and the way investors assess its outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 35 best rare earth metal stocks of the very few that mine this essential strategic resource.

Yelp Investment Narrative Recap

To own Yelp today, you need to believe its local discovery platform and AI features can offset soft ad demand and rising competition, supporting steady revenue and earnings growth. The recent pattern of insider selling, including the CFO’s December transaction, may slightly sharpen near term concerns around leadership conviction, but does not materially change the core catalyst around AI driven engagement or the key risk of structurally weaker advertiser demand.

The most relevant recent update is Yelp’s ongoing investment in AI tools like Yelp Assistant and Review Insights, which aim to deepen user engagement and improve advertiser outcomes. If these features successfully increase qualified leads and justify ad spend, they could help counter the risk of slowing growth in paying advertising locations and reinforce the investment case even as insider activity raises questions.

Yet, while AI adoption is encouraging, investors should still be aware that advertiser demand could weaken further if ...

Read the full narrative on Yelp (it's free!)

Yelp's narrative projects $1.6 billion revenue and $193.5 million earnings by 2028.

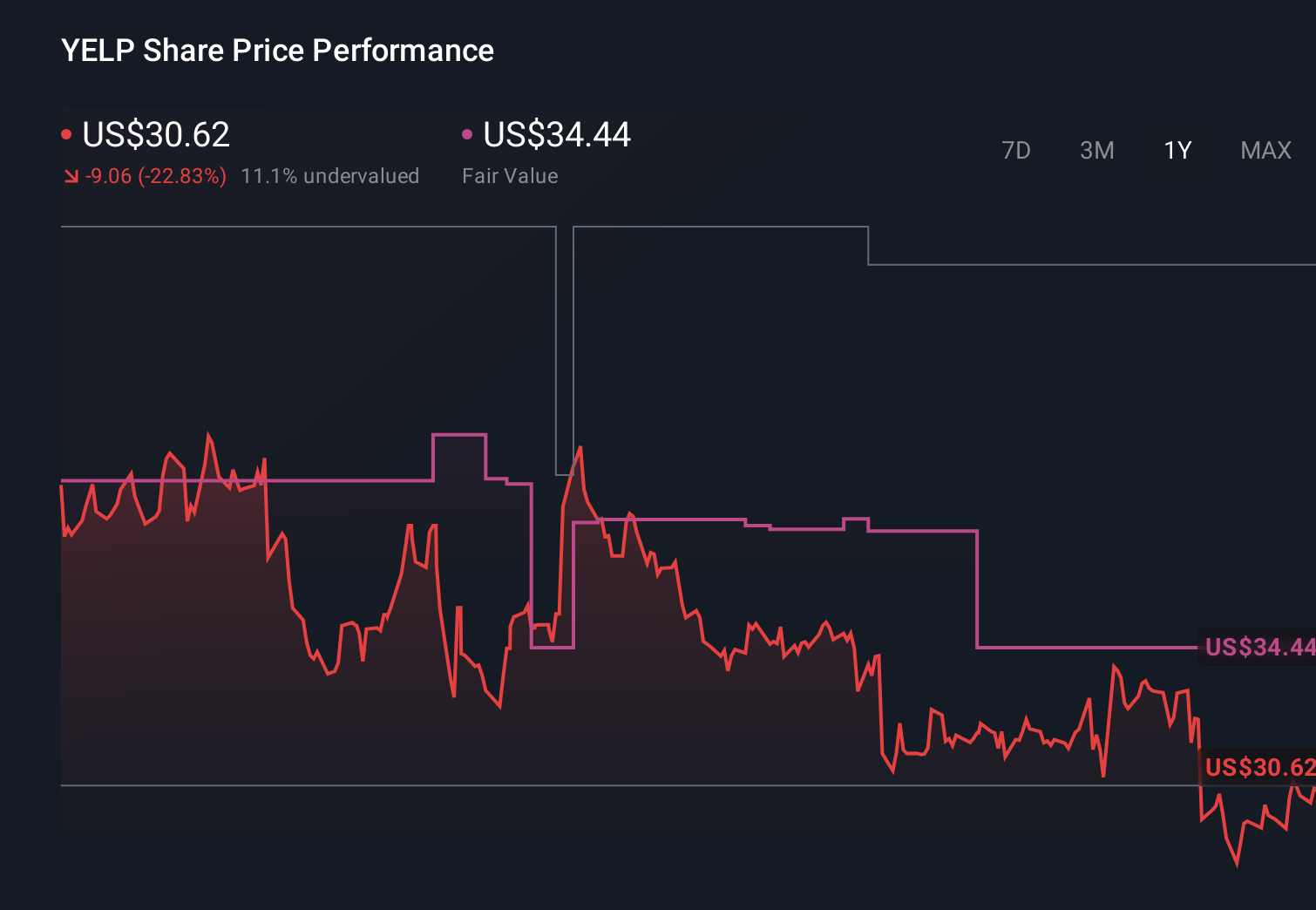

Uncover how Yelp's forecasts yield a $34.44 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Six Simply Wall St Community fair value estimates for Yelp span roughly US$20 to US$66 per share, underlining wide disagreement on upside. Against this, concerns about structurally softer advertiser demand remind you to weigh growth assumptions carefully and compare several independent views before forming a view on Yelp’s prospects.

Explore 6 other fair value estimates on Yelp - why the stock might be worth 36% less than the current price!

Build Your Own Yelp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Yelp research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Yelp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Yelp's overall financial health at a glance.

Interested In Other Possibilities?

Every day counts. These free picks are already gaining attention. See them before the crowd does:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Explore 28 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal