Suzuki Motor (TSE:7269) Valuation Check After Strong Multi‑Year Share Price Gains

Suzuki Motor (TSE:7269) shares have quietly pushed higher over the past month, and that steady climb has investors asking whether this auto and motorcycle maker still offers reasonable upside from here.

See our latest analysis for Suzuki Motor.

That recent climb sits on top of a strong run, with a roughly mid 20s year to date share price return and an impressive triple digit multi year total shareholder return, suggesting momentum is still firmly on Suzuki Motor's side.

If Suzuki's move has you curious about what else is revving up in autos, this is a good moment to explore other potential winners among auto manufacturers.

With earnings still growing and the share price trading below analyst targets but above some intrinsic value estimates, investors now face the key question: is Suzuki still a buy, or is future growth already priced in?

Price-to-Earnings of 11.5x: Is it justified?

On a trailing price to earnings ratio of 11.5 times, Suzuki Motor trades below both the broader JP market and key auto peers, despite its strong share price performance.

The price to earnings multiple compares the current share price to the company’s earnings per share, offering a quick snapshot of how much investors are paying for each unit of profit. For an established automaker with consistent profitability, it is a central yardstick for how the market values current and near term earnings power.

In Suzuki Motor’s case, the 11.5 times price to earnings ratio looks restrained when set against the estimated fair price to earnings ratio of 14.5 times, as well as higher peer and Asian auto industry averages. That gap suggests the market is assigning a discount to Suzuki’s earnings, even though the company has high quality past earnings, growing profits and margins, and earnings that have outpaced the wider auto sector.

Compared to the Asian auto industry average of 19 times and a peer average of 13.4 times, Suzuki Motor’s 11.5 times multiple stands out as materially lower, implying investors are paying less for each unit of earnings than they are for competitors. If the valuation converges toward the estimated fair multiple over time, there could be room for the share price and the market’s expectations to move higher.

Explore the SWS fair ratio for Suzuki Motor

Result: Price-to-Earnings of 11.5x (UNDERVALUED)

However, investors should watch for potential slowdowns in global auto demand and execution risks related to Suzuki’s diversification beyond core vehicles and motorcycles.

Find out about the key risks to this Suzuki Motor narrative.

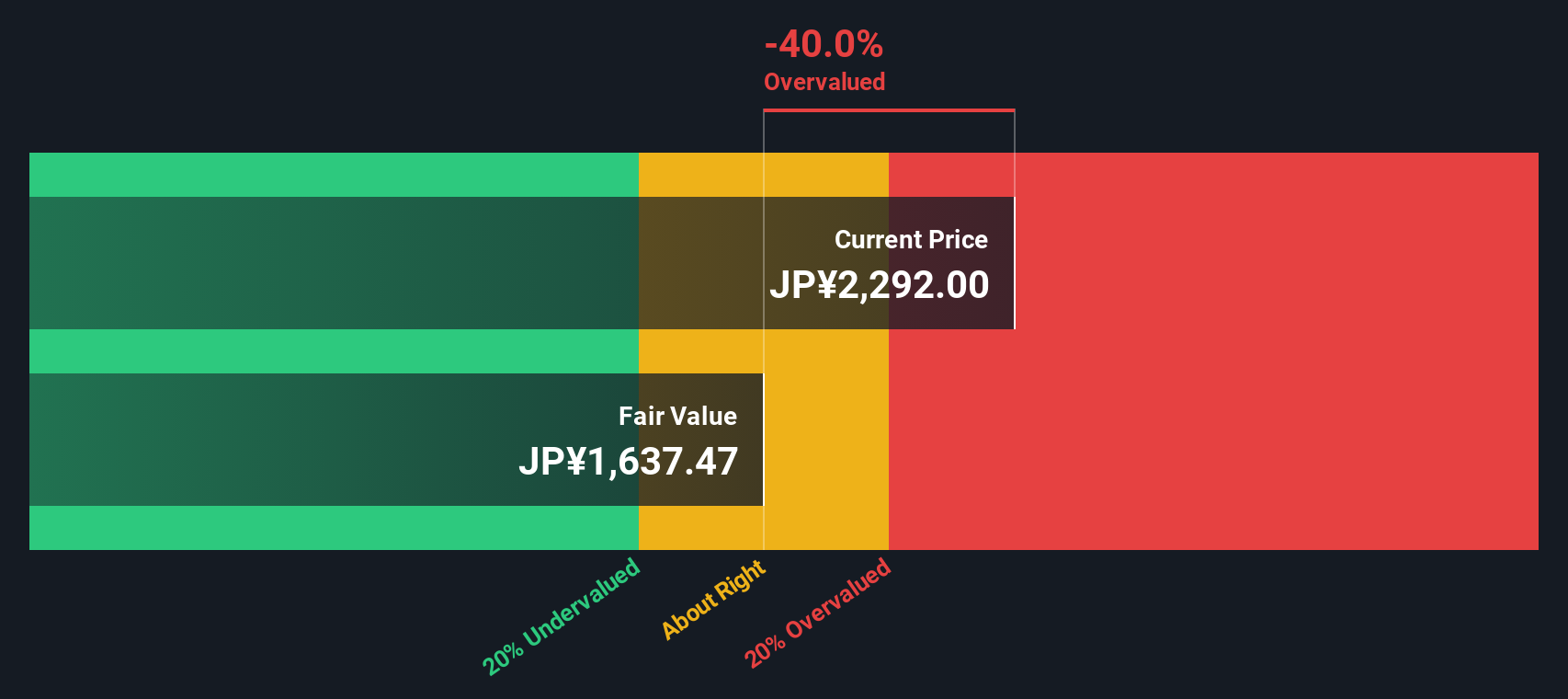

Another View Using Our DCF Model

While earnings multiples point to value upside, our DCF model paints a cooler picture. From this perspective, Suzuki’s current price around ¥2,339 sits above an estimated fair value near ¥1,818, implying the shares may be overvalued rather than cheap. Which lens will markets follow?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Suzuki Motor for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 919 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Suzuki Motor Narrative

If our view does not line up with yours, or you would rather dive into the numbers yourself, you can build a tailored narrative in minutes with Do it your way.

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding Suzuki Motor.

Ready for your next investing move?

Before you stop at Suzuki, lock in your edge by using the Simply Wall St Screener to uncover focused opportunities other investors might be overlooking right now.

- Capture potential multi baggers early by scanning for these 3608 penny stocks with strong financials that already show financial strength and credible growth stories.

- Position yourself at the forefront of innovation by targeting these 24 AI penny stocks that are building real world products with accelerating demand.

- Strengthen your long term core holdings by filtering for these 919 undervalued stocks based on cash flows that pair solid cash flows with attractive entry prices.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal