A Look at Aya Gold & Silver (TSX:AYA)’s Valuation After New Zgounder and Boumadine Technical Reports

Aya Gold & Silver (TSX:AYA) is back on traders radars after filing fresh technical reports that extend Zgounder s mine life to 2036 and outline new economics for the Boumadine project in Morocco.

See our latest analysis for Aya Gold & Silver.

That backdrop of longer mine life and fresh drill results helps explain why Aya s 1 month share price return is 35.66 percent and its year to date share price return sits at 71.42 percent, with a 1 year total shareholder return of 77.58 percent, suggesting momentum is still firmly building rather than fading.

If this kind of rerating story has your attention, it could be worth seeing what else is moving by exploring fast growing stocks with high insider ownership.

With Aya still trading at a roughly 29 percent discount to analyst targets after a huge run, the real debate now is whether this remains an undervalued growth story or if the market is already pricing in the next leg of expansion.

Most Popular Narrative: 18.6% Undervalued

With Aya Gold & Silver last closing at CA$19.25 against an implied fair value near CA$23.65, the most followed narrative leans toward meaningful upside, built on aggressive growth and richer metal price assumptions.

The upcoming Boumadine PEA (scheduled for Q4 2025) is expected to establish Boumadine as a Tier 1 asset and set the stage for transformational growth, expanding Aya's production profile and potentially attracting a higher valuation relative to peers with less project visibility, ultimately improving future cash flow and profitability.

Curious what kind of revenue surge, margin expansion, and future earnings multiple are baked into that fair value, and why they outrun typical metals names? The narrative hides some surprisingly bold forecasts about how fast output can scale, how profitable those ounces become, and what sort of premium the market might one day pay for them.

Result: Fair Value of $23.65 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent ore grade challenges or a sharp pullback in silver prices could quickly puncture those bullish assumptions and compress Aya's valuation.

Find out about the key risks to this Aya Gold & Silver narrative.

Another View: Rich on Sales

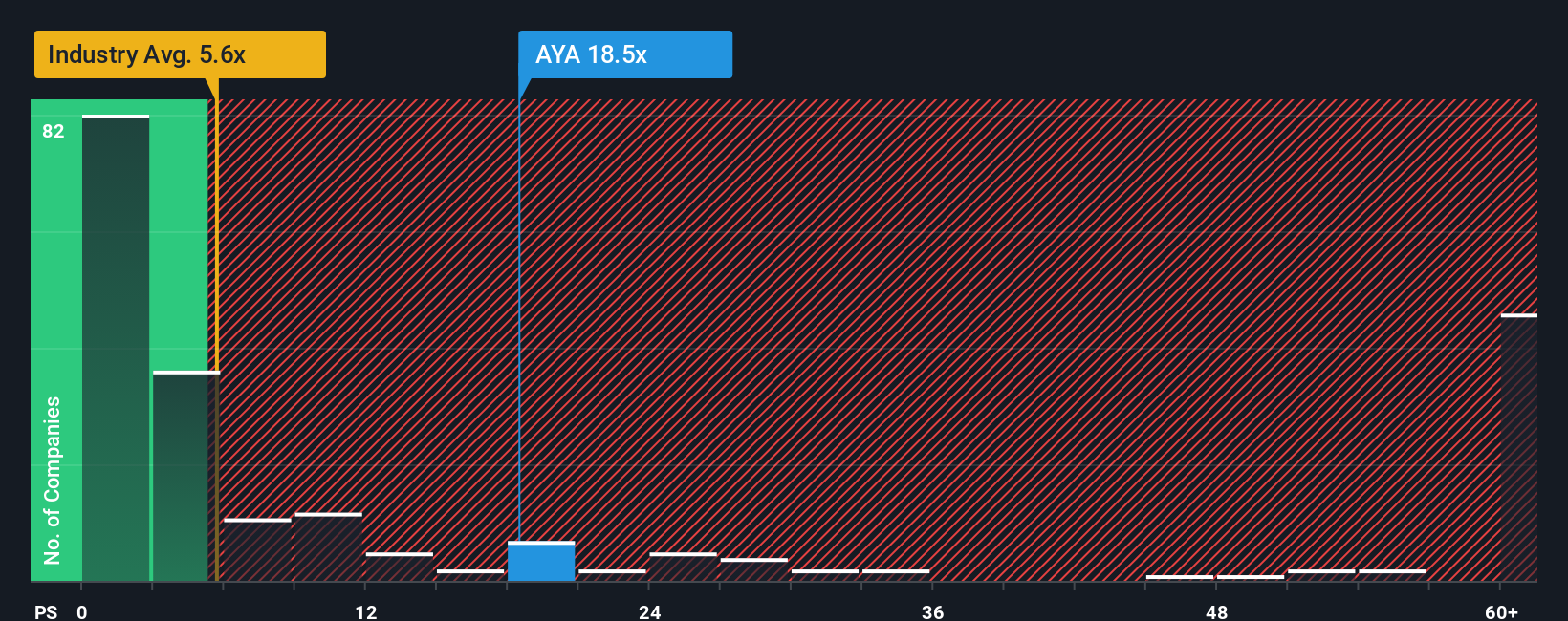

While the narrative fair value points to upside, Aya already trades on a steep 14.6x price to sales versus 6.7x for the Canadian metals and mining group and a 3.5x fair ratio. This implies the market is paying up heavily for growth that still needs to be delivered.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aya Gold & Silver Narrative

If you see the story differently or want to test your own thesis against the numbers, you can build a fresh view in under three minutes: Do it your way.

A great starting point for your Aya Gold & Silver research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

If you stop with Aya, you could miss out on other standout opportunities, so use the Simply Wall Street Screener to explore your next potential theme today.

- Seek potential multi-bagger upside by targeting early stage names using these 3608 penny stocks with strong financials with robust balance sheets and real operating traction behind the headlines.

- Gain exposure to the next wave in automation by focusing on these 24 AI penny stocks that combine powerful technology with scalable business models and recurring revenue.

- Look for potential value opportunities by tracking these 919 undervalued stocks based on cash flows where cash flow strength and discounted valuations indicate the market may not fully reflect underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal