Taking Stock of Dorchester Minerals (DMLP) Valuation After Announced Leadership Transition and Board Changes

Dorchester Minerals (DMLP) is entering a carefully staged leadership transition, with longtime co founder and Chairman William Casey McManemin set to retire at the end of 2025 and fellow co founder Robert C. Vaughn stepping in as Interim Chairman.

See our latest analysis for Dorchester Minerals.

Despite the planned leadership handover, the recent 1 month share price return of negative 3.99% and year to date share price return of negative 36.25% show momentum has faded. However, the 5 year total shareholder return of 231.27% still reflects a strong longer term compounding story.

If you are weighing what this leadership transition might mean for your portfolio, it could also be a good time to broaden your search and explore fast growing stocks with high insider ownership.

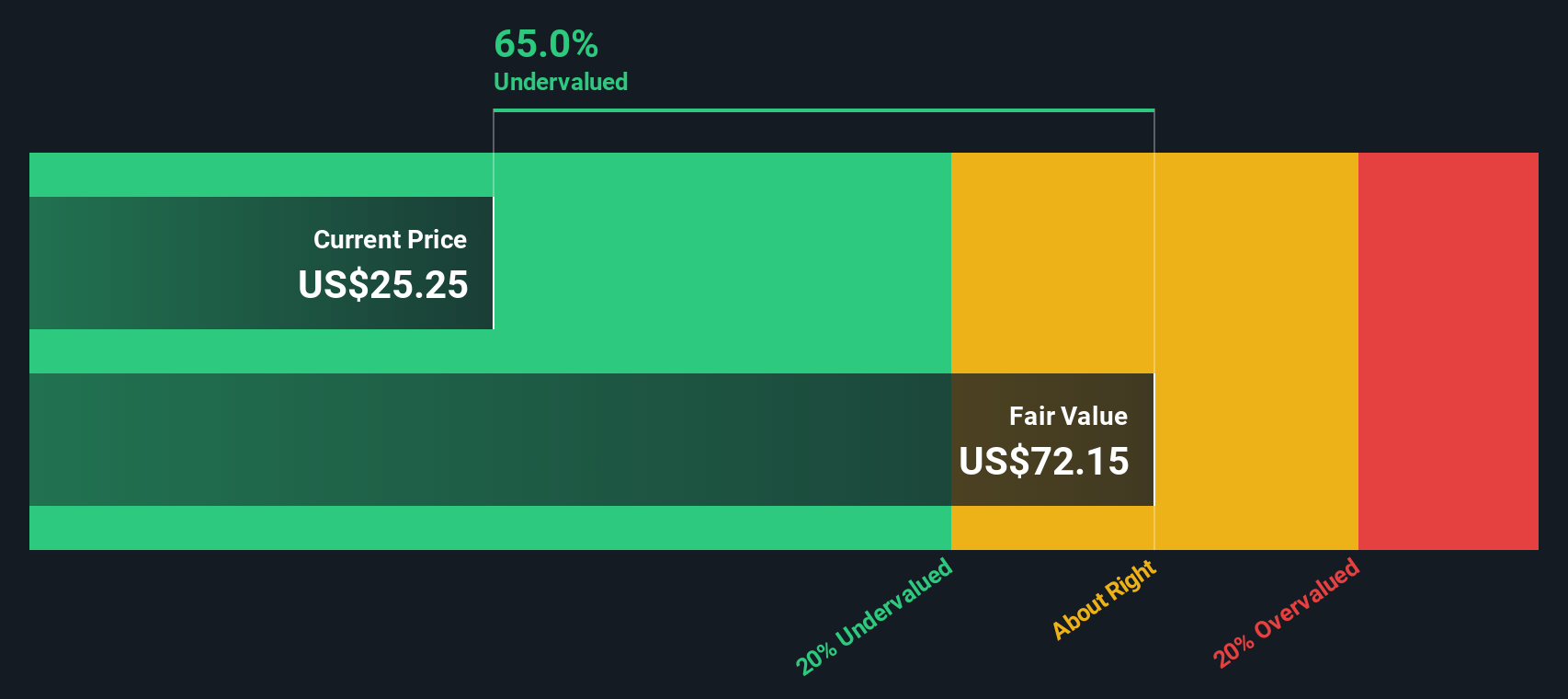

With leadership changes on the horizon and the units trading at what looks like a steep intrinsic discount, is Dorchester Minerals quietly slipping into value territory, or is the market already pricing in muted growth ahead?

Price-to-Earnings of 20x: Is it justified?

On a price-to-earnings basis, Dorchester Minerals trades at 20 times earnings, which makes the current 22.11 dollar unit price look demanding versus many peers.

The price-to-earnings ratio compares what investors pay today for each dollar of current earnings, a useful lens for mature, cash generating energy partnerships like DMLP.

Relative to the broader US Oil and Gas industry average of 13 times earnings, the market is assigning DMLP a clear premium multiple despite its recently weaker profit trends. However, that same 20 times earnings still sits at a discount to the tighter peer group average of 25.2 times, suggesting investors are willing to ascribe above-industry value, but not full peer-level optimism.

Against the industry benchmark, DMLP appears meaningfully more expensive on earnings, with a price-to-earnings tag that stands well above the typical sector valuation.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price-to-Earnings of 20x (OVERVALUED)

However, if operating performance disappoints, sustained unit price weakness and uncertainty around leadership succession could quickly erode the perceived valuation premium.

Find out about the key risks to this Dorchester Minerals narrative.

Another View, Our DCF Signals Deep Undervaluation

While the 20 times earnings multiple looks rich, our DCF model paints a very different picture, with a fair value of 67.09 dollars per unit versus the current 22.11 dollars. That 67% discount suggests investors may be pricing in far more risk than the cash flows imply, or it may indicate that the model is too optimistic about future distributions.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dorchester Minerals for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dorchester Minerals Narrative

If you would rather challenge these assumptions and dig into the numbers yourself, you can build a personalized view of Dorchester Minerals in minutes: Do it your way.

A great starting point for your Dorchester Minerals research is our analysis highlighting 1 key reward and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, lock in an information edge by using the Simply Wall Street Screener to uncover fresh opportunities your watchlist may be missing.

- Capitalize on mispriced opportunities by scanning these 918 undervalued stocks based on cash flows that could offer stronger long term upside than the usual market favorites.

- Ride powerful secular trends by targeting these 24 AI penny stocks positioned at the heart of machine learning, automation, and data driven innovation.

- Strengthen your income stream by focusing on these 13 dividend stocks with yields > 3% that may support more reliable cash payouts through shifting market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal