Sony Group (TSE:6758): Assessing Valuation After Recent Share Price Pullback

Context and recent share performance

Sony Group (TSE:6758) has been drifting lower over the past month, with the share price down roughly 8% and about 8% over the past 3 months, even as its one year return remains comfortably positive.

See our latest analysis for Sony Group.

Recent weakness, including a 1 week share price return of negative 4.54 percent and a 1 month share price return of negative 7.87 percent, suggests momentum is cooling. However, the 1 year total shareholder return of 28.17 percent still points to a solid longer term uptrend.

If Sony’s latest pullback has you thinking more broadly about the sector, it could be a good moment to explore high growth tech and AI stocks for other potential opportunities.

With shares easing despite healthy long term returns and analysts still seeing upside from current levels, the key question now is whether Sony is quietly undervalued or if the market is already pricing in its future growth.

Most Popular Narrative: 22.5% Undervalued

With Sony’s last close at ¥3991, the most widely followed narrative points to a higher fair value of ¥5146.8, implying meaningful upside if its assumptions hold.

Ongoing expansion and robust engagement in Sony's PlayStation ecosystem, including increased monthly active users and growth in network service revenue, indicate a shift toward more stable, high margin, recurring digital income streams, supporting sustained revenue and operating margin expansion.

Curious how steady subscription cash flows, rising margins, and a richer content mix can justify a premium future earnings multiple for Sony’s shares? The narrative unpacks the specific revenue paths, profitability targets, and valuation bridge that connect today’s price to that higher fair value. Want to see which earnings runway and margin profile underpin this upgrade case?

Result: Fair Value of ¥5146.8 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, a weaker slate of gaming and entertainment hits, or intensifying competition in image sensors, could derail margin expansion and challenge that earnings rerating.

Find out about the key risks to this Sony Group narrative.

Another Angle on Value

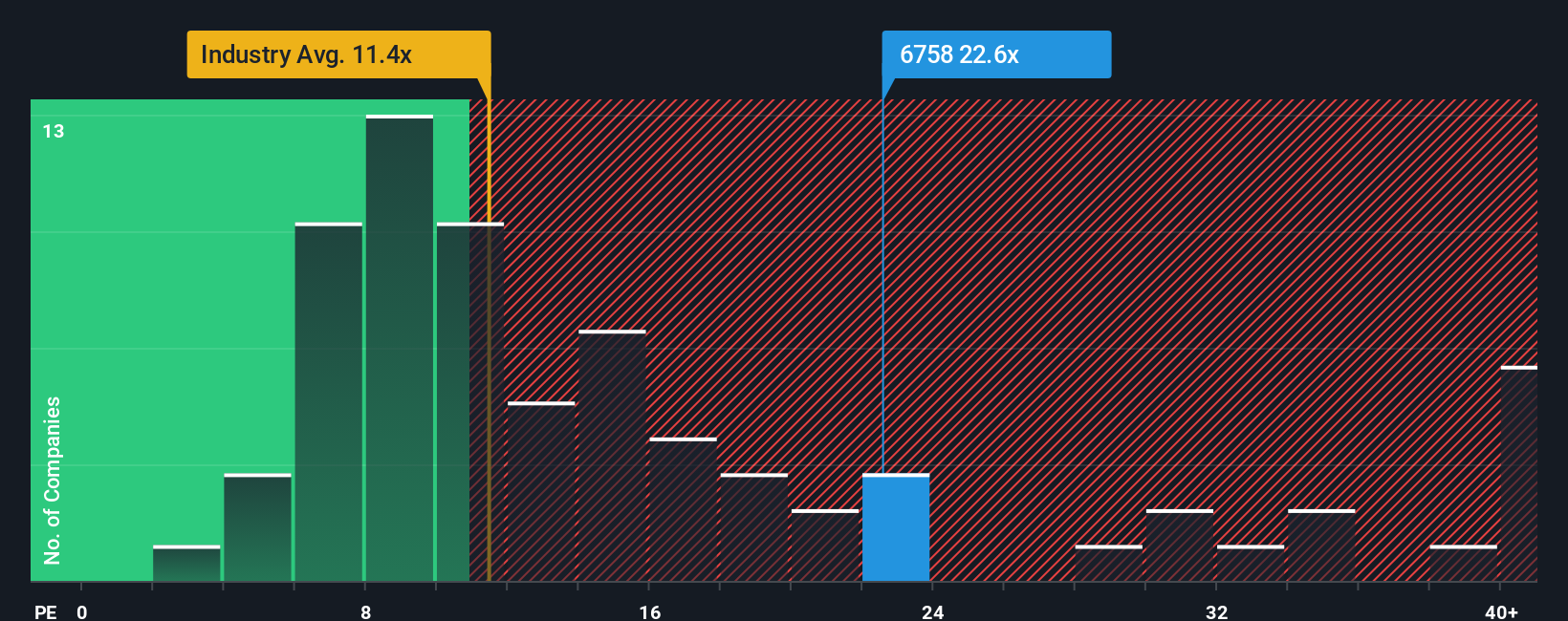

On earnings, Sony looks pricey at 19.7 times, well above the Japan Consumer Durables average of 11.6 times, yet still below peers at 27.8 times and under our fair ratio of 26.6 times. Is that gap a warning of limited upside or a sign the market could still re rate the stock higher over time?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sony Group Narrative

If you see the numbers differently or simply want to dig into the details yourself, you can build a custom view in minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Sony Group.

Ready for your next investing move?

Do not stop with one opportunity. Use the Simply Wall Street Screener now to uncover focused stock ideas that others will only notice after the move.

- Explore underappreciated potential by targeting these 918 undervalued stocks based on cash flows that the market has not fully priced in yet.

- Explore powerful technology shifts by zeroing in on these 24 AI penny stocks that are involved in emerging innovations.

- Explore potential income opportunities by filtering for these 13 dividend stocks with yields > 3% that can support more reliable cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal