Is Bausch Health a Contrarian Opportunity After Its Recent Price Rebound and DCF Valuation Gap

- Wondering if Bausch Health Companies at around $6.82 is a contrarian bargain or a value trap? You are not alone, and this is exactly the kind of setup where a closer look at valuation can really pay off.

- The share price is down 1.4% over the last week but up 12.7% over the past month, even though it is still negative year to date and over the last year. This mix suggests shifting market expectations and risk perceptions rather than a simple straight line trend.

- Recent headlines have focused on the company’s ongoing balance sheet repair efforts and strategic moves around its portfolio. These help explain why investors are rethinking the long term story despite a tough five year return of negative 66.4%. At the same time, renewed interest from value oriented investors has put more attention on whether the current price already reflects the company’s leverage and legacy risks.

- On our framework Bausch Health scores a solid 5 out of 6 on undervaluation checks. This is strong enough to justify a deeper dive into discounted cash flows, multiples, and asset based views, and we will finish by highlighting an approach that can make all those valuation methods more intuitive for long term investors.

Find out why Bausch Health Companies's -8.7% return over the last year is lagging behind its peers.

Approach 1: Bausch Health Companies Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a stock should be worth by projecting the company’s future cash flows and then discounting them back to today in dollar terms. For Bausch Health Companies, the model starts with last twelve month Free Cash Flow of about $1.14 billion and then layers on analyst forecasts and longer term extrapolations.

Analysts see Free Cash Flow climbing into the low to mid $2 billion range over the coming years. Simply Wall St then extends those projections so that by 2035 the model is using an annual Free Cash Flow figure of roughly $2.7 billion. Each of these future cash flows is discounted back using a 2 Stage Free Cash Flow to Equity framework to reflect risk and the time value of money.

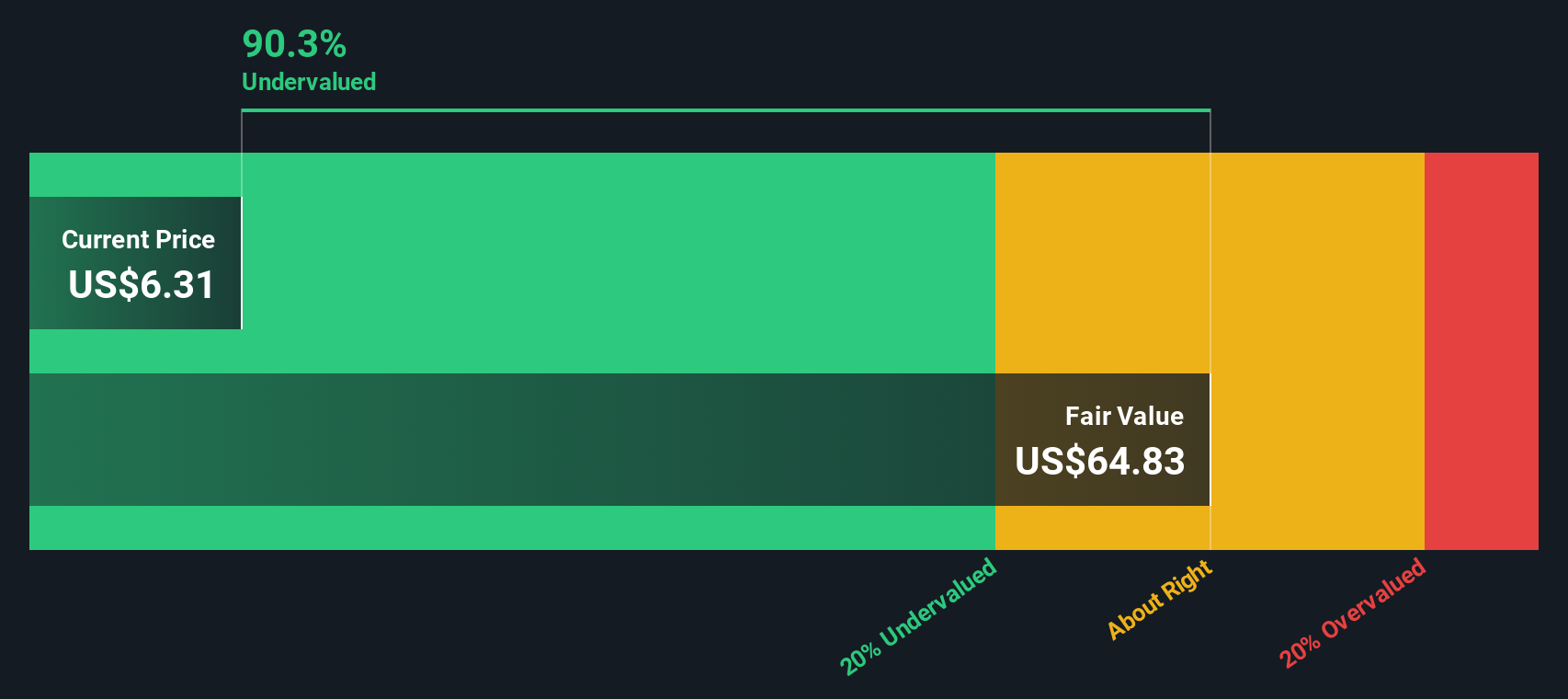

On this basis, the DCF model estimates an intrinsic value of about $68.71 per share. This implies the stock is currently trading at roughly a 90.1% discount to fair value. That signals a deep value setup, assuming the cash flow trajectory and discount assumptions hold up.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Bausch Health Companies is undervalued by 90.1%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Bausch Health Companies Price vs Earnings

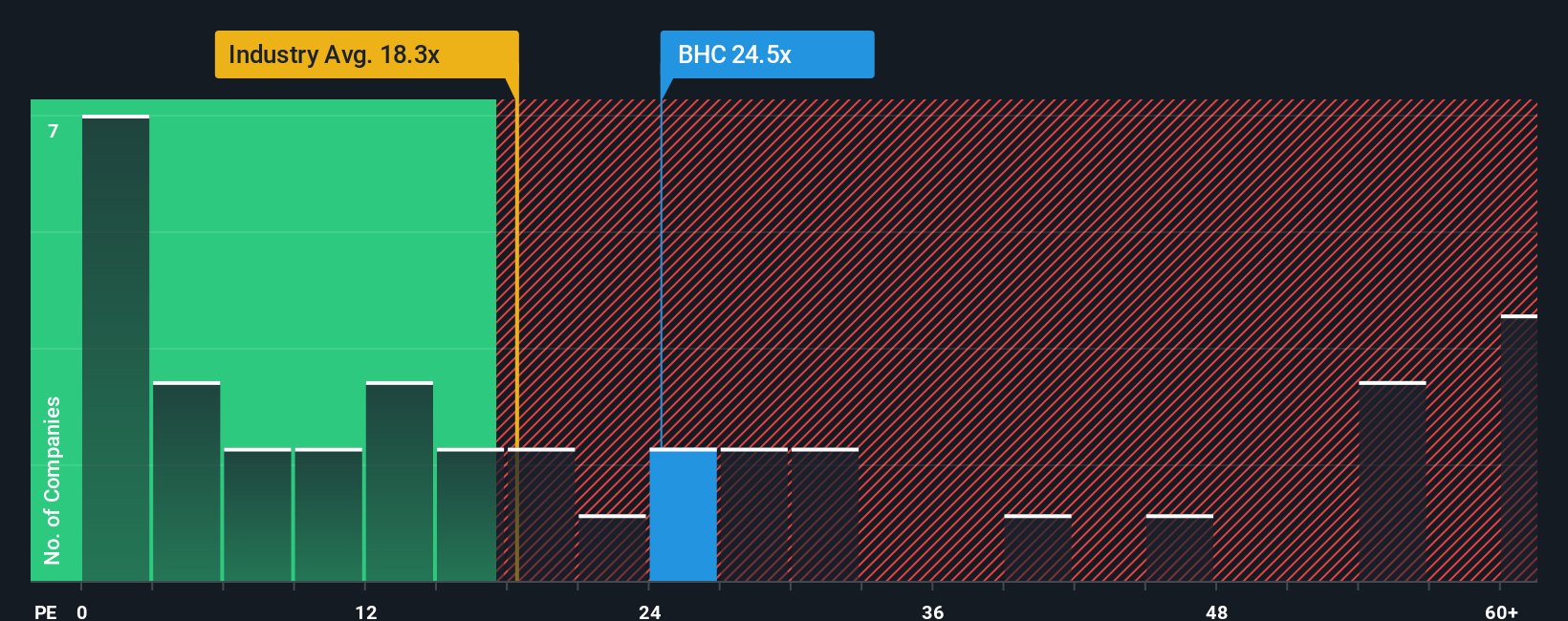

For a profitable business like Bausch Health Companies, the Price to Earnings, or PE, ratio is a useful way to gauge how much investors are paying for each dollar of current earnings. In general, faster growth and lower perceived risk justify a higher PE, while slower growth and higher risk typically call for a lower, more conservative multiple.

Bausch Health currently trades on a PE of about 7.0x, which is well below both the Pharmaceuticals industry average of roughly 20.0x and the broader peer group average of around 27.6x. At first glance that kind of discount can look like a clear bargain, but it can also reflect the market pricing in leverage, legacy issues, or earnings volatility.

Simply Wall St tackles this by estimating a Fair Ratio, the PE level that would be expected given Bausch Health’s specific mix of earnings growth, profit margins, risk profile, industry and market cap. On this framework, the Fair Ratio lands at about 18.4x, comfortably above the current 7.0x. That gap suggests the stock is trading well below what its fundamentals would normally justify.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Bausch Health Companies Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. Narratives are simply your story about a company translated into numbers like future revenue, earnings, margins and ultimately a fair value estimate.

A Narrative connects three parts of your thinking in one place: the business story you believe, the financial forecast that follows from that story, and the fair value you get when you discount those assumptions back to today.

On Simply Wall St, Narratives are available on the Community page and used by millions of investors as an easy, accessible tool to consider whether to buy or sell by comparing their Fair Value to the current market Price. Each Narrative updates dynamically as new information, such as earnings results or major news, is released.

For Bausch Health Companies, one investor might build a more optimistic Narrative around margin improvement, growth in gastroenterology and international markets and end up close to the higher analyst target of about 10 dollars per share. A more cautious investor might focus on debt, pricing pressure and concentration risk and land nearer the lower target of about 5 dollars. You can see and refine both perspectives directly in the platform.

Do you think there's more to the story for Bausch Health Companies? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal