Is It Time To Revisit Zscaler After Its Sharp Recent Pullback?

- If you are wondering whether Zscaler is still worth considering after its big run, or if the easy money has already been made, you are not alone. This breakdown is designed to explore exactly that question.

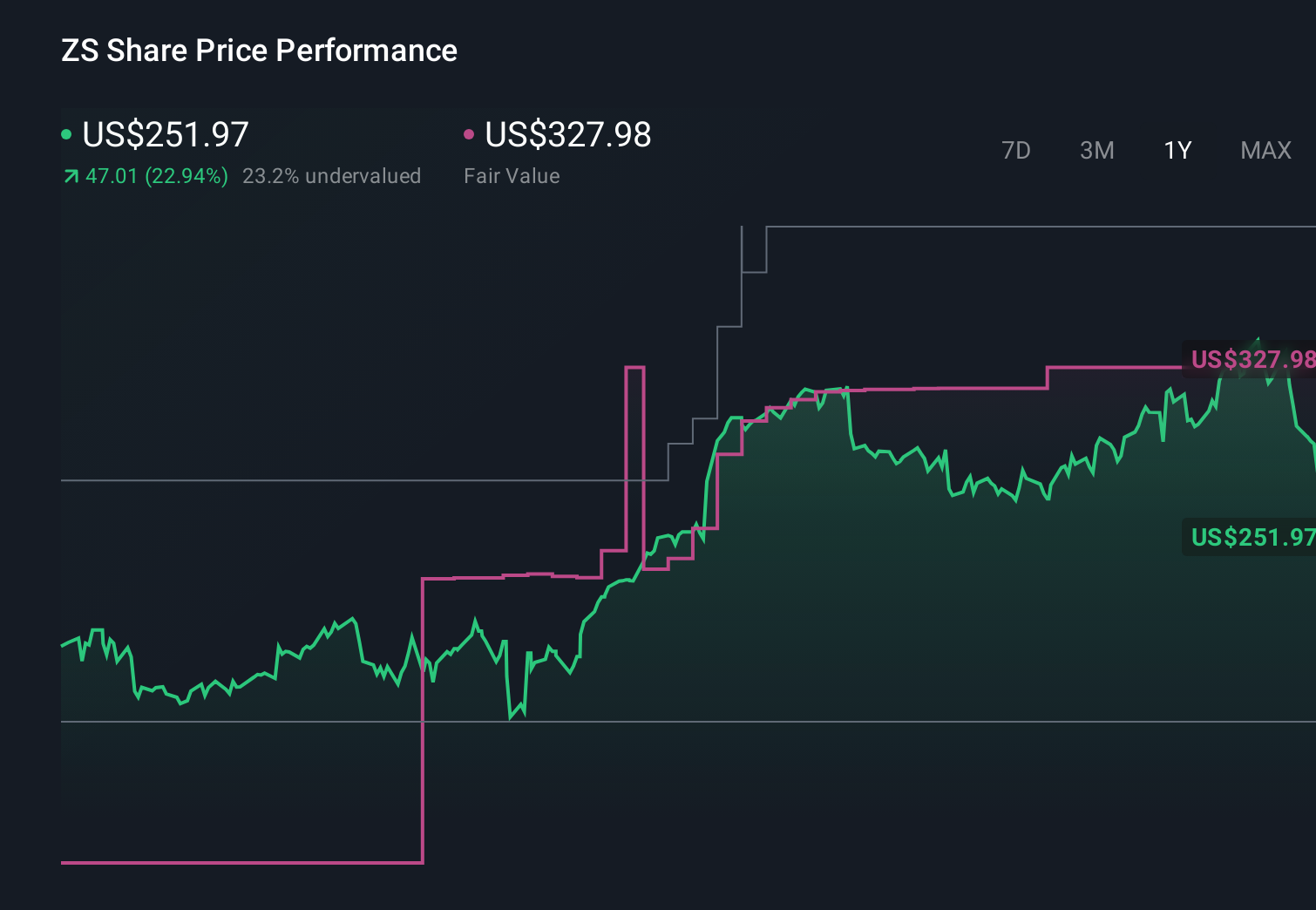

- The stock is up 27.2% year to date and 23.3% over the last year. However, this follows a sharp 20.8% pullback in the past month that has some investors questioning whether the risk reward balance has shifted.

- Recent headlines have focused on Zscaler expanding its zero trust security platform and deepening partnerships across cloud ecosystems, reinforcing its position as a go to name in cloud security. At the same time, sector wide swings in high growth software names have amplified volatility in Zscaler shares as investors reassess future growth and risk.

- Based on our checks, Zscaler scores a 3/6 valuation score, suggesting it appears undervalued on some metrics but stretched on others. In the sections that follow, we will walk through the main valuation approaches, then return to a more holistic way to think about what the stock may be worth.

Approach 1: Zscaler Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a company is worth by projecting the cash it can generate in the future and then discounting those cash flows back to today in dollar terms.

For Zscaler, the 2 stage Free Cash Flow to Equity model starts with last twelve month free cash flow of about $854 million and uses analyst estimates for the next few years, then extrapolates further growth. Under this framework, free cash flow is projected to rise to roughly $2.27 billion by 2030, with growth gradually slowing in later years as the business matures.

When all these future cash flows are discounted back to today, the model arrives at an intrinsic value of about $289.59 per share. Compared with the current share price, this implies Zscaler is trading at a 20.2% discount, indicating the market may be underestimating its long term cash generation potential according to this model.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Zscaler is undervalued by 20.2%. Track this in your watchlist or portfolio, or discover 918 more undervalued stocks based on cash flows.

Approach 2: Zscaler Price vs Sales

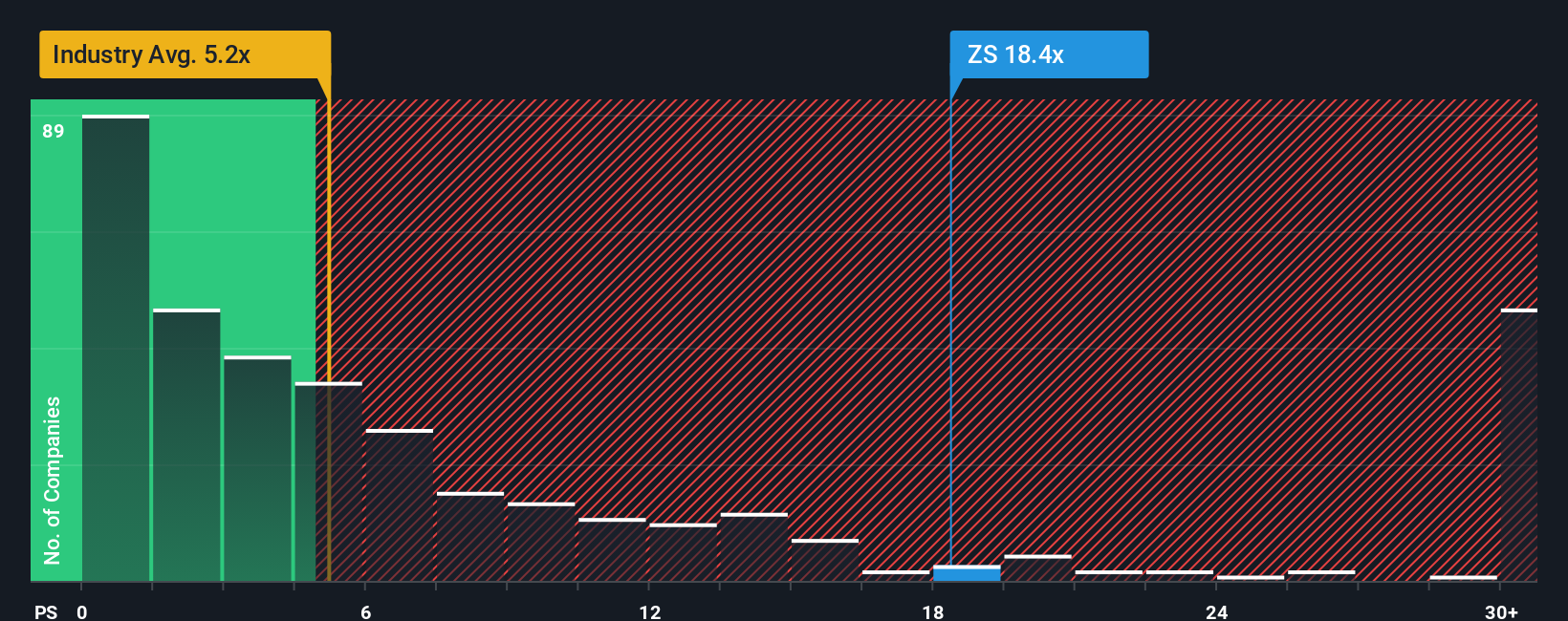

For a fast growing software business that is still prioritizing scale over bottom line profits, the price to sales ratio is often the cleanest way to compare valuation because revenue is less affected by near term investment decisions than earnings.

In general, higher growth and stronger competitive positioning can justify a higher normal price to sales multiple, while elevated risks or slowing momentum tend to cap what investors are willing to pay. Against that backdrop, Zscaler currently trades on a price to sales of about 13.01x, well above the broader Software industry average of 4.85x and also richer than its peer group at roughly 11.66x.

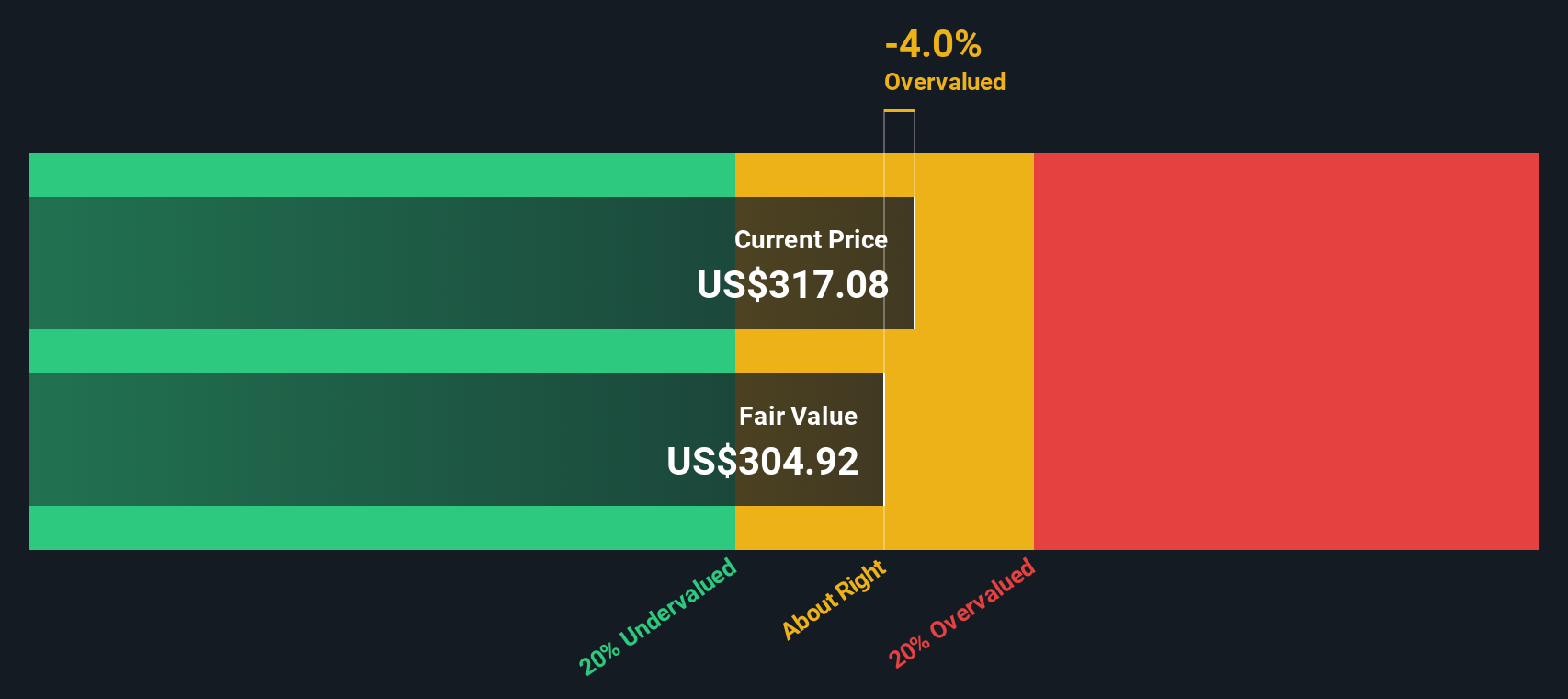

Simply Wall St introduces a Fair Ratio, which is the price to sales multiple you might expect for Zscaler after accounting for its revenue growth outlook, industry, profit margins, size and risk profile. For Zscaler, that Fair Ratio is 10.70x. Because it explicitly incorporates those fundamentals, it is more informative than a simple comparison with peers or the sector. With the actual multiple sitting meaningfully above this Fair Ratio, the shares look somewhat expensive on this metric.

Result: OVERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1460 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making, Choose your Zscaler Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let's introduce you to Narratives, a simple way for you to attach your own story about Zscaler's future to a concrete forecast for its revenues, earnings and margins, and then see what that implies for fair value. A Narrative on Simply Wall St is your perspective written into the numbers, linking what you believe about Zscaler's zero trust demand, AI security opportunity and competitive risks to a full financial forecast, and finally to a fair value you can compare with the current share price. Narratives live inside the Community page, are easy to create and follow, and are updated dynamically as new news, guidance or earnings come in, so your view stays current without you needing to rebuild a model. For example, one Zscaler Narrative might assume stronger long term demand and assign a fair value near $385, while a more cautious Narrative, emphasizing competitive and execution risks, might land closer to $251. Seeing where your own view fits between those can help you decide how you want to approach the stock.

Do you think there's more to the story for Zscaler? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal