Reassessing McCormick (MKC) Valuation After Earnings Beat and Operating Profit Growth in a Tough Environment

McCormick (MKC) just delivered another earnings beat, with revenue topping expectations and operating profit still growing even as costs nibble at margins, signaling the spice maker’s strategy is working in a tougher backdrop.

See our latest analysis for McCormick.

Those results come after a choppy stretch for the stock, with a roughly 4.6% 3 month share price return but a weaker year to date share price performance and a negative 1 year total shareholder return. This suggests momentum is stabilizing rather than surging.

If this earnings beat has you rethinking your watchlist, it might be worth exploring fast growing stocks with high insider ownership as potential next generation compounders to research alongside McCormick.

With the share price still down double digits over the past year, but trading at a discount to analyst targets, the key question is whether McCormick is quietly undervalued or if the market already reflects its next leg of growth.

Most Popular Narrative Narrative: 10.1% Undervalued

Compared with McCormick’s last close of $68.46, the most followed narrative puts fair value meaningfully higher, framing this upside through a long term growth lens.

Robust supply chain digitalization and continuous cost reduction programs (CCI), combined with McCormick's ability to locally manufacture most of its products and mitigate tariff/commodity cost headwinds, are expected to drive operating margin expansion and limit downside risks to earnings.

Curious how steady volume growth, fatter margins, and a richer future earnings multiple can all coexist in one story, and still argue for upside? The narrative unpacks a detailed path for revenue, earnings, and valuation that may surprise anyone who thinks a spices business is low growth. Want to see exactly how those assumptions add up to this fair value call? Read on for the full breakdown behind the projections.

Result: Fair Value of $76.17 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside case could unravel if tariff and commodity cost pressures persist, or if retailer private labels accelerate and squeeze McCormick’s pricing power.

Find out about the key risks to this McCormick narrative.

Another View: Market Ratios Tell a Different Story

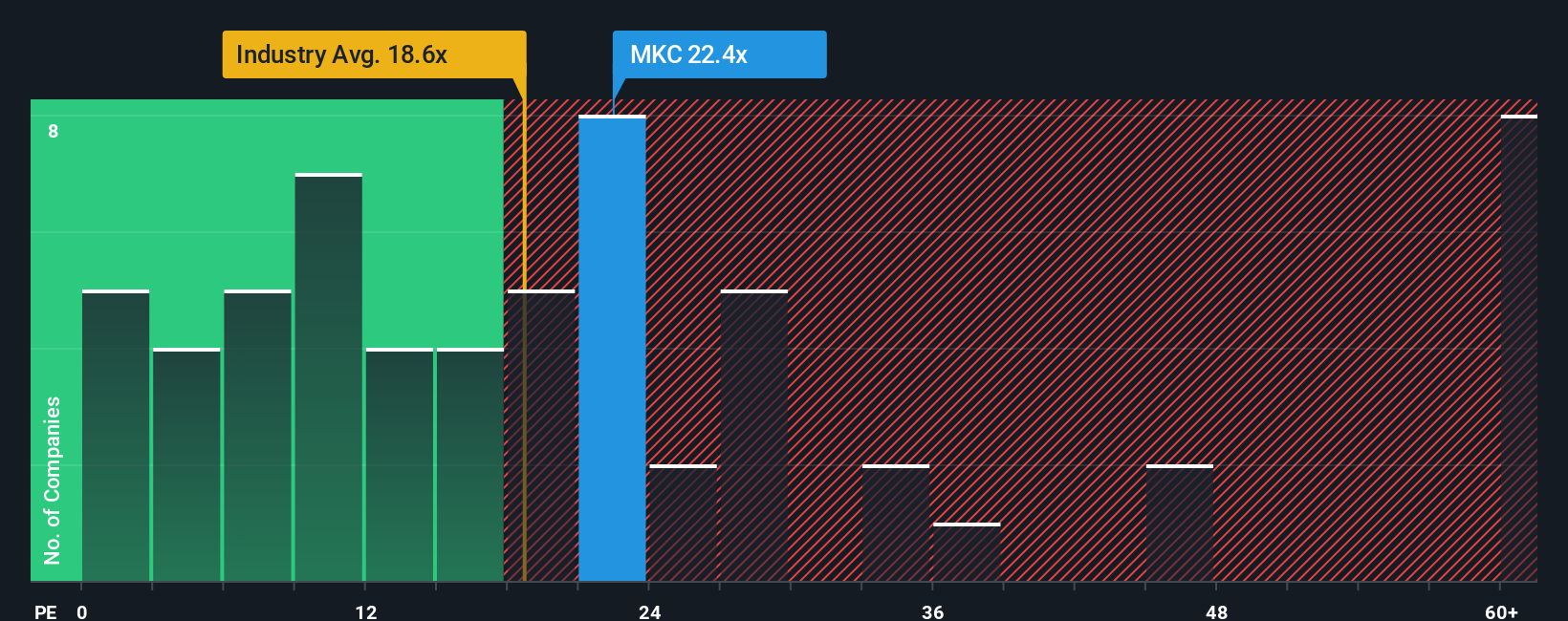

Our fair value work points to upside, but the earnings multiple sends a caution flag. McCormick trades on 23.6 times earnings versus a fair ratio of 18.4 times, and even sits above both food industry and peer averages. Is the market already paying up for safety here?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own McCormick Narrative

If you see the story differently or want to stress test these assumptions with your own inputs, you can build a personalized view in under three minutes: Do it your way.

A great starting point for your McCormick research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more investment ideas?

Before you move on, lock in your next high conviction idea by using the Simply Wall St Screener to uncover opportunities the broader market is still overlooking.

- Capture powerful long term compounding potential by screening for quality companies trading below intrinsic value through these 918 undervalued stocks based on cash flows and sharpen your edge on mispriced growth.

- Ride structural shifts in healthcare innovation by targeting AI driven breakthroughs with these 29 healthcare AI stocks, and position early in businesses transforming patient outcomes.

- Capitalize on secular trends in digital assets by filtering listed opportunities via these 80 cryptocurrency and blockchain stocks, so you are not relying on hype to guide your decisions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal