Does Textron’s (TXT) Civil Air Patrol Deal Hint At Quiet Strength In Its Aviation Franchise?

- Textron Aviation recently secured an order from the Civil Air Patrol for 15 new Cessna aircraft, aimed at upgrading and expanding the organization’s fleet across the United States.

- This deal underlines steady demand for Textron’s civil aviation platforms and highlights how government-affiliated customers can support utilization of its broader aerospace franchise.

- Next, we’ll examine how this Civil Air Patrol order informs Textron’s existing investment narrative, particularly around aviation demand and earnings quality.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Textron Investment Narrative Recap

To own Textron, you generally need to believe its mix of aviation, defense and industrial operations can steadily compound earnings despite uneven margins and slower forecast growth. The Civil Air Patrol order supports the aviation demand story and aftermarket utilization, but it is too small on its own to shift the near term earnings catalyst or offset the key risk around segment profit pressure from product mix and costs.

Among recent company updates, Textron’s reiterated 2025 guidance, including expected GAAP EPS of US$5.19 to US$5.39 and revenue around US$14.7 billion, feels most relevant alongside this order, as investors weigh how incremental aviation wins stack up against headwinds in mix and industrial volumes. The Civil Air Patrol deal fits within that broader question of how consistently Textron can translate a solid order book into healthier margins and returns.

But behind Textron’s aviation wins, investors should also be aware of how a less favorable aircraft mix could still weigh on...

Read the full narrative on Textron (it's free!)

Textron's narrative projects $16.2 billion revenue and $1.1 billion earnings by 2028. This requires 4.8% yearly revenue growth and about a $284 million earnings increase from $816.0 million today.

Uncover how Textron's forecasts yield a $92.57 fair value, a 5% upside to its current price.

Exploring Other Perspectives

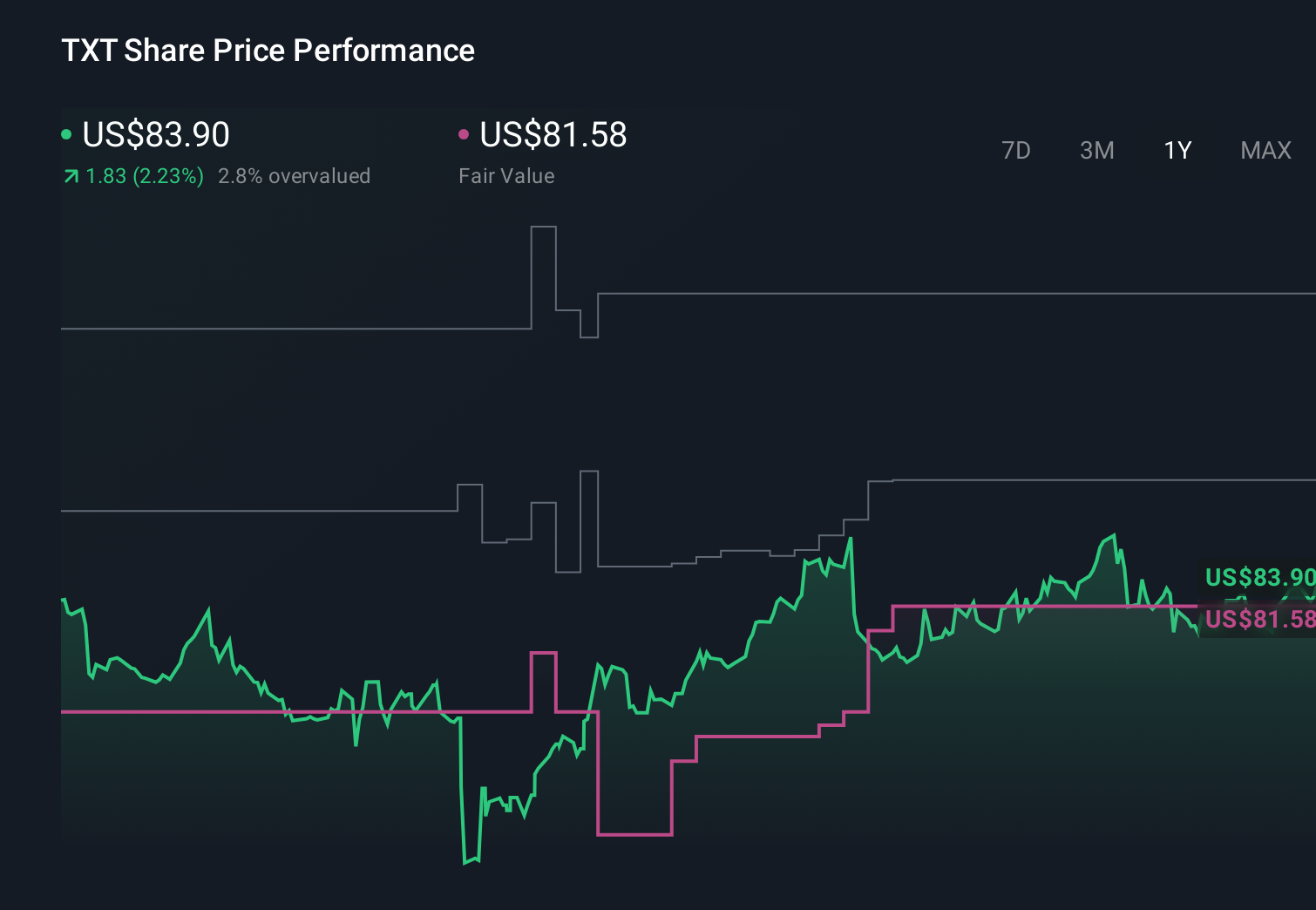

Five fair value estimates from the Simply Wall St Community span roughly US$76 to US$136 per share, showing investors can see Textron very differently. As you weigh those views against the risk that segment profits lag revenue growth, it is worth exploring how each perspective treats Textron’s margin pressure and product mix exposure.

Explore 5 other fair value estimates on Textron - why the stock might be worth 14% less than the current price!

Build Your Own Textron Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Textron research is our analysis highlighting 3 key rewards that could impact your investment decision.

- Our free Textron research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Textron's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- These 16 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Find companies with promising cash flow potential yet trading below their fair value.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal