Innovent Biologics (SEHK:1801): Reassessing Valuation After Landmark Nature Phase 3 Mazdutide Publications

Innovent Biologics (SEHK:1801) just hit a scientific milestone, with two Phase 3 trials of its dual GCG/GLP-1 drug mazdutide published back to back in Nature, sharpening the investment case around its diabetes franchise.

See our latest analysis for Innovent Biologics.

The latest Nature publications cap a run of positive catalysts, including NRDL additions and Hang Seng index inclusion. This comes even as the 30 day share price return of minus 7.1% contrasts with a powerful 1 year total shareholder return of 136.5%, suggesting long term momentum remains firmly intact.

If Innovent's surge has you rethinking healthcare exposure, this could be a smart moment to explore other high potential healthcare stocks that might be under your radar.

Yet with Innovent trading at roughly a 32% discount to analyst targets despite triple digit 12 month gains, are investors still underestimating mazdutide powered earnings, or has the market already priced in the next leg of growth?

Price-to-Earnings of 114.5x: Is it justified?

Innovent's lofty 114.5x price to earnings ratio at HK$83.25 per share points to a market that is clearly paying up for growth.

The price to earnings multiple compares the current share price to expected earnings, a key lens for high growth biopharma where profits are only just emerging.

With earnings only recently turning positive and forecast to grow about 28% annually, the market seems to be front loading a sizeable portion of future profitability into today's valuation, even though our analysis suggests a fair price to earnings closer to 31.5x that the market could ultimately gravitate toward.

Relative to both Asian biotech peers on 38.7x and the broader peer set on 42.2x, Innovent trades at a striking premium, underscoring how aggressively investors are pricing its earnings power compared to the sector.

Explore the SWS fair ratio for Innovent Biologics

Result: Price-to-Earnings of 114.5x (OVERVALUED)

However, regulatory setbacks for mazdutide, or slower than expected uptake in obesity and diabetes, could quickly compress margins and challenge today’s premium valuation.

Find out about the key risks to this Innovent Biologics narrative.

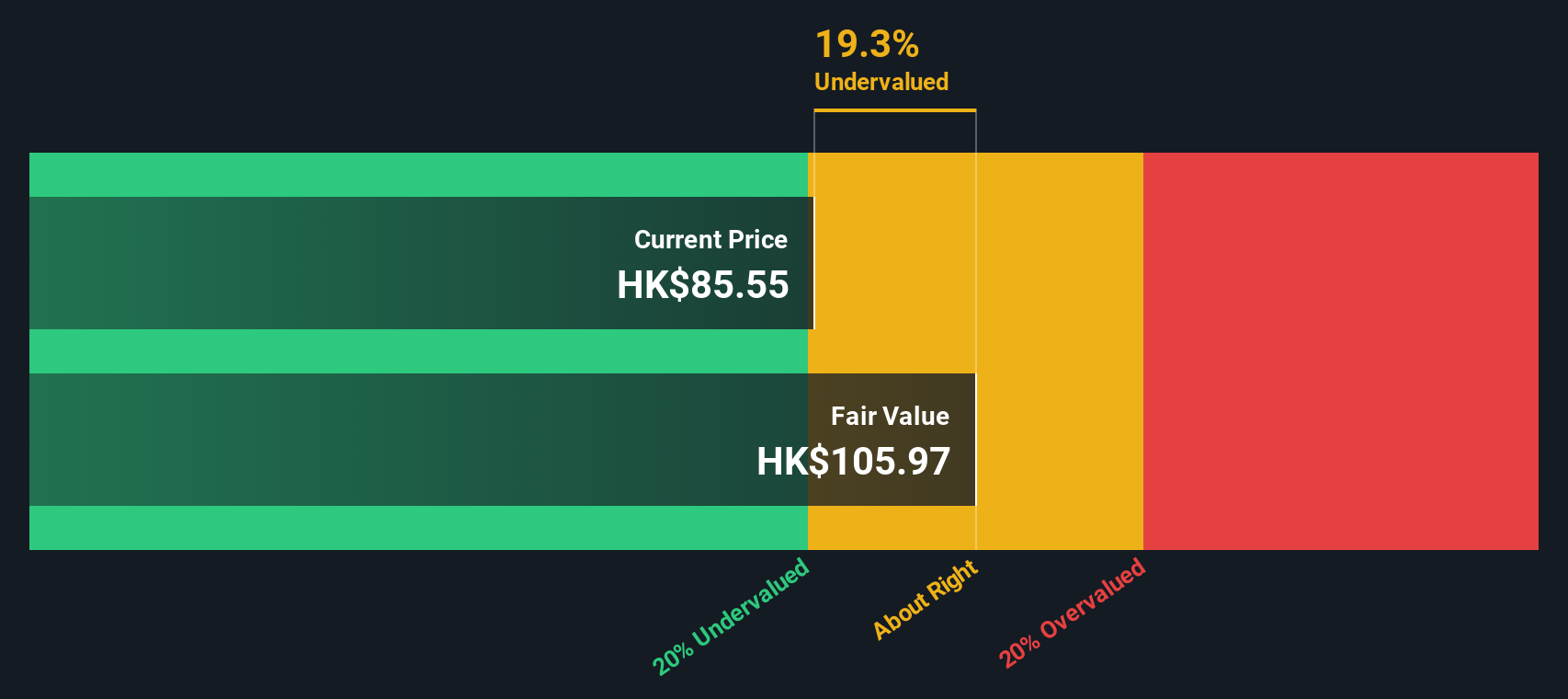

Another View, SWS DCF Says Shares Are Undervalued

While the 114.5x earnings multiple appears expensive, our DCF model suggests a different perspective, pointing to fair value around HK$123.24 versus the current HK$83.25. That 32% implied discount suggests long term cash flows may be underappreciated, not overstated. This raises the question of which lens investors should prioritize.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Innovent Biologics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 918 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Innovent Biologics Narrative

If you see the story differently or want to dig into the numbers yourself, you can craft a personalized view in just a few minutes: Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding Innovent Biologics.

Looking for more investment ideas?

Before you move on, consider scanning fresh opportunities on Simply Wall Street's screener, where targeted ideas can help you refine your overall strategy.

- Turn small positions into higher conviction ideas by targeting resilient businesses using these 3608 penny stocks with strong financials that already show the financial strength many traders may overlook.

- Explore structural themes in automation and machine intelligence by examining these 24 AI penny stocks positioned to participate in the development of AI spending worldwide.

- Look for a combination of income potential and valuation discipline by focusing on these 13 dividend stocks with yields > 3% that offer regular payouts alongside measured pricing.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal