France's 2026 budget is “difficult to produce”! The political impasse impedes fiscal progress, and the risk of debt getting out of control increases

The Zhitong Finance App learned that a committee of the French Parliament failed to agree on the 2026 budget, causing discussions on the full fiscal plan to be postponed until the new year, which has heightened concerns about how the French government can control the deficit.

According to reports, on Friday morning local time, a committee composed of seven members of the National Assembly and seven senators quickly abandoned efforts to coordinate the draft budget because there are still serious differences between the two houses and different political groups. French Prime Minister Sebastien Lecornu (Sebastien Lecornu) said he regretted that some members of parliament lacked the will to reach an agreement. He posted on social platforms: “Parliament will not be able to pass a budget for France before the end of this year. I deeply regret this; our fellow citizens should not bear the consequences.”

Despite this, France will not face the risk of an American-style government shutdown, as it can maintain critical spending and taxes through emergency legislation. The French government warned earlier this week that the content of the finance bill that has now been approved will only reduce the fiscal deficit in 2026 to 5.3% of economic output, down from 5.4% this year. In the initial plan, Le Corney set a goal of reducing the deficit to 4.7%, but since then he said the deficit should be kept within 5%.

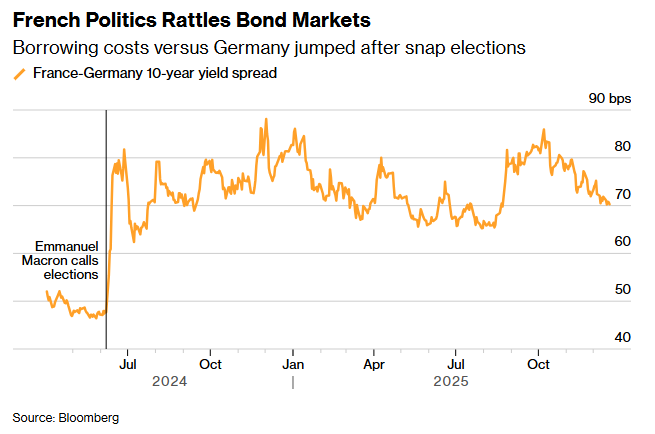

But at the same time, Bank of France Governor Francois Villeroy de Galhau (Francois Villeroy de Galhau) warned that if plans to repair public finances fail to reduce next year's deficit to less than 5% of economic output, France may face a negative market reaction. On Friday, the yield premium on French 10-year treasury bonds compared to German treasury bonds for the same period was about 71 basis points. Previously, it had risen to more than 89 basis points in October.

Borrowing costs soared compared to Germany after early elections in France in June 2024

Will France's worsening debt situation and the failure of the Eurozone economic engine drag down the euro?

According to data from credit rating agency KBRA, France's GDP growth rate slowed to 1.1% in 2024, and is expected to slow further to 0.8% in 2025. Economic output is clearly being dragged down by weak domestic demand in France, weak investment, and continuing uncertainty related to geopolitics and trade fragmentation.

On the positive side, the French inflation rate has declined sharply, providing families with some breathing room after experiencing long-term price pressure. According to the data, France's inflation rate in November was only 0.8%, far below the ECB's target level, and also lower than the Eurozone inflation rate of 2.4%.

The French economy has maintained moderate growth, but high public deficits and long-standing political stalemate are increasingly constraining its development. Although economic growth is expected to recover moderately as inflation eases and financing conditions improve, rating agencies and banks warn that weak fiscal consolidation and legislative impasse have become structural features of the French economic outlook.

KBRA downgraded France's long-term sovereignty rating to AA- last week. The agency pointed out that France's deficit continues to be high and the debt trajectory worsens. Although it adjusted the outlook from negative to stable, it warned that in the absence of decisive reforms and spending restrictions, France's sovereign credit indicators will continue to be under pressure.

Ken Egan, senior director of KBRA Sovereign Ratings, said: “Although France has extraordinary access to liquidity, the fragmented political environment is putting pressure on credit indicators by preventing substantial fiscal consolidation and maintaining high deficit levels.”

The main constraint on fiscal progress is France's increasingly divided political landscape. During his second term, French President Emmanuel Macron faced many difficulties, such as successive budget impasse, loss of an absolute majority of seats in parliament, and increasing difficulty in passing key legislation. Efforts to advance fiscal reform, including the controversial 2023 pension reform (which was expected to achieve annual savings of 11 billion euros by 2027) have been delayed or put on hold as the government seeks weak parliamentary support. According to reports, the reform and adjustment plan is currently expected to achieve cost savings of 100 million euros in 2026 alone.

Ken Egan warned that uncertainty about policy direction is “adding a premium to France's sovereign debt,” reflecting the increasingly cautious attitude of investors. He added that despite possible interludes with limited political cohesion, “the overall pattern is still a situation of continuing division, showing little sign of easing, and may even intensify further.”

Public finance remains the weakest part. The International Monetary Fund (IMF) predicts that France's debt as a share of GDP will rise from about 116% in 2025 to nearly 130% in 2030, contrary to the fiscal consolidation path of most countries in the Eurozone. Meanwhile, rising interest payments are increasing the financial burden. The French Ministry of Finance expects debt repayment costs to surge to 59.3 billion euros in 2026 (36.2 billion euros in 2020). France also continues to face a basic budget deficit, which is expected to reach 3.4% between 2026 and 2030, reducing its ability to stabilize its debt trajectory.

In its report, KBRA warned: “Rising financing costs and increased spending pressure mean that real fiscal consolidation will require years of effort.” Although government revenue still accounts for more than 51% of GDP, considering that France is already one of the countries with the highest tax burden as a share of GDP among the Organization for Economic Cooperation and Development (OECD) countries, there is limited room for further improvement. Furthermore, structural pressure on spending is expected to persist, particularly in the areas of pensions and defense.

Despite many weaknesses, KBRA emphasized that France maintains excellent financing flexibility. French treasury bonds benefit from deep liquidity, a diverse investor base, and the country's central position in the Eurozone. These factors continue to support smooth market access even in the face of heightened political uncertainty. The rating agency believes that this balance between strong market access and weak fiscal fundamentals determines France's development prospects as it moves towards 2026.

Although liquidity reduces short-term risks, KBRA warns that without continued fiscal consolidation and greater political stability, France's debt burden may continue to rise, thereby limiting medium-term policy flexibility.

As for the impact on the euro, France's problems may not cause the euro to collapse, but they may make the euro “lame.” It labels the euro as an “internal governance risk,” putting pressure on its long-term valuation and making it more likely to be sold off in times of market turmoil. In the future, the euro's upward movement will depend not only on the ECB's monetary policy, but also on whether member states, led by France, can demonstrate real fiscal reform and political governance capabilities.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal