3 Top TSX Dividend Stocks To Consider With At Least 3.3% Yield

With Canadian equities reaching new record highs, the market has shown resilience despite ongoing trade-policy uncertainties and a cautious economic outlook. In this environment, dividend stocks with solid yields can offer investors a measure of stability and income, making them an attractive option for those navigating these complex market conditions.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Wajax (TSX:WJX) | 5.01% | ★★★★★☆ |

| Transcontinental (TSX:TCL.A) | 3.96% | ★★★★★☆ |

| Toronto-Dominion Bank (TSX:TD) | 3.39% | ★★★★★☆ |

| Rogers Sugar (TSX:RSI) | 5.98% | ★★★★☆☆ |

| Pulse Seismic (TSX:PSD) | 15.61% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 3.36% | ★★★★★☆ |

| Olympia Financial Group (TSX:OLY) | 6.30% | ★★★★★☆ |

| Great-West Lifeco (TSX:GWO) | 3.64% | ★★★★★☆ |

| Canadian Imperial Bank of Commerce (TSX:CM) | 3.36% | ★★★★★☆ |

| Bank of Montreal (TSX:BMO) | 3.76% | ★★★★★☆ |

Click here to see the full list of 18 stocks from our Top TSX Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

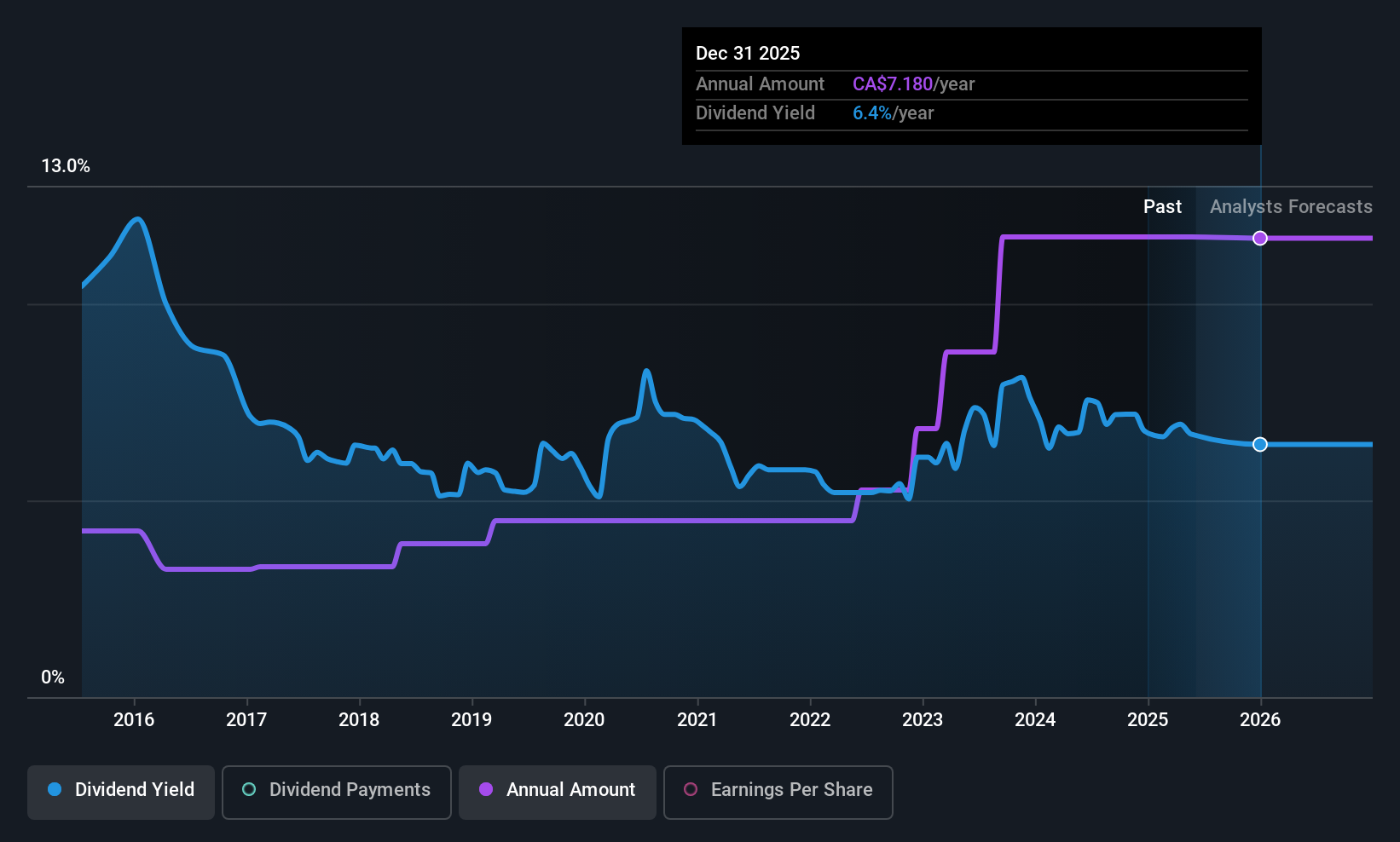

Olympia Financial Group (TSX:OLY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Olympia Financial Group Inc., with a market cap of CA$281.18 million, operates in Canada as a non-deposit taking trust company through its subsidiary, Olympia Trust Company.

Operations: Olympia Financial Group Inc. generates revenue through several segments, including Investment Account Services (IAS) at CA$78.03 million, Health at CA$10.18 million, Currency and Global Payments (CGP) at CA$5.78 million, Corporate and Shareholder Services (CSS) at CA$5.21 million, Raisr at CA$1.57 million, and Corporate services at CA$0.03 million.

Dividend Yield: 6.3%

Olympia Financial Group offers a dividend yield in the top quartile of Canadian payers at 6.3%, but its dividend history is marked by volatility and unreliability, with past drops exceeding 20%. Recent earnings reports show declining revenue and net income, impacting payout sustainability despite dividends being covered by earnings (80.7%) and cash flows (89.6%). Significant insider selling raises concerns about future stability, although dividends have consistently been CAD 0.60 monthly recently.

- Navigate through the intricacies of Olympia Financial Group with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Olympia Financial Group shares in the market.

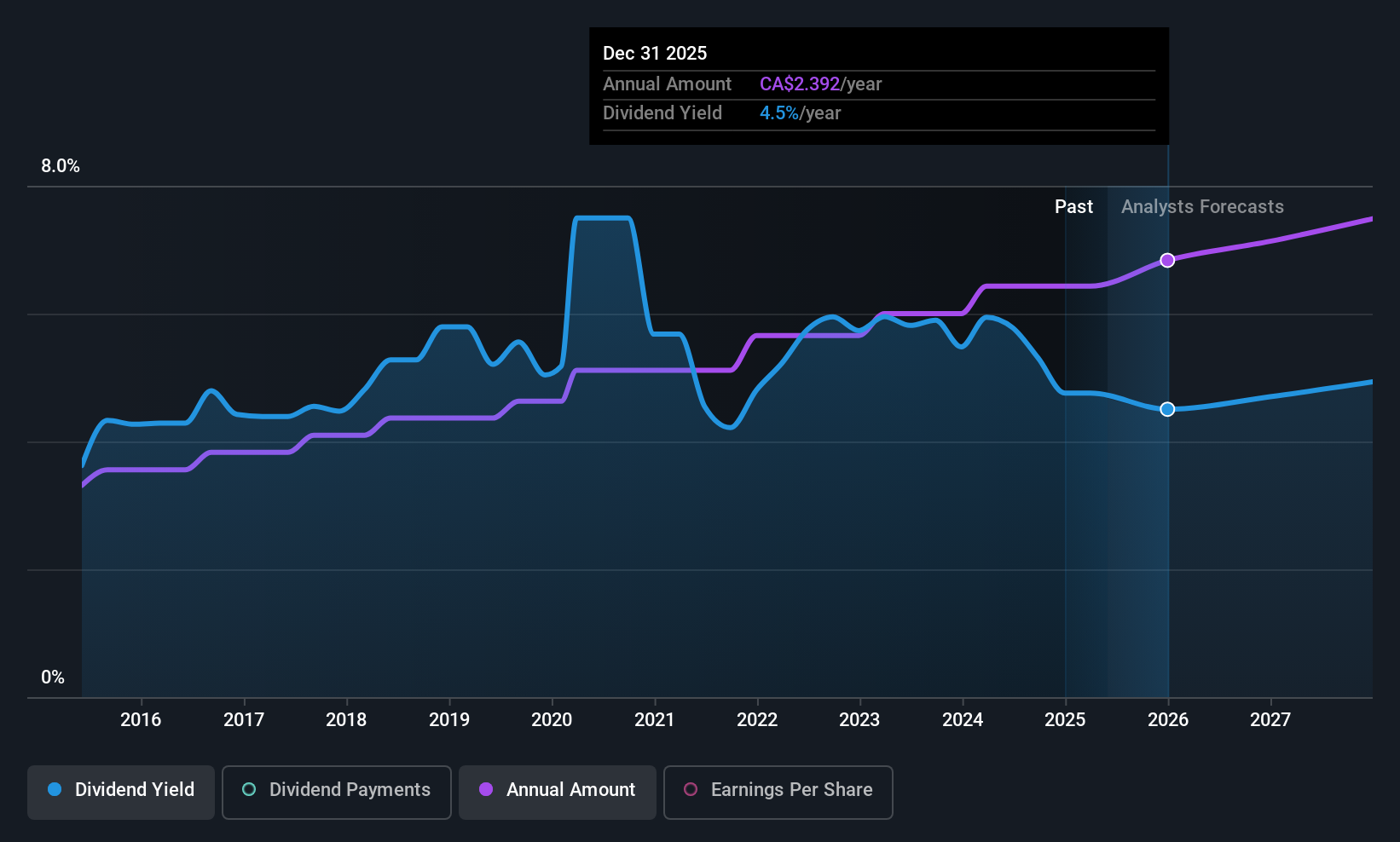

Power Corporation of Canada (TSX:POW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada is an international management and holding company offering financial services across North America, Europe, and Asia with a market cap of CA$45.54 billion.

Operations: Power Corporation of Canada generates revenue from several segments, including Lifeco at CA$31.92 billion, IGM at CA$3.73 billion, and Alternative Asset Investment Platforms at CA$2.93 billion.

Dividend Yield: 3.4%

Power Corporation of Canada offers a reliable dividend yield of 3.36%, supported by stable and growing payments over the past decade. Its dividends are well-covered by earnings (payout ratio: 48.8%) and cash flows (cash payout ratio: 28.8%). Recent earnings growth, with net income reaching C$2.20 billion for nine months ended September 2025, underscores its financial health, although significant insider selling could be a point of concern for investors seeking stability in dividend stocks.

- Dive into the specifics of Power Corporation of Canada here with our thorough dividend report.

- Our valuation report here indicates Power Corporation of Canada may be overvalued.

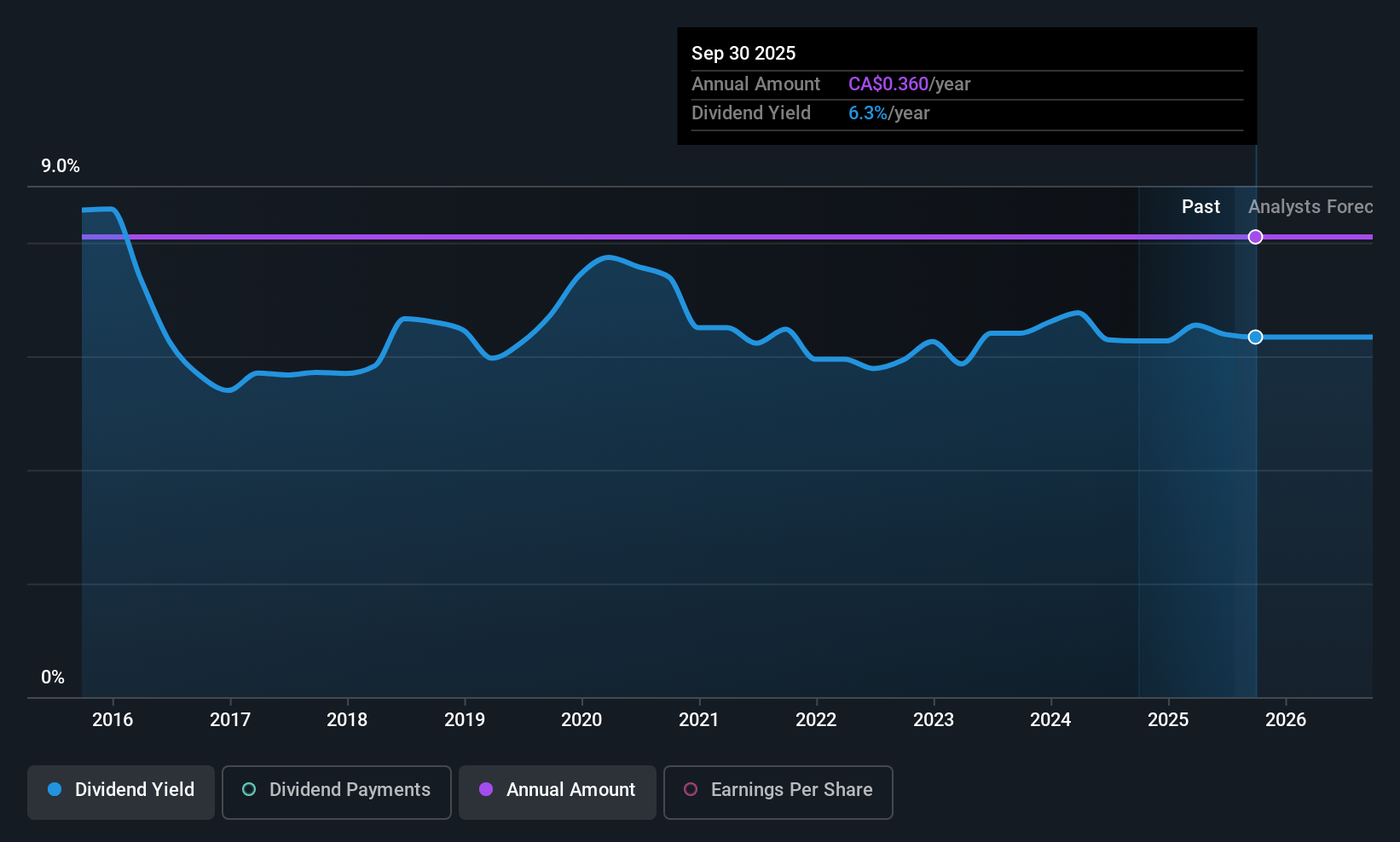

Rogers Sugar (TSX:RSI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rogers Sugar Inc. is involved in the refining, packaging, marketing, and distribution of sugar and maple syrup products across Canada, the United States, Europe, and internationally with a market cap of CA$772.30 million.

Operations: Rogers Sugar Inc.'s revenue is primarily derived from its sugar segment, which accounts for CA$1.05 billion, and its maple products segment, contributing CA$263.14 million.

Dividend Yield: 6%

Rogers Sugar's dividend yield of 5.98% ranks in the top 25% among Canadian dividend payers, yet its payments have been unreliable and not growing over the past decade. Despite a reasonable payout ratio of 71.5%, dividends are not well-covered by cash flows, with a high cash payout ratio of 140.9%. Recent earnings growth to C$64.46 million and stable sales indicate financial resilience, but high debt levels remain a concern for sustainability.

- Unlock comprehensive insights into our analysis of Rogers Sugar stock in this dividend report.

- The analysis detailed in our Rogers Sugar valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Unlock our comprehensive list of 18 Top TSX Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal