Cui Dongshu: Strong growth in domestic commercial vehicle traffic insurance data in 2025, domestic sales of commercial vehicles increased 4% year-on-year in November

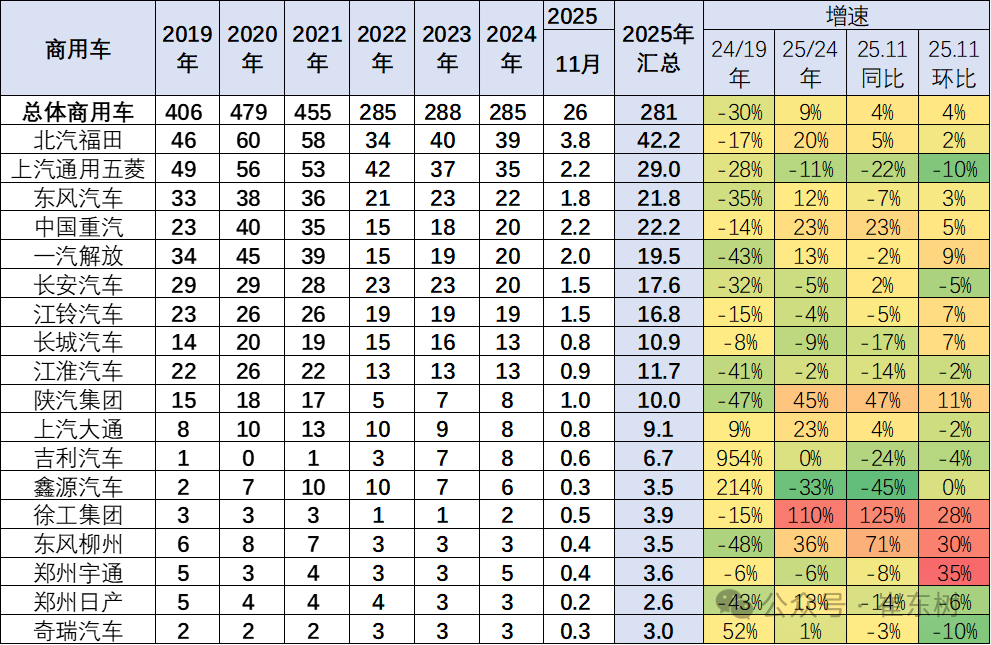

The Zhitong Finance App learned that on December 19, Cui Dongshu, Secretary General of the Passenger Transport Association, published an article analyzing the characteristics of domestic insurance for commercial vehicles nationwide in November 2025. According to the National Finance Administration's Jiaotong Insurance data, there was a strong increase in commercial vehicles in 2025 in domestic commercial vehicle traffic insurance data. Due to the strong growth of new energy vehicles and policies promoting vehicle renewal, new energy commercial vehicles as a whole showed a good situation of rapid rise in 2025. The high level continued from March to November, and the growth of new energy sources was strong. Domestic sales of commercial vehicles reached 260,000 units in November, up 4% year on year and 4% month on month. Domestic sales of commercial vehicles reached 2.81 million units from January to November 2025, an increase of 9% over the previous year. From January to November 2025, the total number of new energy commercial vehicles reached 770,000, an increase of 54% over the previous year. After the end of 2024, the performance of new energy sources was relatively weak in January 2025. The year-on-year surge surged in February-September, and reached 92,000 new energy commercial vehicles in November, up 45% year on year and 15% month on month.

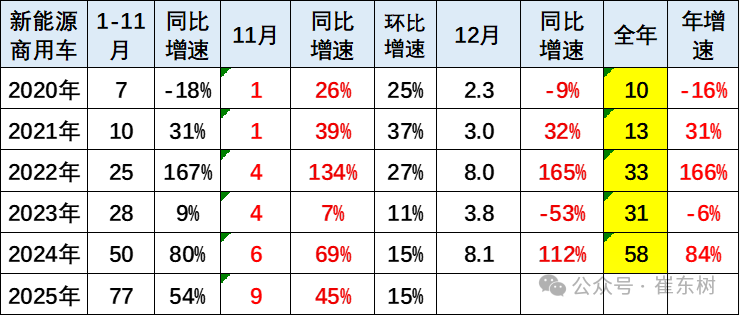

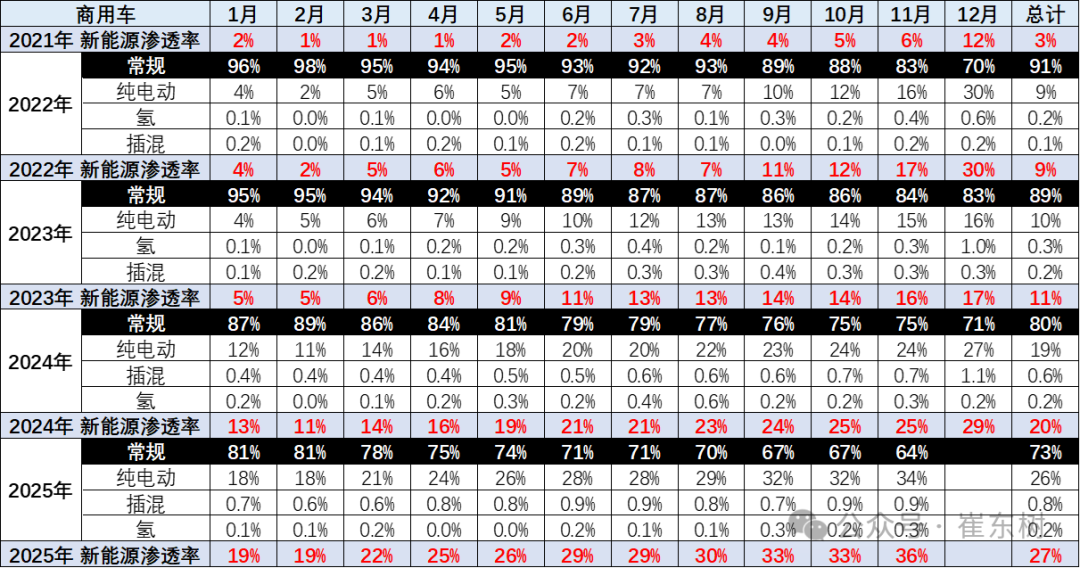

From 2019 to 2021, the overall penetration rate of new energy commercial vehicles was around 3%, reaching 9% in 2022, 11% in 2023, 20% for the full year of 2024, and 27% in January-November 2025, an increase of 7 points over the previous year, which is stronger than the growth of passenger vehicles, reflecting the strong growth trend of new energy commercial vehicles. In November 2025, the penetration rate of new energy for commercial vehicles was 36%, an increase of 11 points over the same period. Among them, the penetration rate of new energy for trucks was 27% and the penetration rate of new energy for buses was 74%, all of which were significant increases over the same period. The domestic market for new energy commercial vehicles has shown relatively strong performance under policy impetus, and fuel vehicle exports are strong, forming a characteristic market pattern under policy distortions. Traditional fuel vehicles require effective policy support.

1. Analysis of traffic insurance data in the national commercial vehicle market

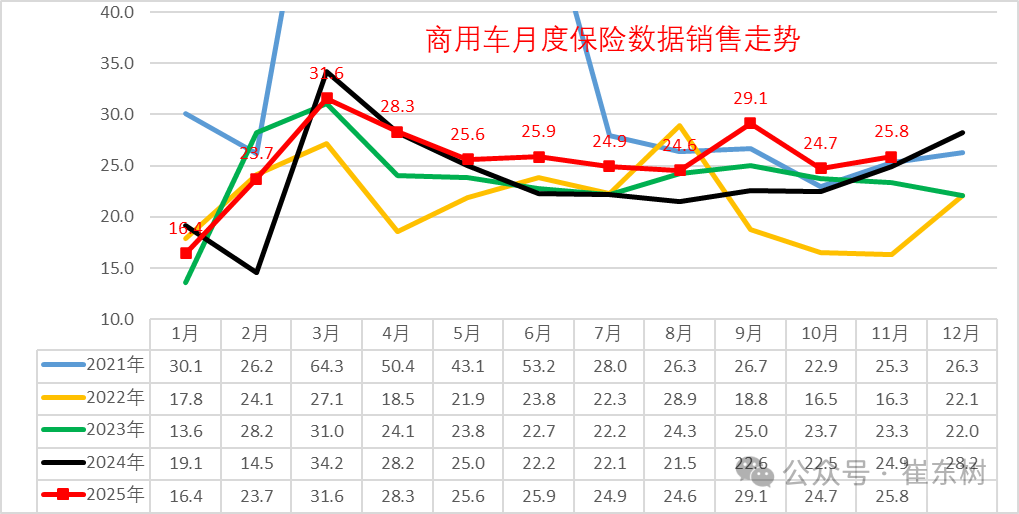

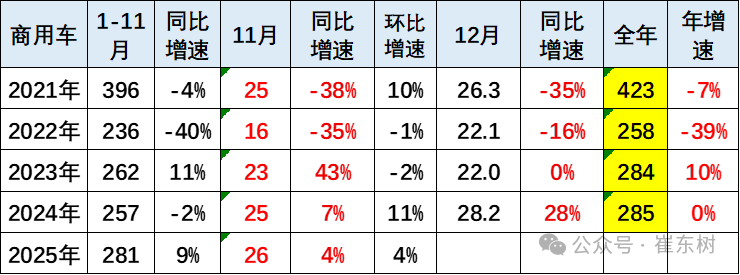

In 2025, the commercial vehicle market showed the characteristics of a continuous strengthening trend in February-November brought about before the Spring Festival in January. The monthly commercial vehicle data for January of this year dropped significantly from month to month. In February, commercial vehicle sales were 237,000 units, which is the middle of sales over the years. Commercial vehicle sales were relatively stable in March-May. Commercial vehicles were strongly driven by new energy sources in June-November. September was unusually strong, and November continued to hit a recent record high for that month.

In recent years, the domestic commercial vehicle market has shown a rapid decline in demand. From high sales volume in 2020 to falling peak value in 2021, the period from 2022 to 2023 was at a low point. Domestic commercial vehicle insurance reached 2.85 million units in 2024, almost the same as the previous year.

Domestic sales of commercial vehicles reached 260,000 units in November, up 4% year on year and 4% month on month. Domestic sales of commercial vehicles reached 2.81 million units from January to November 2025, an increase of 9% over the previous year. Compared with the steady period of commercial vehicles since 2022, this year it reached a new high level of good quality in recent years.

2. Analysis of the sales volume of the national new energy commercial vehicle market

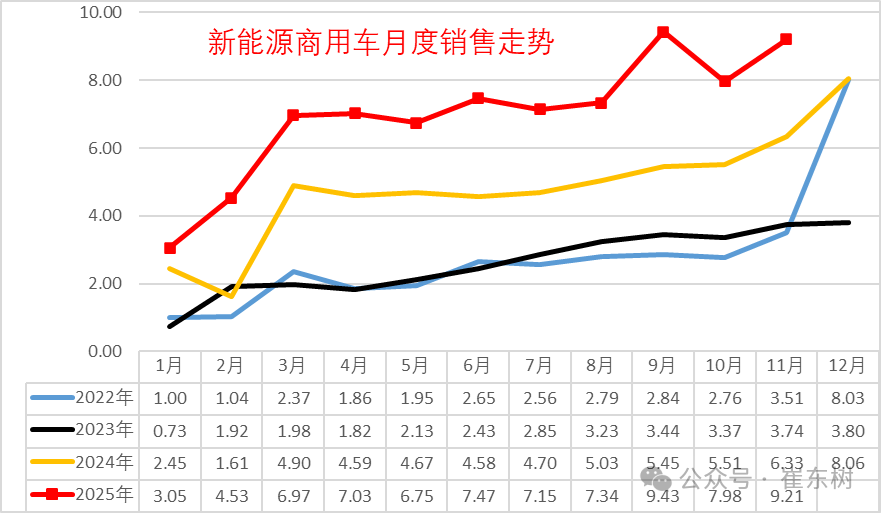

In 2025, new energy commercial vehicles as a whole showed a good situation of rapid growth. The high level continued from March to November, and the growth of new energy sources was strong. New energy sales quickly reached a high of 92,000 units in November 2025, indicating strong demand for new energy sources.

In 2024, sales of new energy commercial vehicles were 579,000 units, up 84% year on year; in November 2025, new energy commercial vehicles reached 92,000 units, up 45% year on year and 15% month on month. After the end of 2024, the performance of new energy sources was relatively weak in January 2025, then surged year-on-year, reaching a cumulative total of 770,000 units in January-November, an increase of 54% over the previous year.

3. Penetration rate of new energy commercial vehicles

In 2024, the penetration rate of new energy commercial vehicles in commercial vehicles reached 20%, which is a good increase compared to 2023. The penetration rate of new energy sources reached 36% in November 2025, an increase of 11 percentage points compared to 25% in November last year. The performance is relatively strong.

From 2019 to 2021, the overall penetration rate of new energy commercial vehicles was around 3%, reaching 9% in 2022, 11% in 2023, 20% for the whole of 2024, and reaching a good level of 27% penetration from January to November 2025, reflecting the strong growth trend of new energy commercial vehicles.

In November 2025, the penetration rate of new energy for commercial vehicles was 36%, an increase of 11 points over the same period, while the year-on-year increase in January-November was 7 points higher than that of passenger cars.

4. Analysis of changes in the commercial vehicle market

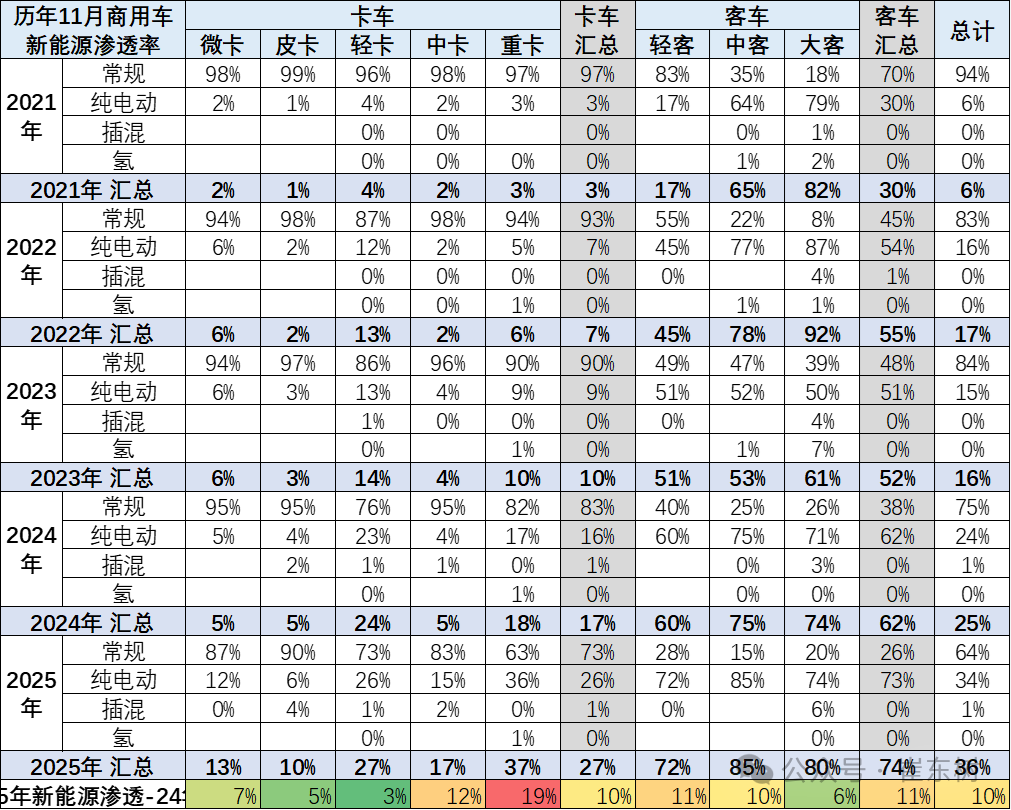

Commercial vehicles have relatively stable truck and bus structures. Heavy trucks and light trucks among trucks performed well. The institutional trend of medium and heavy trucks improved this year after deep adjustments last year, and the driving effect of the scrapping and renewal policy was slightly reflected.

Light buses are trending strongly, and electrification has brought light buses to replace WeChat as the main force in the market. The performance of large and medium-sized buses was weak in early 2025, the trend of fuel-fueled large and medium-sized buses was stable, and the performance of new energy large and medium-sized buses was average.

Among them, the penetration rate of new energy for trucks was 27%, and the penetration rate of new energy for buses was 74%, a significant increase over the same period. Among them, the penetration rate of electric vehicles for heavy trucks, light trucks, and large and medium passenger vehicles has increased significantly.

5. Analysis of changes in the competitive structure of commercial vehicles

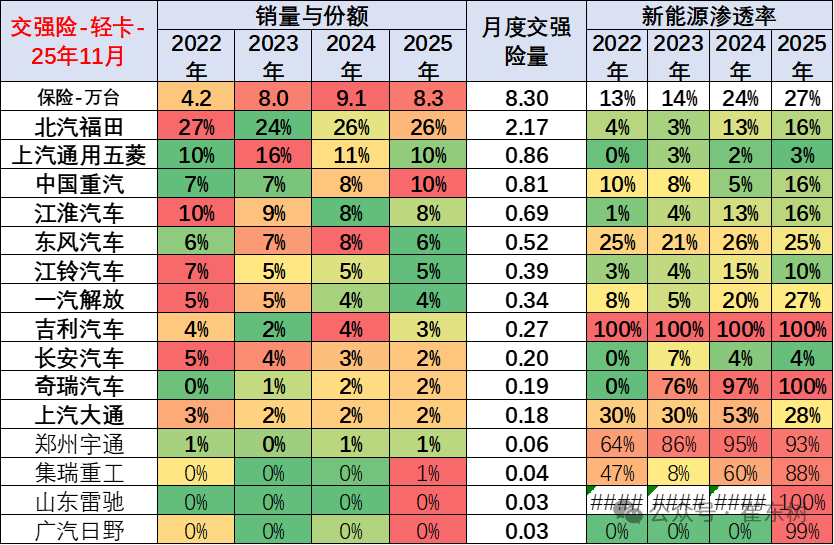

Commercial vehicle companies are mainly light truck companies that support sales. Foton and Wuling are the main players in commercial vehicles, and have strong sales in the light truck and bus markets respectively. Sinotruk is also strong in heavy trucks and light trucks.

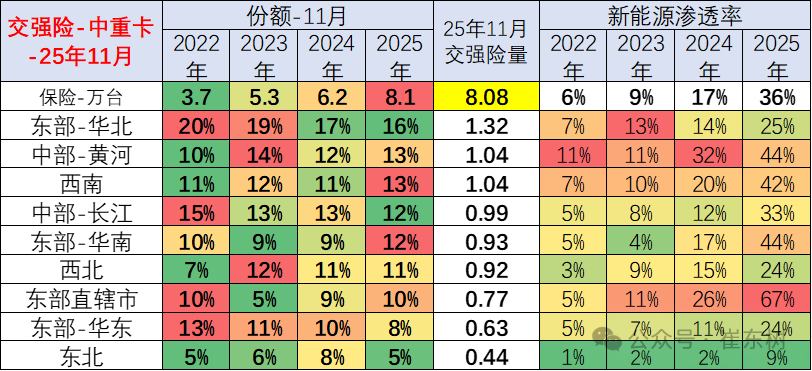

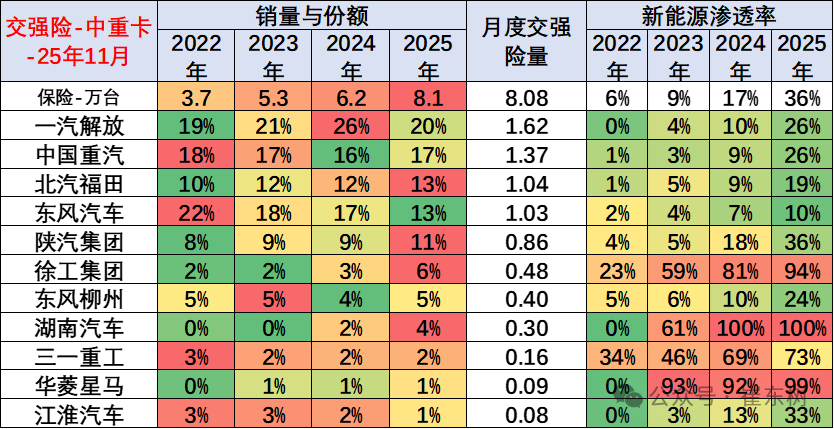

6. Regional market structure for medium and heavy trucks

Overall, medium and heavy trucks have a high market share in North China and other regions, but the South China and Southwest China have continued to strengthen in the past two years. This year, the penetration rate of new energy heavy trucks in Beijing-Tianjin-Shanghai, South China, the Yellow River in central China, and the southwest regions has increased rapidly.

In the domestic market, companies such as FAW Jiefang, Sinotruk, Foton, and Dongfeng Motor should have the best performance in the heavy truck market. The overall performance of heavy trucks is relatively strong, and subsidy factors have led to a significant increase in the electrification of heavy trucks. The electric vehicle penetration rate of some second-tier heavy truck companies, such as XCMG, has increased. Exports were strong last year. Domestic energy was high this year, and fuel vehicles were temporarily lower in November of this year.

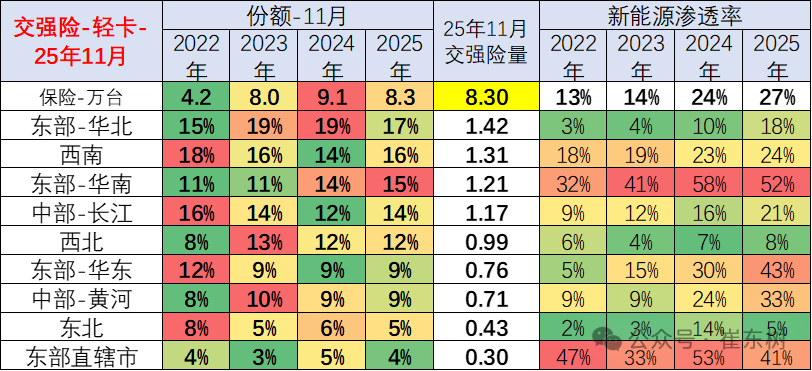

7. Regional market structure for light trucks

The light truck market mainly has a high share in East China - North China, South China, Southwest China, etc., and the light truck performance in South China and Southwest China is gradually strengthening.

The main markets for new energy light trucks are still relatively strong in the East-South China market and the East China market. Overall, the Beijing-Tianjin-Shanghai municipal market has recovered relatively well this year.

The main domestic light truck manufacturers are still companies such as Beiqi Foton, SAIC-GM-Wuling, Sinotruk, JAC, and Dongfeng Motor. In particular, recently, the small micro cards such as Wuling have gradually risen to small and light trucks. The market performance is relatively excellent.

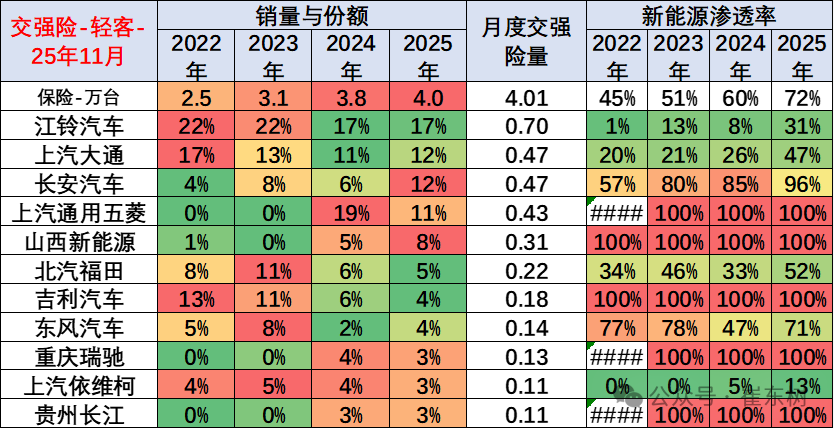

The main NEV light truck companies are Geely Automobile, etc. In particular, Chery has performed relatively well in NEV light trucks in the past two years.

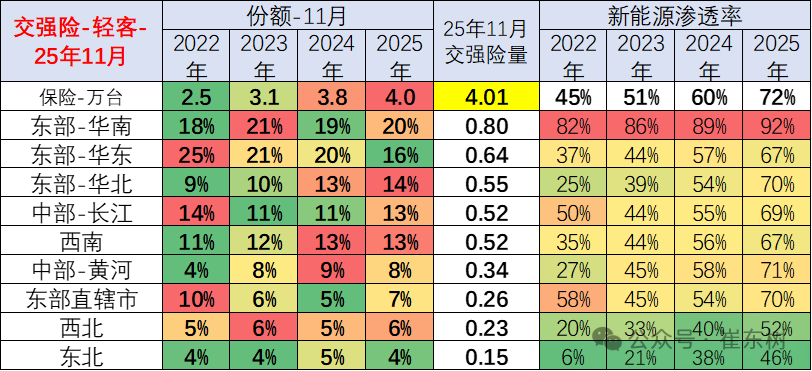

8. Regional market structure for light buses

The sales area of the domestic light passenger market is mainly East China and South China, where the economy is relatively developed. The Central Yangtze River region also had a high share this year.

New energy light buses are mainly in high demand in developed regions, and the performance of new energy in South China is strong. Due to the right-of-way policy, fuel and light passenger sales have shrunk in urban areas such as Beijing, Tianjin, and Shanghai.

The main light passenger manufacturers are mainly companies such as Jiangling Motors, SAIC-Chase, Changan Automobile, SAIC-GM-Wuling, and Geely Commercial Vehicles. Among them, new energy light vehicles such as Geely Commercial Vehicles, which are emerging forces, have performed well. Recently, Changan's electric light buses are very competitive.

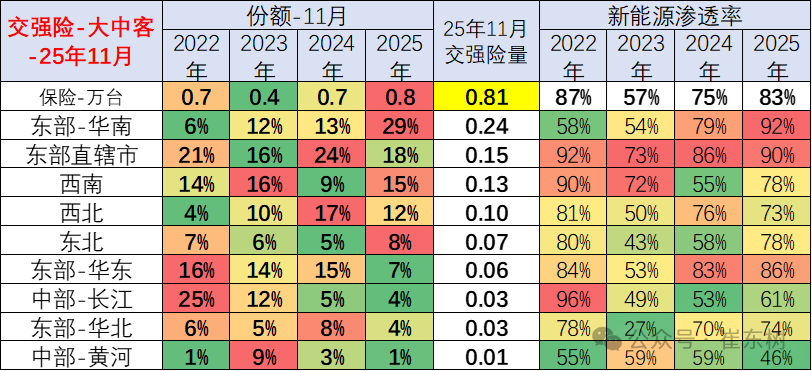

9. Regional market structure for large and medium-sized buses

The large and medium customer markets have performed well recently, and market demand has fluctuated greatly between regions. Policy subsidies and market promotion differentiate between the promotion of new energy policies by large and Chinese customers and the market demand for fuel vehicles.

The high penetration rate of the new energy market is mainly in the southern region. Other regions look at policy subsidies. Buses in Northeast China and North China started earlier this year.

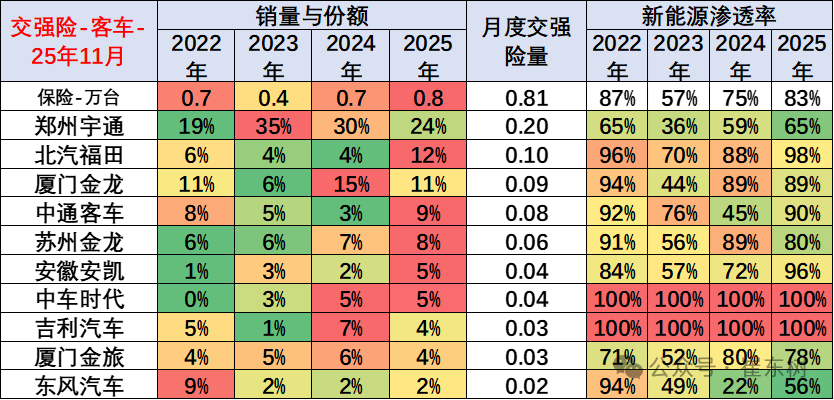

The main manufacturers of large and medium-sized customers are also companies such as Yutong, Futian, Xiamen Jinlong, and Suzhou Jinlong, which performed relatively well. In particular, traditional fuel vehicles from Yutong, Jinlong, and Zhongtong performed well. The performance of companies such as Beiqi Foton in November was also relatively strong.

New energy companies with a high customer penetration rate are mainly second-tier companies. The main companies are all fully developing new energy sources for fuel vehicles, and the fuel vehicle market of the main companies is good.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal