3 Dividend Stocks To Consider With Up To 3.5% Yield

As major indexes in the United States, including the S&P 500 and Dow Jones Industrial Average, face consecutive declines amid tech stock retreats and AI bubble concerns, investors are increasingly looking toward stable income sources. In such a volatile market environment, dividend stocks with yields up to 3.5% can offer a reliable stream of income while potentially providing some buffer against market fluctuations.

Top 10 Dividend Stocks In The United States

| Name | Dividend Yield | Dividend Rating |

| Provident Financial Services (PFS) | 4.53% | ★★★★★★ |

| Peoples Bancorp (PEBO) | 5.15% | ★★★★★★ |

| OTC Markets Group (OTCM) | 4.80% | ★★★★★★ |

| Host Hotels & Resorts (HST) | 5.15% | ★★★★★☆ |

| First Interstate BancSystem (FIBK) | 5.28% | ★★★★★★ |

| Farmers National Banc (FMNB) | 4.72% | ★★★★★★ |

| Ennis (EBF) | 5.43% | ★★★★★★ |

| Dillard's (DDS) | 4.78% | ★★★★★★ |

| Columbia Banking System (COLB) | 4.99% | ★★★★★★ |

| Citizens & Northern (CZNC) | 5.12% | ★★★★★★ |

Click here to see the full list of 109 stocks from our Top US Dividend Stocks screener.

We'll examine a selection from our screener results.

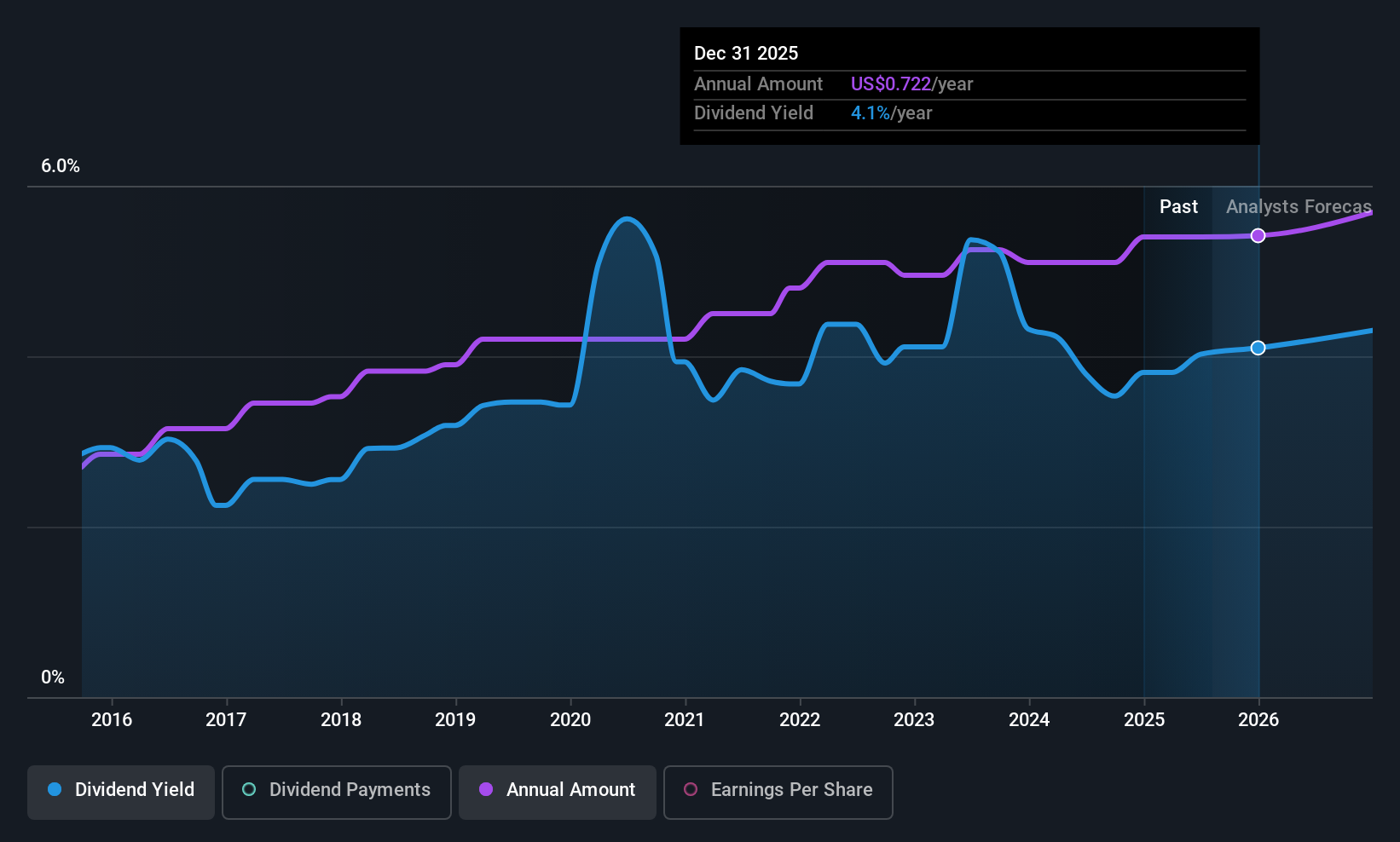

Fulton Financial (FULT)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Fulton Financial Corporation is a bank holding company for Fulton Bank, offering banking and financial products and services in the United States, with a market cap of $3.68 billion.

Operations: Fulton Financial Corporation generates revenue primarily through its banking segment, which accounts for $1.23 billion.

Dividend Yield: 3.5%

Fulton Financial has demonstrated a consistent dividend history, with recent increases reflecting a stable payout strategy. The company's dividends are well-covered by earnings, evidenced by a low payout ratio of 37.3%. Despite its dividend yield being lower than the top quartile in the U.S., Fulton maintains reliable and growing dividends over the past decade. Recent earnings growth and an active share repurchase program further support its commitment to returning value to shareholders.

- Get an in-depth perspective on Fulton Financial's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Fulton Financial shares in the market.

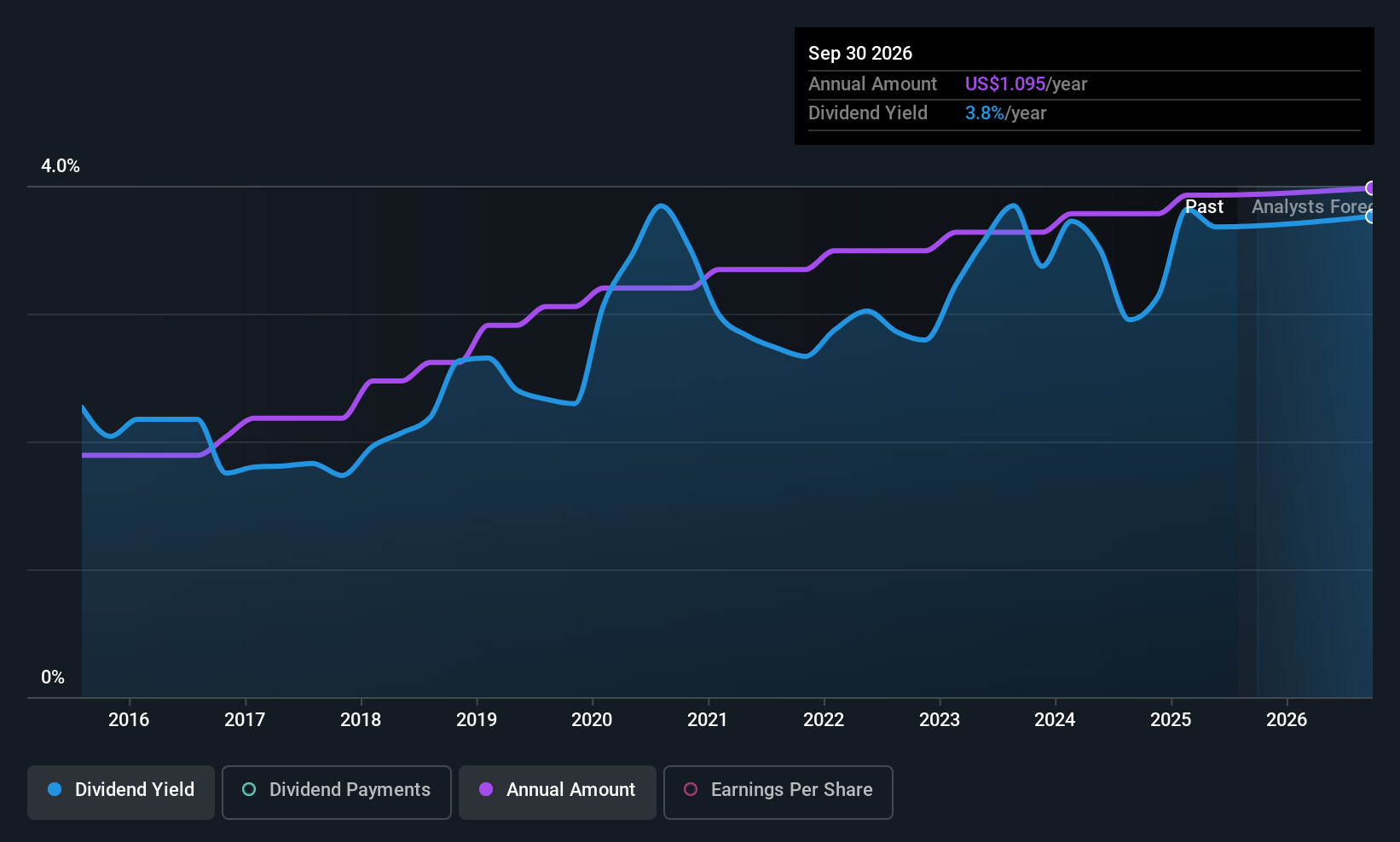

WaFd (WAFD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: WaFd, Inc. is the bank holding company for Washington Federal Bank, offering lending, depository, insurance, and various banking services in the United States with a market cap of approximately $2.56 billion.

Operations: WaFd, Inc.'s revenue segment primarily consists of Thrift/Savings and Loan Institutions, generating approximately $717.73 million.

Dividend Yield: 3.2%

WaFd, Inc. maintains a consistent dividend history with its 171st consecutive quarterly cash dividend recently affirmed at $0.27 per share, payable on December 5, 2025. Its dividends are well-covered by earnings with a payout ratio of 40.6%, and the yield stands at 3.22%, which is lower than top-tier U.S. dividend payers but reliable over the past decade. Recent financials show steady earnings growth and an ongoing share buyback program enhancing shareholder value.

- Click here to discover the nuances of WaFd with our detailed analytical dividend report.

- The valuation report we've compiled suggests that WaFd's current price could be inflated.

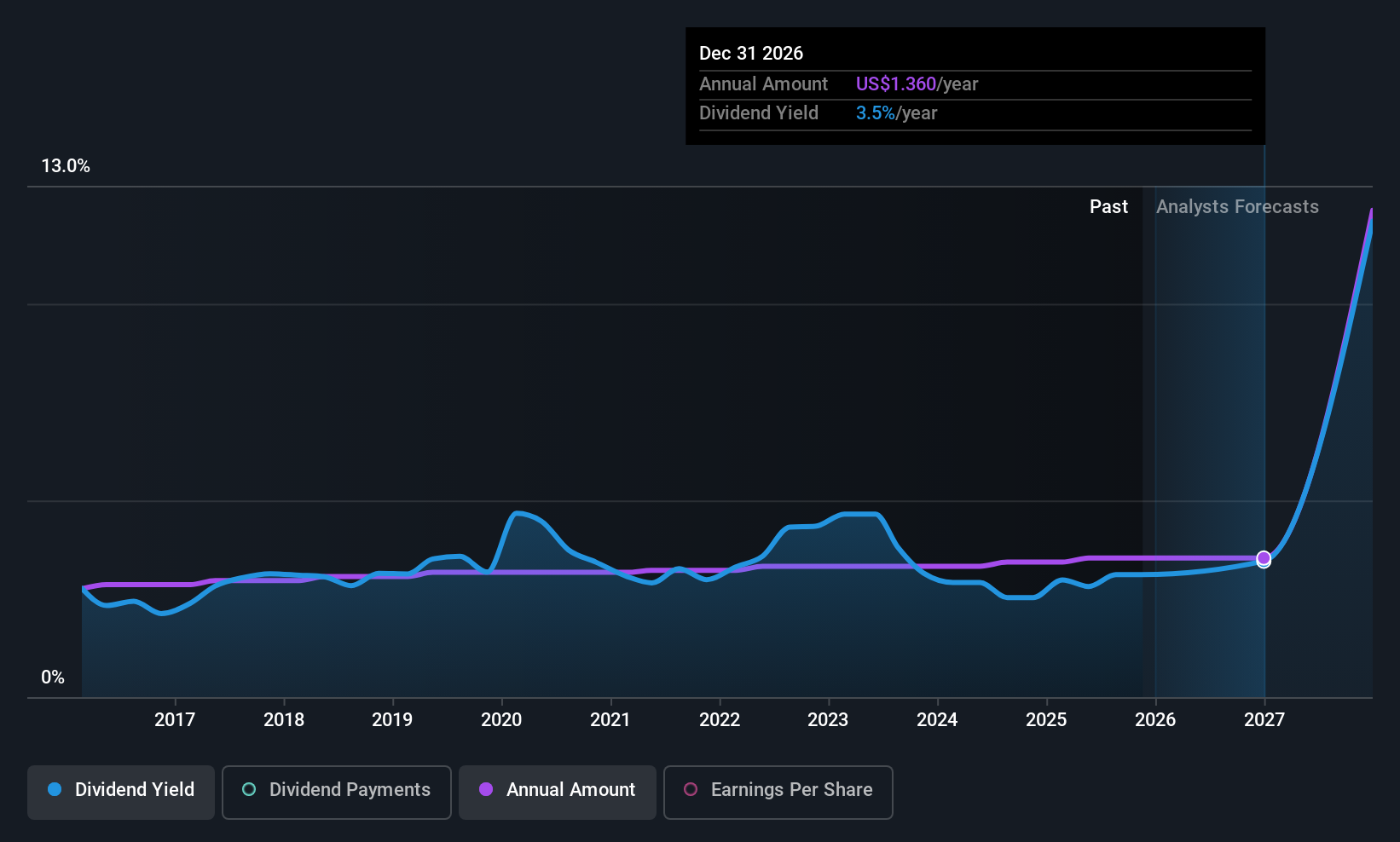

HNI (HNI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: HNI Corporation, with a market cap of $1.96 billion, manufactures, sells, and markets workplace furnishings and residential building products primarily in the United States and Canada.

Operations: HNI Corporation generates revenue through two primary segments: Workplace Furnishings, which contributes $1.94 billion, and Residential Building Products, accounting for $656.30 million.

Dividend Yield: 3.2%

HNI Corporation offers a stable dividend yield of 3.16%, supported by a low payout ratio of 44.1% and cash flow coverage at 32.9%. Recent earnings grew by 14.5%, indicating financial health, though its yield is below the top U.S. dividend payers' average of 4.4%. The company's recent acquisition of Steelcase and related debt financing, including US$500 million in new term loans, may impact future cash flows but could potentially enhance long-term growth prospects.

- Click here and access our complete dividend analysis report to understand the dynamics of HNI.

- Upon reviewing our latest valuation report, HNI's share price might be too pessimistic.

Make It Happen

- Click here to access our complete index of 109 Top US Dividend Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal