Waberer's International Nyrt Leads 3 Undiscovered European Gems with Strong Metrics

In recent weeks, the European market has experienced mixed performance, with the pan-European STOXX Europe 600 Index ending slightly lower and major stock indexes showing varied results. Amidst these fluctuations and potential rate hikes from the European Central Bank, investors are increasingly on the lookout for small-cap stocks that demonstrate resilience and strong fundamentals. Identifying a good stock in this environment often involves focusing on companies with robust financial metrics and growth potential that can withstand economic uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 37.61% | 3.36% | 6.34% | ★★★★★★ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Freetrailer Group | 38.17% | 23.13% | 31.09% | ★★★★★☆ |

| Dn Agrar Group | NA | 29.02% | 36.03% | ★★★★★☆ |

| VNV Global | 15.38% | -18.33% | -18.19% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Practic | NA | 4.86% | 6.64% | ★★★★☆☆ |

| Alantra Partners | 11.36% | -6.39% | -33.69% | ★★★★☆☆ |

| MCH Group | 126.04% | 19.05% | 60.90% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Waberer's International Nyrt (BST:3WB)

Simply Wall St Value Rating: ★★★★☆☆

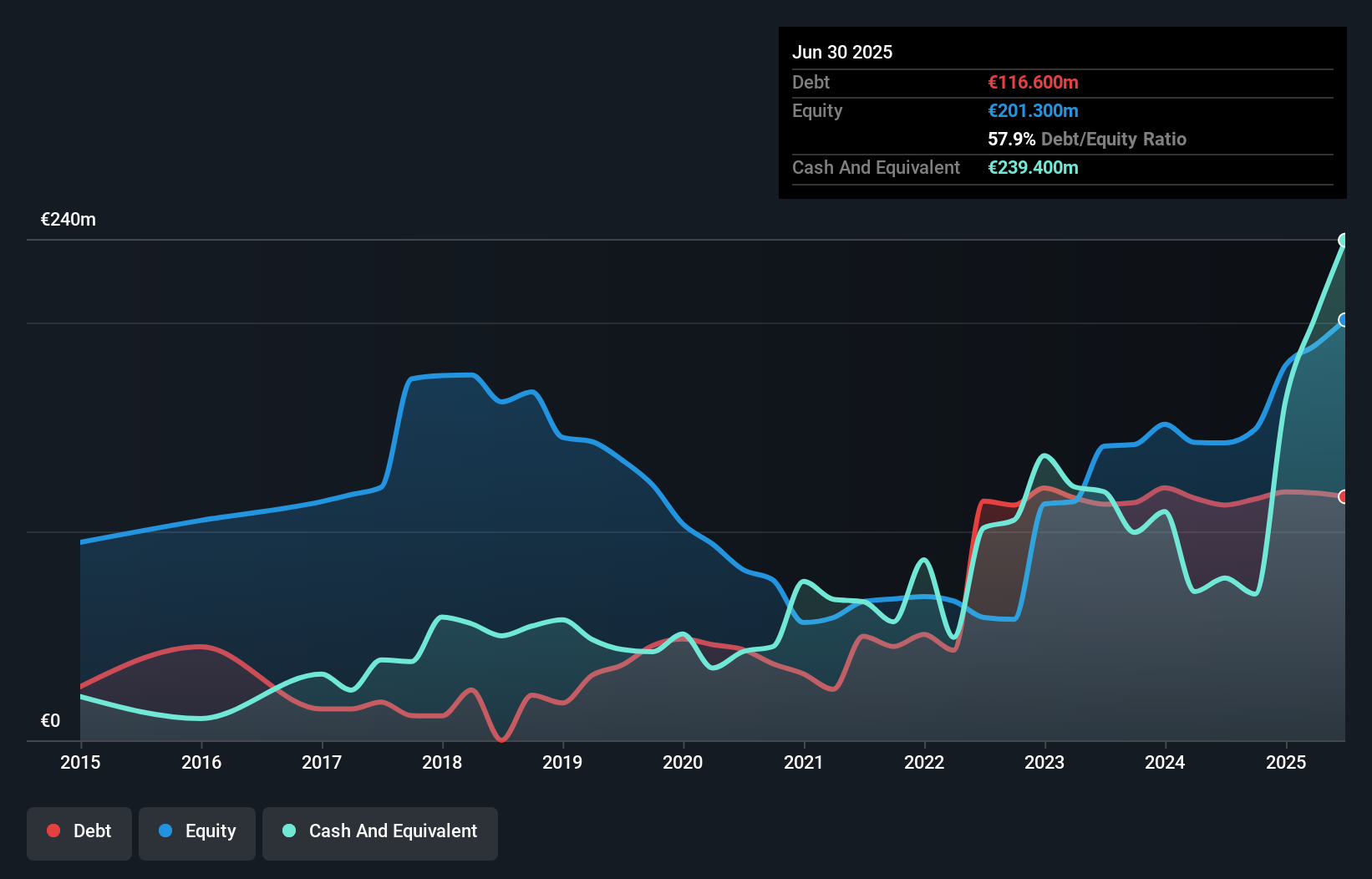

Overview: Waberer's International Nyrt. offers transportation, forwarding, and logistics services across Europe and internationally, with a market cap of €227.43 million.

Operations: Waberer's International Nyrt. generates revenue primarily from its insurance segment, contributing €136.17 million, with a segment adjustment of €649.99 million.

Waberer's International Nyrt. is making waves with its recent performance, showcasing a robust earnings growth of 128.5% over the past year, outpacing the transportation industry's 7.6%. With sales reaching €205.4 million in Q3 2025 compared to €190.5 million last year, and net income jumping from €5.4 million to €11.2 million, this company is on an upward trajectory. Its debt-to-equity ratio has risen slightly from 47.7% to 53.1% over five years but remains manageable with interest payments well-covered by EBIT at a multiple of 12x, indicating financial resilience and potential for continued growth in the sector.

ABG Sundal Collier Holding (OB:ABG)

Simply Wall St Value Rating: ★★★★☆☆

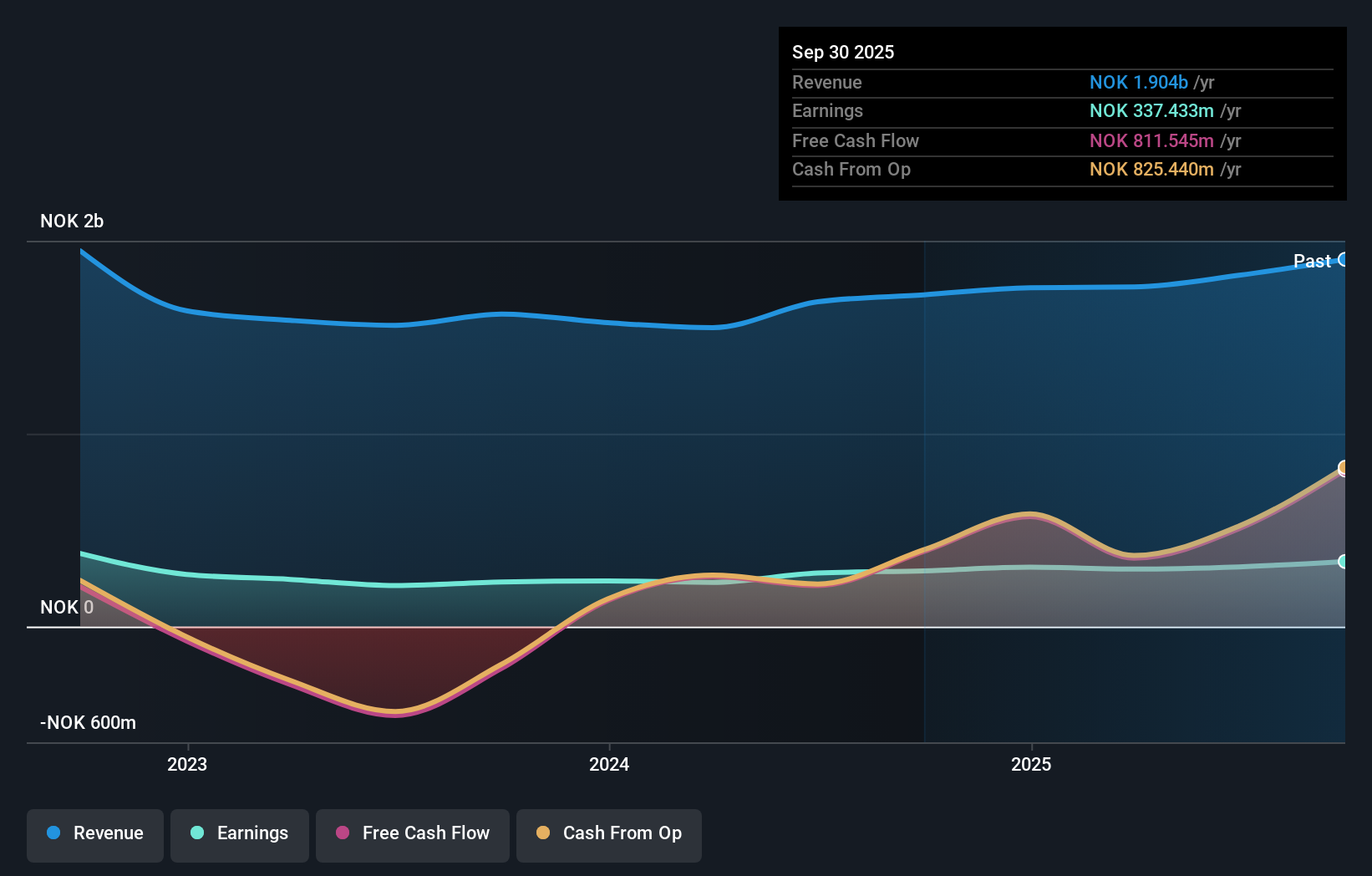

Overview: ABG Sundal Collier Holding ASA is a company offering investment banking, stock broking, and corporate advisory services across Norway, Sweden, Denmark, and internationally with a market cap of NOK4.20 billion.

Operations: ABG Sundal Collier generates revenue through three primary segments: M&A and Advisory (NOK709.73 million), Corporate Financing (NOK761.54 million), and Brokerage and Research (NOK607.53 million).

ABG Sundal Collier Holding, a player in the financial sector, has seen its debt to equity ratio rise from 28.6% to 35.6% over five years, indicating a shift in financial structure. Despite this, it holds more cash than total debt, showcasing solid liquidity management. The company reported third-quarter revenue of NOK 475.5 million and net income of NOK 74.2 million, both up from the previous year’s figures of NOK 392.3 million and NOK 46 million respectively. Trading at a discount of about 7%, ABG's earnings growth outpaced the industry at 16.8%, hinting at potential value for investors seeking opportunities in smaller firms within capital markets.

Byggmax Group (OM:BMAX)

Simply Wall St Value Rating: ★★★★★☆

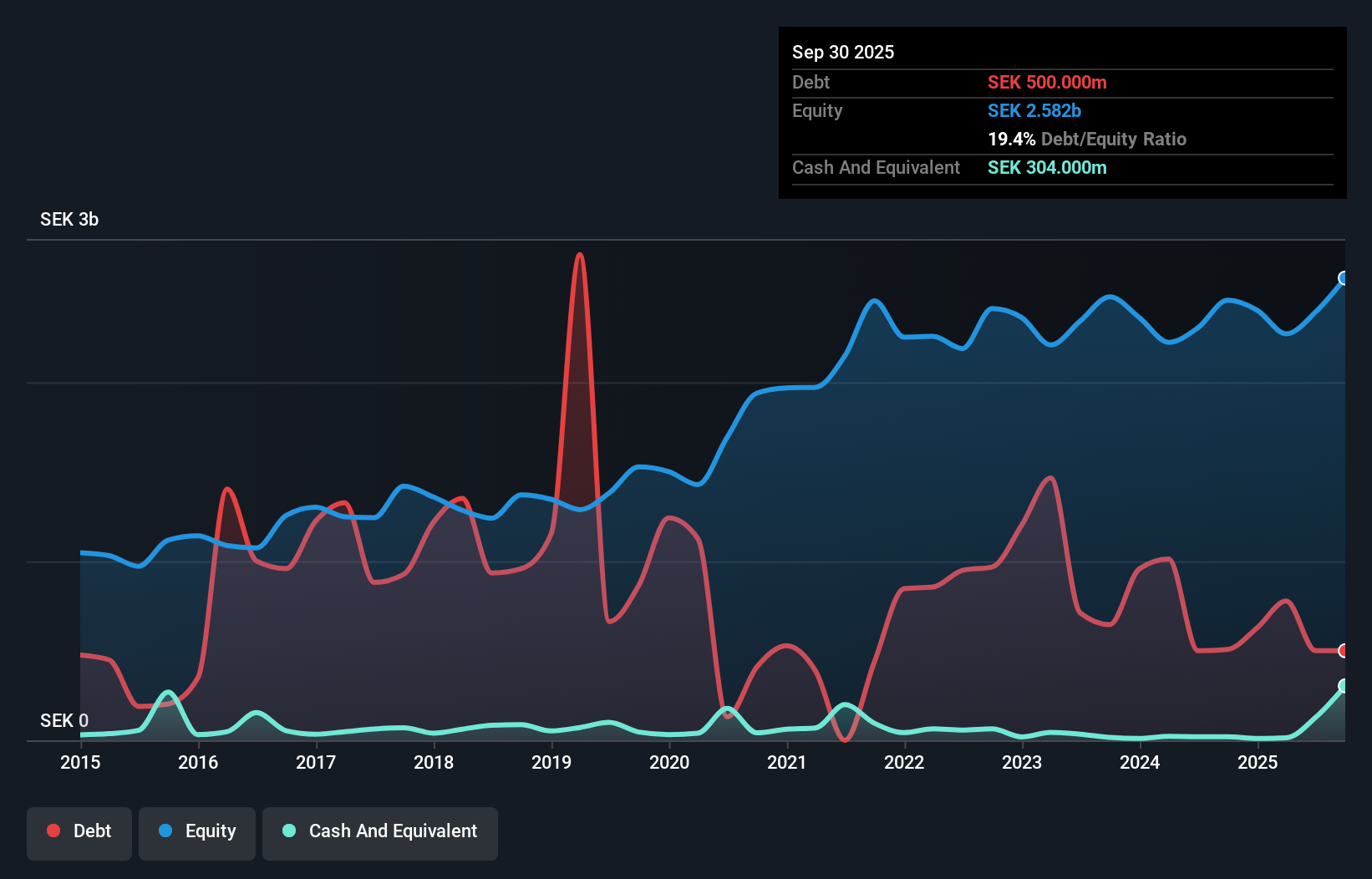

Overview: Byggmax Group AB (publ) is a company that provides building materials and related products for DIY projects across Sweden, Norway, and internationally, with a market cap of approximately SEK3.08 billion.

Operations: Byggmax Group generates revenue primarily from its Byggmax segment, which accounts for SEK6.17 billion. The company's financial performance can be analyzed through its market cap of approximately SEK3.08 billion.

Byggmax Group, a building materials retailer in Sweden and Norway, shows promise with its robust financial health and strategic focus on e-commerce logistics. Recent earnings reveal net income of SEK 191 million for Q3 2025, up from SEK 169 million the previous year, alongside a basic EPS increase to SEK 3.26 from SEK 2.88. The company's net debt to equity ratio stands at a satisfactory 7.6%, providing flexibility for future investments. Despite potential challenges like currency fluctuations and inventory management issues, Byggmax's price-to-earnings ratio of 17.3x suggests it offers good value relative to the Swedish market average of 21.6x.

Turning Ideas Into Actions

- Unlock our comprehensive list of 308 European Undiscovered Gems With Strong Fundamentals by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal