Assessing Workday (WDAY) Valuation After New Compensation and AI Partnership Announcements

Workday (WDAY) is back in the spotlight after unveiling fresh partnerships that deepen its compensation and AI agent ecosystem, moves that matter less for today’s share price and more for its long term platform stickiness.

See our latest analysis for Workday.

That backdrop of new partnerships lands at a tricky moment for sentiment, with the share price at $218.08 after a soft recent stretch, including a negative year to date share price return and a weaker 1 year total shareholder return, even though the 3 year total shareholder return remains solid and suggests longer term momentum has not fully broken.

If Workday’s AI and platform story has your attention, this is also a good time to explore other high growth tech and AI names using high growth tech and AI stocks as a curated starting point.

With revenue and earnings still growing double digits and the stock trading at a sizable discount to analyst targets, the key question now is whether Workday is quietly undervalued or if the market is already factoring in its next leg of AI driven growth.

Most Popular Narrative: 20.9% Undervalued

With Workday closing at $218.08 against a narrative fair value near $275.64, the spread points to a meaningful upside embedded in long term forecasts.

Broad adoption of Workday's AI enabled HR and finance products (with >70% of customers using Workday Illuminate and >75% of net new deals including at least one AI product), along with acquisitions like Paradox and Flowise, is fueling cross sell/upsell activity, increasing average contract values and bolstering future topline growth.

Curious how this adoption story turns into a higher valuation stack over time? The narrative leans on faster earnings compounding and expanding margins to bridge that gap.

Result: Fair Value of $275.64 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, investors cannot ignore rising competitive pressure from AI native rivals, as well as potential margin drag if heavy R&D and M&A spending fails to deliver efficiencies.

Find out about the key risks to this Workday narrative.

Another Lens on Valuation

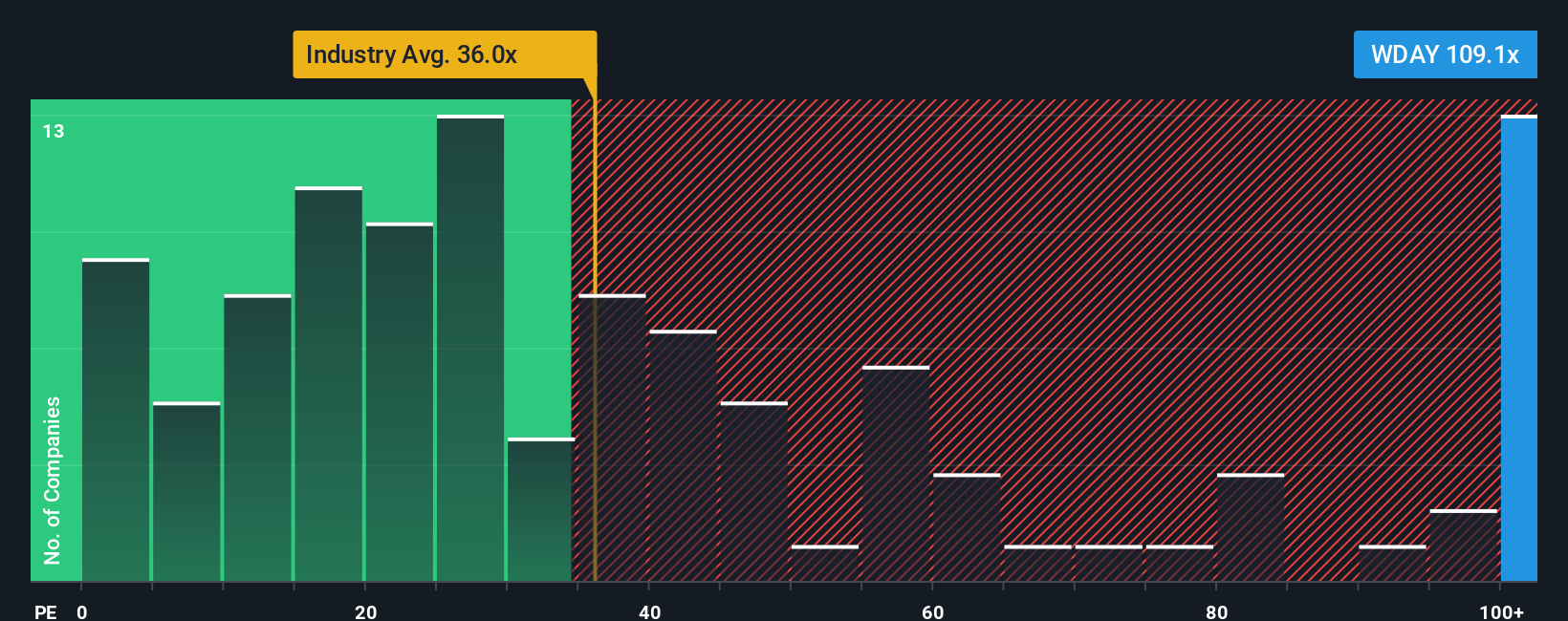

On earnings multiples, the picture is much tougher. Workday trades at about 89 times earnings versus 54 times for peers and a fair ratio of 48.4, which suggests investors are still paying a steep premium and that any growth wobble could hit the share price hard.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Workday Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a custom narrative in just minutes: Do it your way.

A great starting point for your Workday research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Ready for more high conviction opportunities?

Before you move on, put Simply Wall St’s Screener to work so you do not miss quality opportunities beyond Workday that fit your strategy.

- Supercharge your hunt for resilient income by targeting these 13 dividend stocks with yields > 3% that can strengthen cash flow in your portfolio.

- Capitalize on structural trends in automation and data by focusing on these 24 AI penny stocks positioned to benefit from long term AI adoption.

- Upgrade your bargain hunting with these 915 undervalued stocks based on cash flows that the market may be mispricing based on their future cash flows.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal