Is Exact Sciences Stock Still Attractive After a 78.1% Surge in 2025?

- Whether you are wondering if Exact Sciences is still a smart buy after its big run or if most of the upside is already priced in, this breakdown will help you cut through the noise and focus on what the valuation really says.

- After climbing 78.1% year to date and 70.7% over the last year, the stock has clearly caught the market's attention, even if the last week has been flat at around a 0.1% slip.

- Investors have been reacting to a steady drumbeat of news around Exact Sciences' expanding cancer screening franchise and growing adoption of its flagship diagnostics. This has reinforced the narrative that it is building a durable growth platform. At the same time, heightened focus on competition and reimbursement policy has added some volatility, as the market debates how much of that growth is already in the price.

- On our framework, Exact Sciences scores a 4/6 valuation check, suggesting the market may still be underestimating parts of the story. Next, we will unpack what different valuation methods say about that, before closing with an even more intuitive way to think about its true worth.

Approach 1: Exact Sciences Discounted Cash Flow (DCF) Analysis

A Discounted Cash Flow model estimates what a business is worth by projecting its future cash flows and then discounting them back into today’s dollars, using a required rate of return.

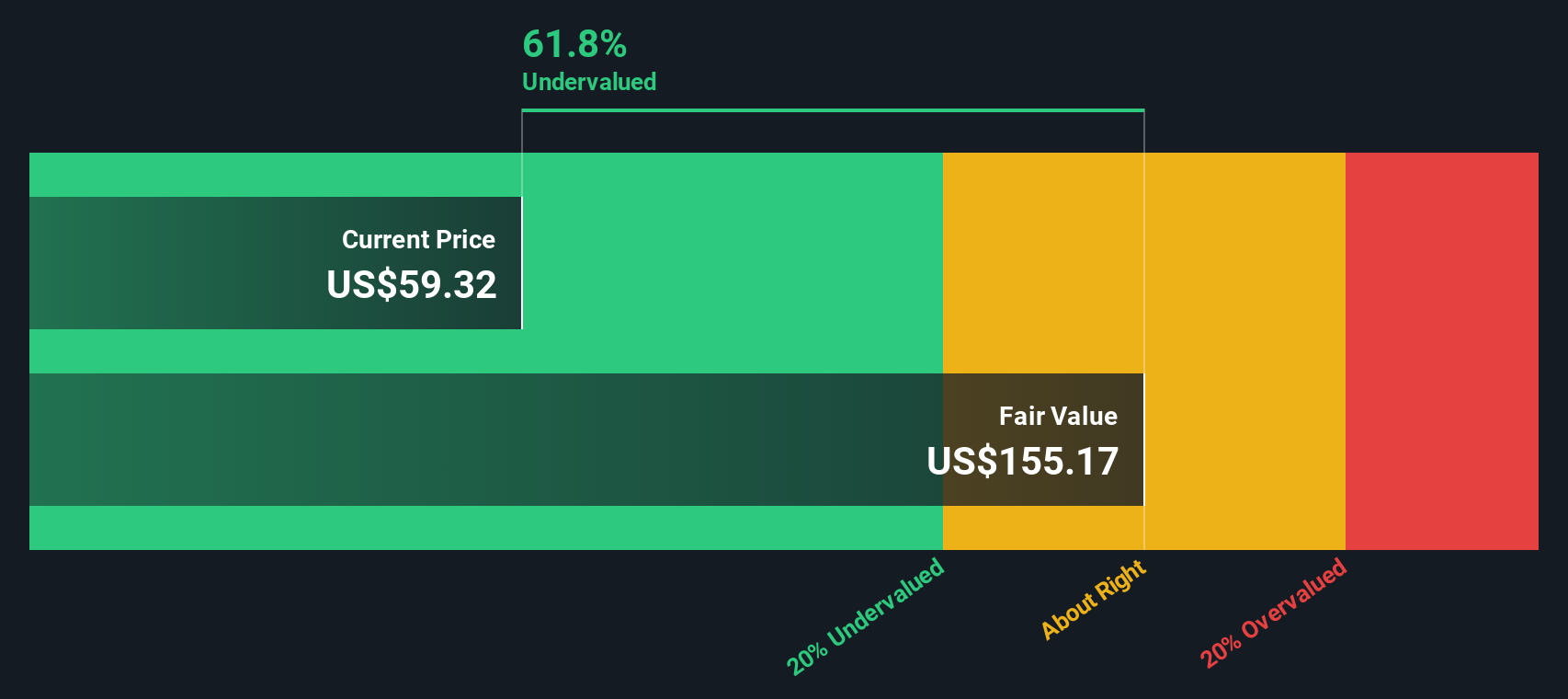

For Exact Sciences, the model starts with last twelve month Free Cash Flow of about $222 million and projects how that could grow as its diagnostics franchise scales. Analysts provide detailed forecasts for the next few years. Beyond that, Simply Wall St extrapolates the trend, with Free Cash Flow expected to reach roughly $1.1 billion by 2035. These future cash flows are discounted using a 2 Stage Free Cash Flow to Equity framework to reflect risk and the time value of money.

On this basis, the model arrives at an intrinsic value of about $105.37 per share, implying the stock is roughly 3.8% undervalued versus the current market price. In practical terms, that is a modest discount rather than a deep bargain. This suggests the market already prices in most of the long term growth story.

Result: ABOUT RIGHT

Exact Sciences is fairly valued according to our Discounted Cash Flow (DCF), but this can change at a moment's notice. Track the value in your watchlist or portfolio and be alerted on when to act.

Approach 2: Exact Sciences Price vs Sales

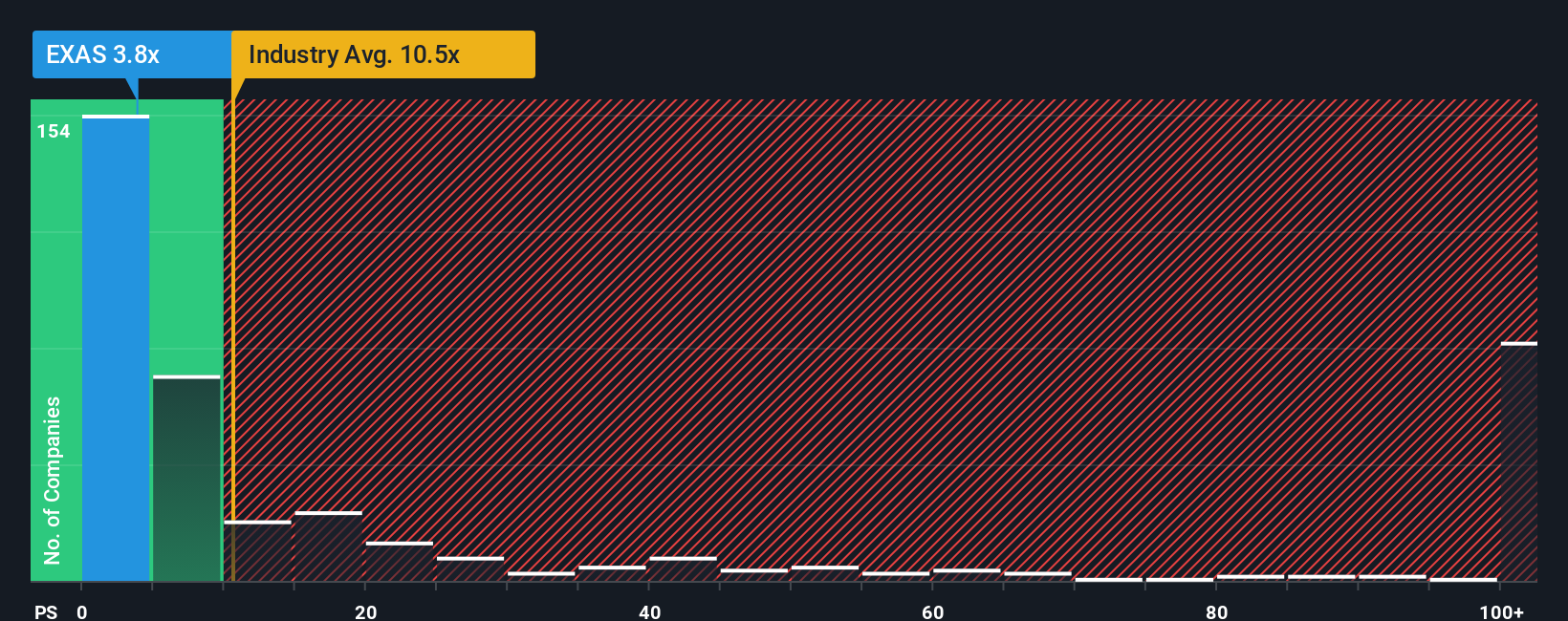

For a company like Exact Sciences that is still prioritizing growth and reinvestment, revenue is often a cleaner signal than earnings, which makes the price to sales ratio a useful way to judge valuation. Investors typically accept a higher multiple for businesses with stronger growth prospects and lower perceived risk, while slower or riskier names usually trade on lower sales multiples.

Exact Sciences currently trades on about 6.24x sales, which is below the broader Biotechs industry average of roughly 11.76x and also under the peer group average of around 7.31x. Simply Wall St goes a step further with its Fair Ratio, an estimate of what a reasonable price to sales multiple should be for this specific company, given its growth outlook, profitability profile, market cap, risk factors and industry context. This is more tailored than a simple comparison to peers or the sector because it adjusts for the company’s own fundamentals instead of assuming they are average.

Exact Sciences Fair Ratio is calculated at about 6.93x, modestly above the current 6.24x, which indicates that the shares may be trading at a mild discount on this metric.

Result: UNDERVALUED

PS ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1455 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Exact Sciences Narrative

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives, a simple tool on Simply Wall St’s Community page that lets you turn your view of Exact Sciences into a clear story. You can connect that story to a set of forecasts for revenue, earnings and margins, and then see the fair value that drops out of those assumptions alongside today’s share price. All of this updates automatically when new news or earnings arrive. For example, one investor might build a bullish Exact Sciences Narrative around an eventual fair value near $104 per share based on strong adoption of new cancer tests and improving margins. Another might create a far more cautious Narrative closer to $50 per share that assumes slower growth and more competitive pressure. Each Narrative gives you a live, easy to understand framework for deciding whether the current market price looks high, low or about right for your own beliefs.

Do you think there's more to the story for Exact Sciences? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal