GlobalFoundries (GFS): Weighing Undervaluation Claims Against DCF Signals in a Choppy Turnaround Story

GlobalFoundries (GFS) has been grinding through a choppy stretch, with the stock down over the past year even as revenue and net income have grown. That disconnect sets up an interesting risk reward debate.

See our latest analysis for GlobalFoundries.

Short term, GlobalFoundries has been volatile, with a 1 month share price return close to 10 percent but a negative year to date share price performance and a weak 3 year total shareholder return. This suggests sentiment is still rebuilding rather than surging.

If this kind of turnaround story has your attention, it might be worth scanning other specialist chip makers and design names through our high growth tech and AI stocks.

With GlobalFoundries trading below analyst targets yet showing solid top line and earnings momentum, the key question now is simple: are investors getting a mispriced turnaround, or is the market already discounting that future growth?

Most Popular Narrative Narrative: 8.3% Undervalued

Against the last close of $36.17, the most followed narrative pegs GlobalFoundries closer to $39.43, framing a modest valuation gap that hinges on execution.

The company's focus on differentiated technologies (such as FD SOI, RF, and power management platforms) and recent MIPS acquisition strengthens its value proposition in edge AI, automotive, and data center markets, deepening customer partnerships and enabling premium pricing, which is likely to drive sustained improvements in revenue visibility and margin stability.

It is interesting to see how steady mid single digit growth assumptions can still support a richer multiple and a sizeable profit swing. The noteworthy element is how margins, cash flows, and a reset P E expectation combine to justify that higher fair value. This raises the question of which levers do the heavy lifting in this story.

Result: Fair Value of $39.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this depends on GlobalFoundries overcoming its limited exposure to leading edge nodes and managing heavy capital demands, which could constrain free cash flow and long term returns.

Find out about the key risks to this GlobalFoundries narrative.

Another Angle on Valuation

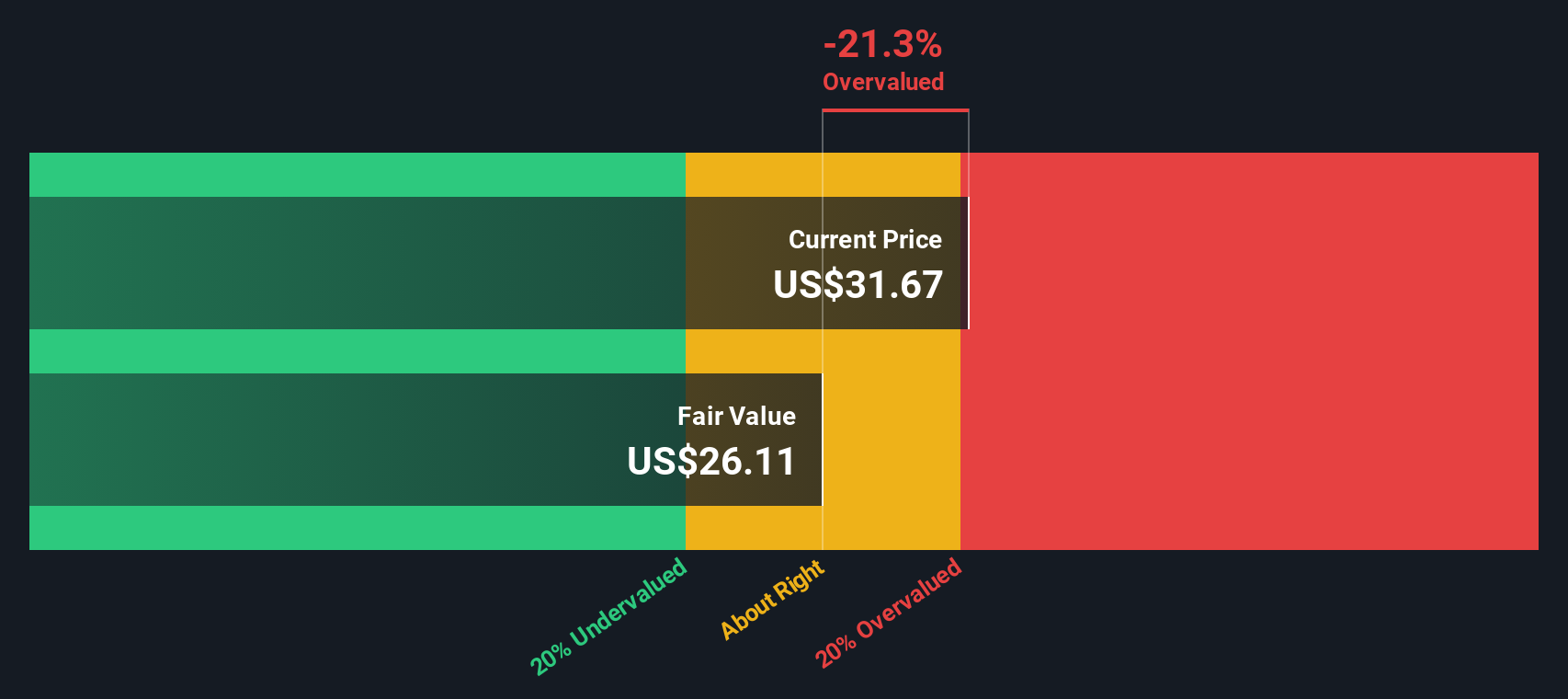

Our DCF model is much less forgiving, pointing to a fair value closer to $29.96, which makes the current $36.17 share price look overvalued rather than cheap. If the cash flows do not ramp as quickly as consensus expects, could this gap turn into downside instead of upside?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out GlobalFoundries for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 916 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own GlobalFoundries Narrative

If you would rather dig into the numbers yourself and challenge these assumptions, you can craft a personalized view in minutes: Do it your way.

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding GlobalFoundries.

Ready for your next investing move?

Do not stop at GlobalFoundries when you can quickly scan other focused opportunities on Simply Wall Street, where structured screeners turn scattered ideas into clear, actionable shortlists.

- Power up your hunt for resilient income by scanning these 13 dividend stocks with yields > 3% that can help anchor your portfolio when markets turn rough.

- Zero in on potential mispricings by reviewing these 916 undervalued stocks based on cash flows that the market has not fully recognized yet.

- Ride the next wave of innovation by targeting these 24 AI penny stocks before the crowd fully catches on.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal