MillerKnoll (MLKN) Profit Rebound Challenges Persistent Loss Narrative After Q2 2026 EPS Beat

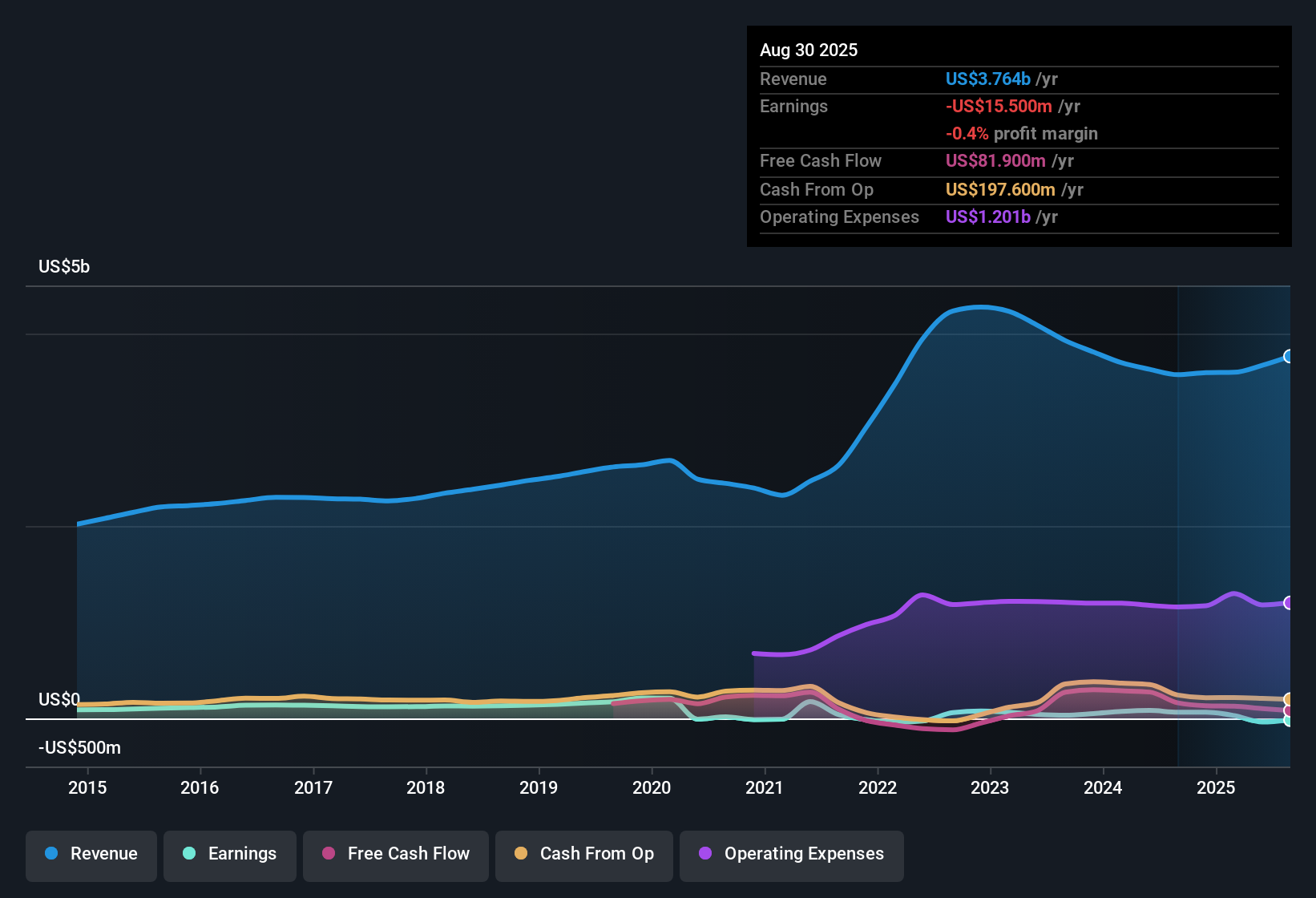

MillerKnoll (MLKN) just posted Q2 2026 results with revenue of $955.2 million and basic EPS of $0.35, setting the stage for another closely watched quarter. The company has seen quarterly revenue move from $970.4 million in Q2 2025 to $955.2 million in Q2 2026, while basic EPS has swung from $0.49 a year ago to $0.35 this quarter. This signals a business where profitability remains in focus even as headline sales stay near the $1 billion mark. With that backdrop, investors will be zeroing in on how sustainable these margins look as management tries to balance growth with consistent earnings power.

See our full analysis for MillerKnoll.With the numbers on the table, the next step is to line them up against the dominant narratives around MillerKnoll to see which stories the latest quarter backs up and which ones start to crack.

See what the community is saying about MillerKnoll

Profit swings from loss to $44 million run rate

- Net income moved from a loss of $57.1 million in Q4 2025 to positive $24.2 million in Q2 2026, with the last two quarters together totaling $44.4 million in profit.

- Bears point to the trailing 12 month net loss of $25.4 million and negative Basic EPS of $0.37, yet

- recent quarters show a shift from negative EPS of $0.84 in Q4 2025 to positive $0.29 and $0.35 in Q1 and Q2 2026, which contrasts with the idea of steadily worsening losses,

- while analysts still flag that these improvements sit against a five year backdrop where losses have grown about 6.1 percent per year.

Low 0.3x sales multiple versus slow 4.4 percent growth

- The stock trades at a price to sales ratio of 0.3 times compared with 0.8 times for peers and 1.2 times for the broader US Commercial Services industry, even though revenue is only forecast to grow around 4.4 percent a year.

- Consensus narrative talks up restructuring, new products and global retail expansion as growth drivers, and

- the forecast move in profit margins from about minus 1.0 percent today to 7.3 percent in three years helps explain why some investors see potential value at this low sales multiple,

- yet the modest revenue growth outlook versus a 10.5 percent US market forecast shows that much of the bullish case rests on margin repair rather than rapid top line expansion.

DCF fair value gap against debt and dividend strain

- With the share price at $18.92 and a DCF fair value of about $24.28, MillerKnoll trades roughly 22 percent below that valuation while remaining unprofitable on a trailing 12 month basis.

- Bulls argue that earnings could grow about 109.3 percent per year and turn positive within three years, but

- major risk flags show debt is not well covered by operating cash flow, so that growth would need to come with stronger cash generation,

- and a 3.96 percent dividend yield is not well covered by current earnings, which may limit how much cash can be returned to shareholders while the balance sheet is still under pressure.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for MillerKnoll on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Take a couple of minutes to explore the figures, challenge the consensus, and shape your own view on MillerKnoll, Do it your way.

A great starting point for your MillerKnoll research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

MillerKnoll’s story still hinges on repairing a stretched balance sheet and supporting an uncovered dividend, while recent profitability gains remain fragile.

If you want businesses where leverage is less of a question mark and financial strength underpins returns, use our solid balance sheet and fundamentals stocks screener (1943 results) today to focus on companies built to withstand tougher cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal