Basic-Fit And 2 Other European Stocks That Might Be Priced Below Their Estimated Value

As European markets display mixed performance, with indices like Germany's DAX showing gains while others such as France's CAC 40 experience declines, investors are keenly observing the potential for undervalued opportunities amidst economic uncertainties. In this environment, identifying stocks that may be priced below their estimated value becomes crucial, as these can offer potential upside in a market where central bank policies and economic data continue to influence investor sentiment.

Top 10 Undervalued Stocks Based On Cash Flows In Europe

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Unimot (WSE:UNT) | PLN129.00 | PLN257.76 | 50% |

| Truecaller (OM:TRUE B) | SEK18.60 | SEK36.55 | 49.1% |

| Straumann Holding (SWX:STMN) | CHF94.42 | CHF187.49 | 49.6% |

| Outokumpu Oyj (HLSE:OUT1V) | €4.348 | €8.54 | 49.1% |

| Kitron (OB:KIT) | NOK68.05 | NOK135.42 | 49.7% |

| Jæren Sparebank (OB:JAREN) | NOK378.00 | NOK752.65 | 49.8% |

| Inission (OM:INISS B) | SEK48.90 | SEK97.00 | 49.6% |

| cyan (XTRA:CYR) | €2.28 | €4.51 | 49.5% |

| Circle (BIT:CIRC) | €8.00 | €15.74 | 49.2% |

| Allegro.eu (WSE:ALE) | PLN30.535 | PLN60.33 | 49.4% |

Here's a peek at a few of the choices from the screener.

Basic-Fit (ENXTAM:BFIT)

Overview: Basic-Fit N.V., with a market cap of €1.91 billion, operates fitness clubs through its subsidiaries.

Operations: The company's revenue is derived from its operations in the Benelux region, contributing €541.70 million, and from France, Spain, and Germany, which together generate €766 million.

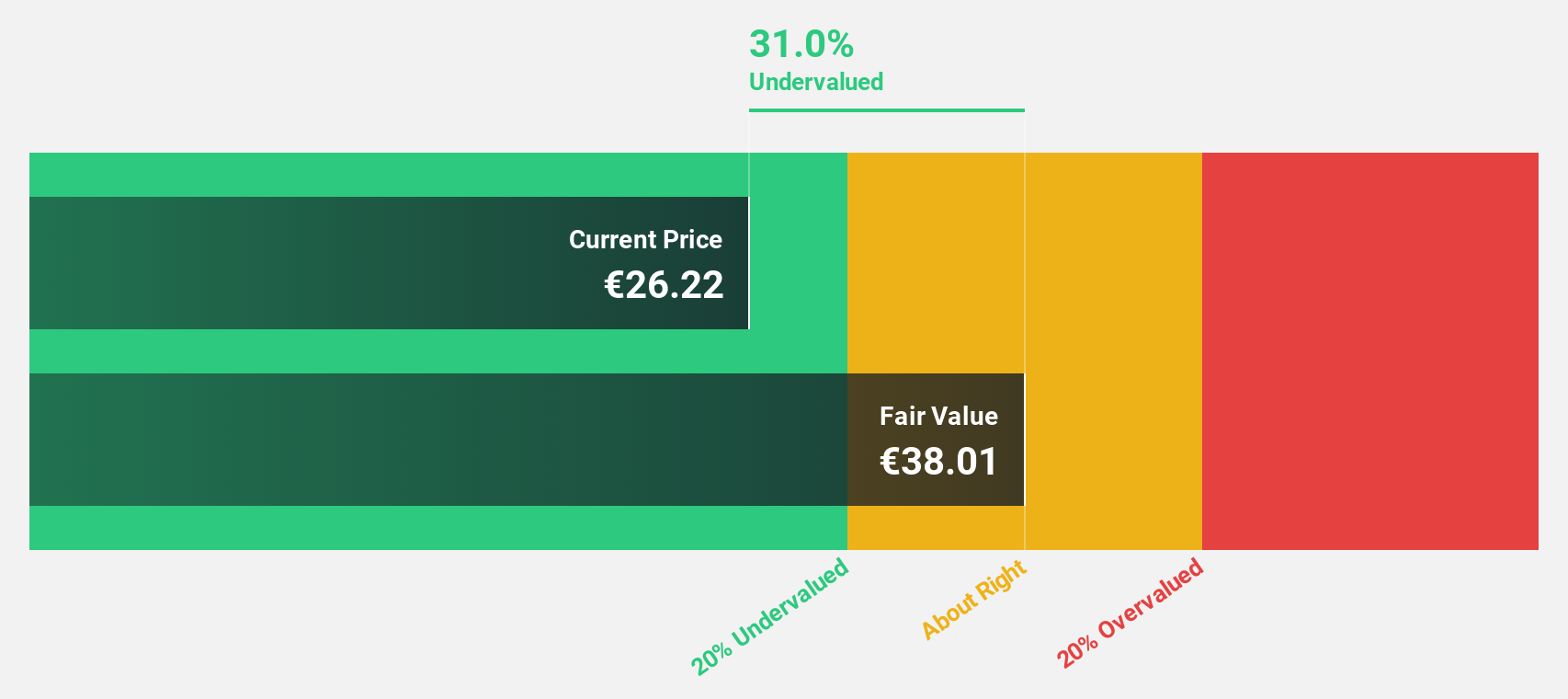

Estimated Discount To Fair Value: 25.5%

Basic-Fit is trading at €29.22, 25.5% below its estimated fair value of €39.22, highlighting its undervaluation based on discounted cash flows. The company reported a significant revenue increase to €1.034 billion for the first nine months of 2025, up 60% from the previous year, and reaffirmed its annual revenue guidance between €1.375 billion and €1.425 billion. Earnings are forecast to grow annually by 46.77%, with profitability expected in three years, surpassing market averages.

- Upon reviewing our latest growth report, Basic-Fit's projected financial performance appears quite optimistic.

- Delve into the full analysis health report here for a deeper understanding of Basic-Fit.

SMG Swiss Marketplace Group Holding (SWX:SMG)

Overview: SMG Swiss Marketplace Group Holding AG is an online marketplace and digital company offering decision-making tools in Switzerland, with a market cap of CHF3.24 billion.

Operations: The company's revenue is derived from three main segments: Automotive (CHF81.33 million), Real Estate (CHF169.27 million), and General Marketplaces (CHF76.51 million).

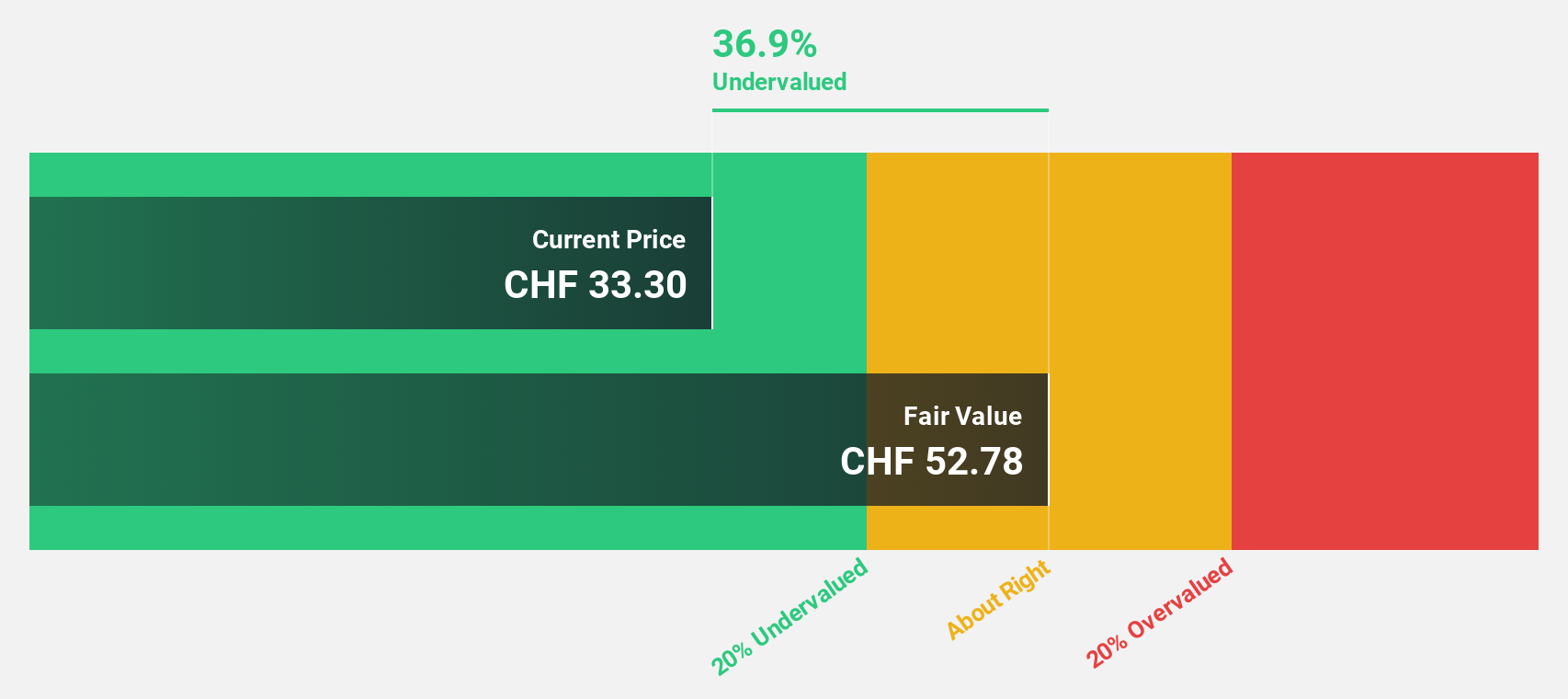

Estimated Discount To Fair Value: 37.5%

SMG Swiss Marketplace Group Holding, trading at CHF33.05, is significantly undervalued with a fair value estimate of CHF52.86. Analysts agree on a potential 43.3% price increase, supported by strong earnings growth forecasts of 24.8% annually over the next three years, outpacing the Swiss market's 10.5%. Despite recent share price volatility and a modest revenue growth forecast of 8.7%, SMG remains attractive due to its robust cash flow valuation and profit outlook.

- The growth report we've compiled suggests that SMG Swiss Marketplace Group Holding's future prospects could be on the up.

- Click here to discover the nuances of SMG Swiss Marketplace Group Holding with our detailed financial health report.

Dino Polska (WSE:DNP)

Overview: Dino Polska S.A., along with its subsidiaries, operates a network of medium-sized grocery supermarkets under the Dino brand in Poland and has a market cap of PLN39.99 billion.

Operations: The company's revenue primarily comes from Sales In The Retail Network and Online Sales, amounting to PLN32.24 billion.

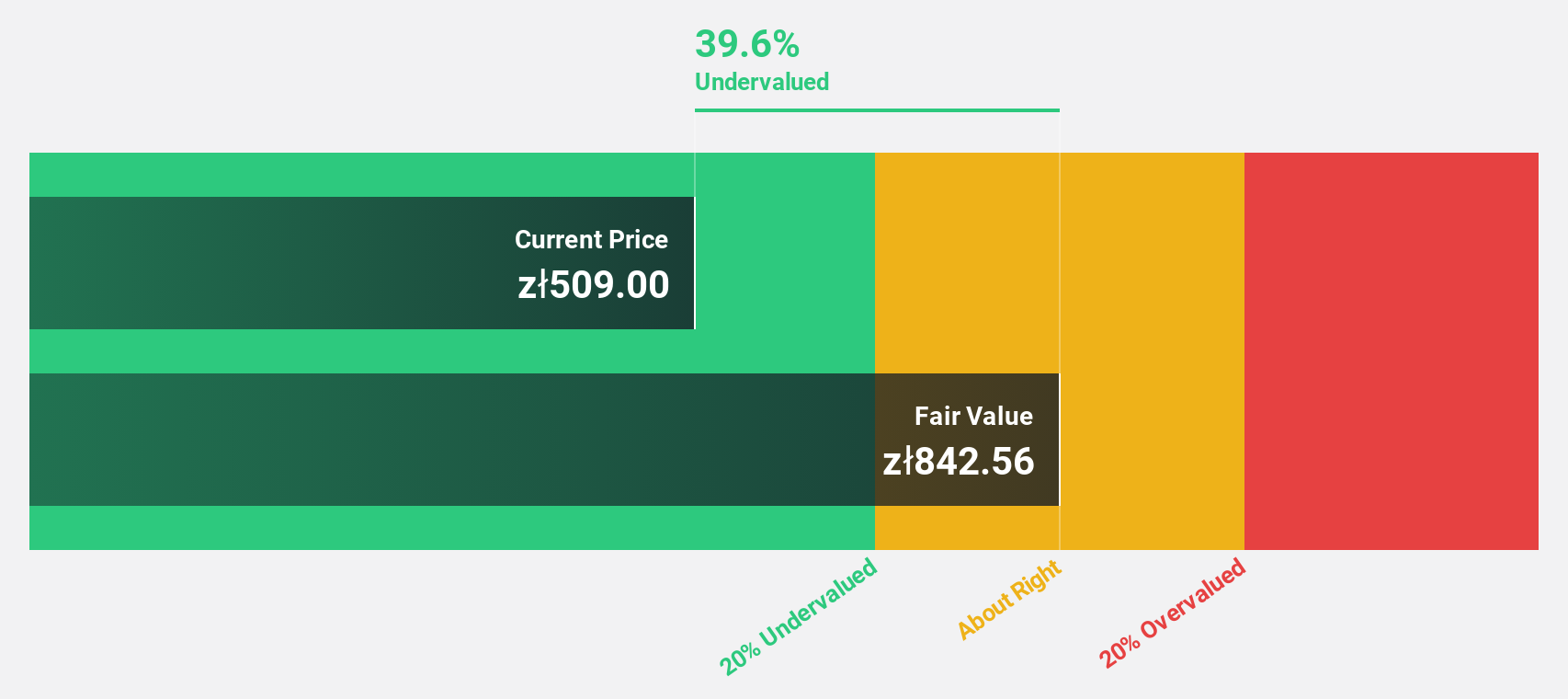

Estimated Discount To Fair Value: 42.4%

Dino Polska is trading at PLN 40.79, significantly below its estimated fair value of PLN 70.81, indicating it may be undervalued based on cash flows. The company reported strong earnings growth with net income rising to PLN 481.87 million in Q3 2025 from PLN 438.21 million a year ago, and forecasts suggest annual profit growth of over 20%, outpacing the Polish market's average. Analysts anticipate a potential price increase of around 23.6%.

- The analysis detailed in our Dino Polska growth report hints at robust future financial performance.

- Get an in-depth perspective on Dino Polska's balance sheet by reading our health report here.

Seize The Opportunity

- Take a closer look at our Undervalued European Stocks Based On Cash Flows list of 193 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal