Jabil (JBL) Q1: Margin Compression Reinforces Bearish Narrative Despite Solid Revenue Base

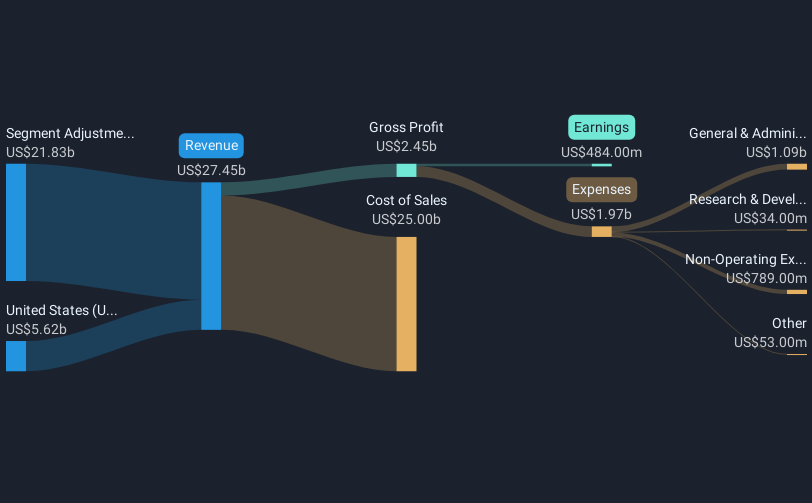

Jabil (JBL) opened Q1 2026 with revenue of about $8.3 billion and basic EPS of $1.36, alongside net income of $146 million. This provides a clear snapshot of its latest quarter following a year in which trailing twelve month revenue reached roughly $31.1 billion and EPS came in at $6.50.

Over recent quarters the company has seen revenue move from $7.0 billion and EPS of $0.89 in Q1 2025 to $8.3 billion and EPS of $1.36 in Q1 2026. At the same time trailing twelve month net income has shifted from $1.39 billion in Q4 2024 to $703 million in Q1 2026, leaving investors focused on how much of that compression reflects cyclical margin pressure versus reset expectations for future growth.

See our full analysis for Jabil.With the headline numbers on the table, the next step is to weigh them against the most common narratives around Jabil to see which stories the latest margin picture supports and which ones start to crack.

See what the community is saying about Jabil

Margins Squeezed as Net Income Slips

- Net income fell from $218 million in Q4 2025 to $146 million in Q1 2026, while trailing net profit margin sits at 2.3 percent versus 4.7 percent a year ago, showing much thinner profitability despite revenue growing to about $8.3 billion this quarter.

- Critics highlight that a large $306 million one off loss and lower margins question earnings quality, and the numbers partly back that view:

- The trailing 12 month net income of $703 million is roughly half the $1.39 billion level from a year earlier, even though trailing revenue is up to about $31.1 billion from $28.9 billion.

- Within the last year, quarterly net income has moved in a tight $100 million to $222 million band despite revenue climbing from $7.0 billion to $8.3 billion. This aligns with the bearish focus on margin pressure.

Revenue Growth Outpaces Profitability

- Quarterly revenue has risen from about $6.96 billion in Q4 2024 to $8.31 billion in Q1 2026, and trailing 12 month revenue has grown from roughly $28.9 billion to $31.1 billion, yet trailing net income over that span has dropped from $1.39 billion to $703 million.

- Consensus narrative points to growth drivers like AI demand and expansion in India and pharmaceuticals, and the data both supports and challenges that story:

- On the supportive side, trailing revenue growth of around $2.2 billion in a year and Q1 2026 revenue that is about $1.3 billion higher than Q4 2024 suggest the business is finding new sales, consistent with expectations for mid single digit annual revenue growth.

- On the challenging side, the fall in trailing net income by about $685 million over the same period, alongside a margin slide from 4.7 percent to 2.3 percent, shows that the new revenue has not yet translated into stronger profitability. This is a key tension for bulls counting on higher margins.

High Growth Forecasts Versus Rich Valuation

- Earnings are forecast to grow about 19.8 percent per year with a five year earnings growth rate of 9.4 percent annually, yet the stock trades on a 33 times P E ratio that is above the broader US Electronic industry average of 24.5 times and slightly below the 35.3 times peer average.

- Bulls argue that strong earnings growth and valuation upside justify today’s pricing, and current figures give them some powerful support:

- The share price of $217.04 sits about 37.9 percent below an indicated DCF fair value of roughly $349.53, leaving a sizable valuation gap even after the recent run up.

- At the same time, trailing EPS has climbed from 6.00 dollars to about 6.50 dollars over the last few quarters despite the one off loss. This lines up with the view that underlying earnings power can grow into the current multiple if forecasts prove accurate.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Jabil on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers differently? Use your own lens on this quarter, turn it into a concise narrative in just a few minutes, and Do it your way.

A great starting point for your Jabil research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Explore Alternatives

Despite healthy top line growth and a headline valuation gap, Jabil’s shrinking margins and halved trailing net income raise doubts about the durability of its earnings power.

If those profit swings make you uneasy, use our stable growth stocks screener (2095 results) to quickly focus on companies that already pair consistent revenue with steadier earnings momentum across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal