Grupa Azoty Zaklady Chemiczne Police S.A.'s (WSE:PCE) Price Is Out Of Tune With Revenues

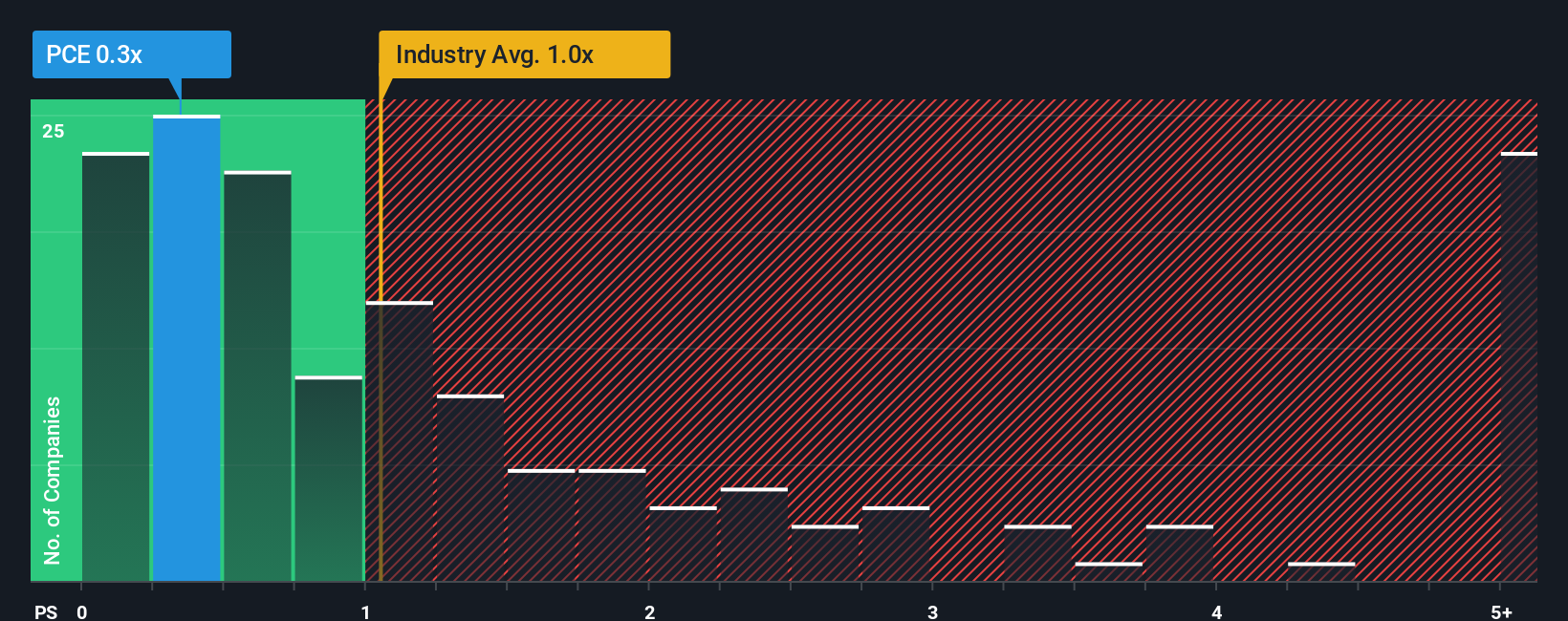

There wouldn't be many who think Grupa Azoty Zaklady Chemiczne Police S.A.'s (WSE:PCE) price-to-sales (or "P/S") ratio of 0.3x is worth a mention when the median P/S for the Chemicals industry in Poland is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Grupa Azoty Zaklady Chemiczne Police

What Does Grupa Azoty Zaklady Chemiczne Police's Recent Performance Look Like?

For instance, Grupa Azoty Zaklady Chemiczne Police's receding revenue in recent times would have to be some food for thought. One possibility is that the P/S is moderate because investors think the company might still do enough to be in line with the broader industry in the near future. If you like the company, you'd at least be hoping this is the case so that you could potentially pick up some stock while it's not quite in favour.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on Grupa Azoty Zaklady Chemiczne Police's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

Grupa Azoty Zaklady Chemiczne Police's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 4.3%. The last three years don't look nice either as the company has shrunk revenue by 51% in aggregate. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 0.5% shows the industry is more attractive on an annualised basis regardless.

With this information, it's perhaps strange that Grupa Azoty Zaklady Chemiczne Police is trading at a fairly similar P/S in comparison. In general, when revenue shrink rapidly the P/S often shrinks too, which could set up shareholders for future disappointment. There's potential for the P/S to fall to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

Our examination of Grupa Azoty Zaklady Chemiczne Police revealed its sharp three-year contraction in revenue isn't impacting its P/S as much as we would have predicted, given the industry is set to shrink less severely. Right now we are uncomfortable with the P/S as this revenue performance isn't likely to support a more positive sentiment for long. In addition, we would be concerned whether the company can even maintain its medium-term level of performance under these tough industry conditions. This would place shareholders' investments at risk and potential investors in danger of paying an unnecessary premium.

And what about other risks? Every company has them, and we've spotted 1 warning sign for Grupa Azoty Zaklady Chemiczne Police you should know about.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal