Darden Restaurants (DRI) Margin Resilience Supports Bullish Narrative in Q2 2026 Results

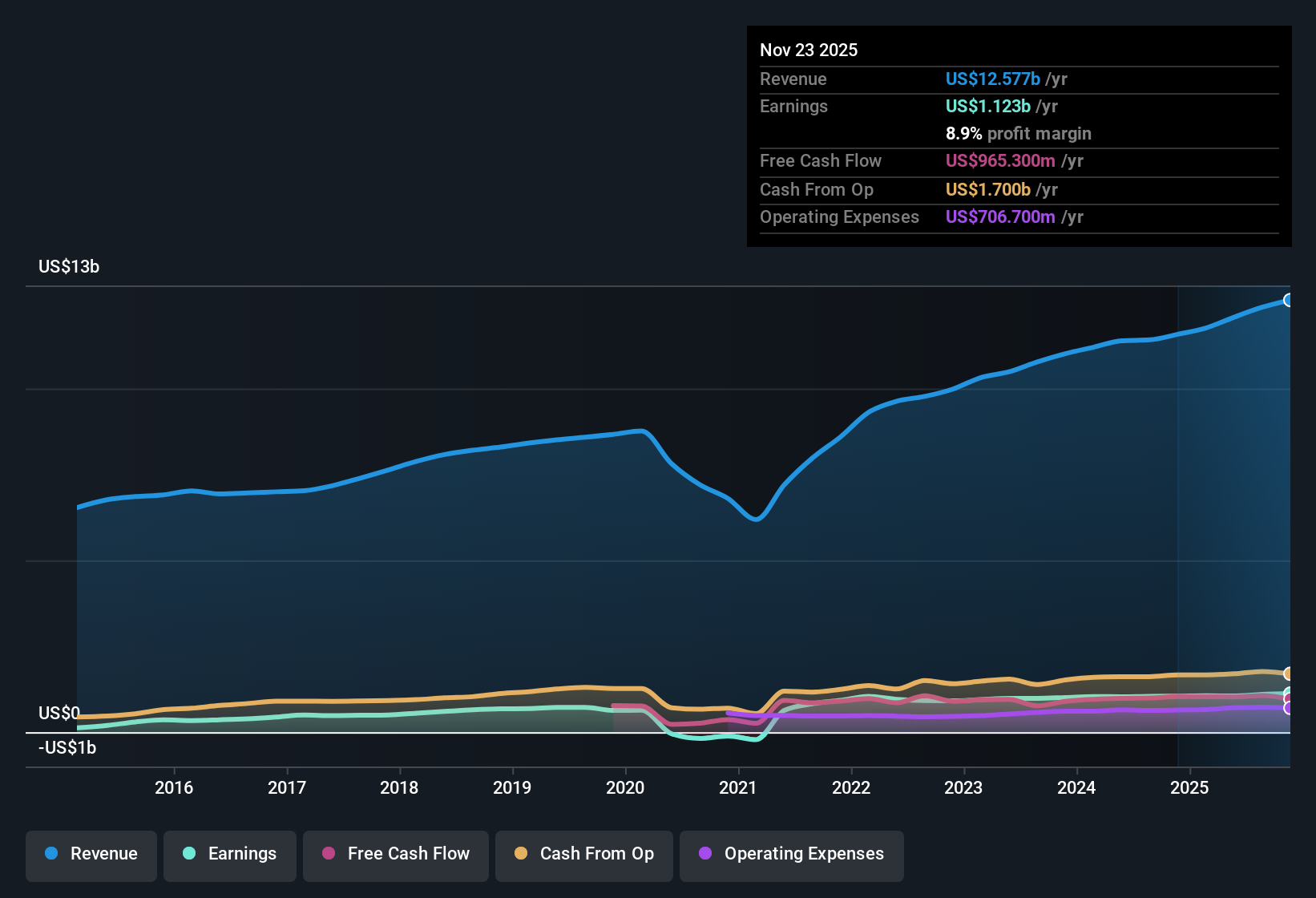

Darden Restaurants (DRI) opened Q2 2026 with revenue of about $3.1 billion and basic EPS of $2.05, setting a clear snapshot of where the restaurant group stands heading into the back half of its fiscal year. The company has seen quarterly revenue move from $2.89 billion in Q2 2025 to $3.1 billion in Q2 2026, alongside EPS stepping up from $1.84 to $2.05. Trailing twelve month revenue reached roughly $12.6 billion with EPS of $9.63, giving investors a solid read on how scale and profitability are tracking together. With net income from ongoing operations at $237.4 million this quarter and margins holding in a tight range, the story now pivots to how durable those earnings drivers really are.

See our full analysis for Darden Restaurants.With the headline numbers on the table, the next step is to line them up against the dominant narratives around Darden, seeing where the data backs the story and where expectations might need a reset.

See what the community is saying about Darden Restaurants

Margins Steady Near 9 Percent

- Over the last year, Darden turned $12.6 billion in revenue into $1.1 billion of net income, with net profit margins sitting at about 8.9 percent, just below last year’s 9 percent but still described as high quality.

- Consensus narrative highlights operational wins like Olive Garden’s Uber Direct rollout and LongHorn’s quality focus, and that sits alongside these stable margins by:

- Pointing to margin support from efficiency moves such as integrating Chuy’s into Darden’s HR and supply chain, which aligns with net income holding above $1.1 billion on trailing twelve month figures.

- Flagging risks like delivery complexity and supply chain disruptions, which investors can contrast against margins only slipping by 0.1 percentage points year over year, not a sharp drop in the reported data.

Earnings Growth Slows From Five Year Pace

- Five year earnings growth averaged 17.8 percent per year, while the most recent year shows earnings growth of 7.3 percent and forward expectations sit near 7.9 percent annually, clearly slower than that earlier run rate.

- Bears focus on softer guest counts and macro pressure, and this growth step down interacts with that view in a few ways:

- Critics highlight that forecast revenue growth of about 4.9 percent per year trails the broader US market’s 10.6 percent, which fits a narrative that traffic and spending in casual dining are under pressure.

- At the same time, analysts still model EPS climbing to $12.64 and profit margins rising toward 10 percent in a few years, which suggests current mid single digit growth could still compound meaningfully if the industry headwinds do not worsen.

Valuation Looks Cheaper Than Fundamentals

- With the stock at about $192.73 versus a DCF fair value of roughly $223.59, Darden screens around 13.8 percent below that DCF fair value and also trades on a 20 times P E, under both peer and industry averages near the mid 20s.

- Bulls argue that efficiency gains and new growth channels can justify that gap, and the numbers give them some backing:

- The company generated $9.63 in trailing twelve month EPS and $1.1 billion of net income while still carrying high debt, so any improvement toward the projected 10 percent margin could make today’s 20 times multiple look conservative.

- Unit expansion, including smaller prototypes for brands like Yard House and Cheddar’s, is designed to accelerate openings without heavy cost inflation, which could help earnings move closer to analyst expectations if revenue keeps tracking above $12 billion a year.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Darden Restaurants on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

See the numbers through a different lens? Turn that view into a concise narrative in just a few minutes, then share it with the community, Do it your way

A great starting point for your Darden Restaurants research is our analysis highlighting 4 key rewards and 3 important warning signs that could impact your investment decision.

See What Else Is Out There

Darden’s slowing earnings growth, softer traffic, and high debt load raise questions about how long its margins and valuation gap can stay this supportive.

If you want businesses where financial strength is less of a question mark, use our solid balance sheet and fundamentals stocks screener (1943 results) today to uncover companies built on sturdier foundations and more resilient balance sheets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal