AutoZone (AZO): Reassessing Valuation After EPS Miss on LIFO Charge and Higher Growth Investments

AutoZone (AZO) just delivered quarterly results that frustrated some investors, with earnings per share missing expectations even as sales landed roughly where Wall Street had penciled them in.

See our latest analysis for AutoZone.

The mixed quarter has landed against a tricky backdrop, with the share price down roughly 10 percent over the past month and about 17 percent over the last quarter, yet still showing a positive year to date share price return and a solid multi year total shareholder return. This suggests that longer term momentum has not fully broken.

If earnings volatility at a mature retailer like AutoZone has you rethinking where growth might come from next, it could be worth exploring auto manufacturers as another way to play the vehicle ecosystem.

With the shares now trading well below analyst targets but still carrying a modest intrinsic premium, the key question is whether AutoZone is quietly undervalued or if the market has already priced in the next leg of growth.

Most Popular Narrative Narrative: 21.5% Undervalued

With AutoZone last closing at $3,429.09 against a narrative fair value of about $4,369, the valuation view leans bullish and hinges on execution.

The analysts have a consensus price target of $4202.409 for AutoZone based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $4900.0, and the most bearish reporting a price target of just $2900.0.

Want to see what earnings path and margin profile could justify a premium multiple for a mature retailer like AutoZone? The narrative leans on steady growth, disciplined buybacks, and a surprisingly rich future valuation bar. Curious how those moving parts combine to argue the stock is still below fair value?

Result: Fair Value of $4,369 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent inflation and elevated tariffs on China sourced parts could prolong margin pressure and delay the earnings recovery that this bullish narrative relies on.

Find out about the key risks to this AutoZone narrative.

Another Angle on Valuation

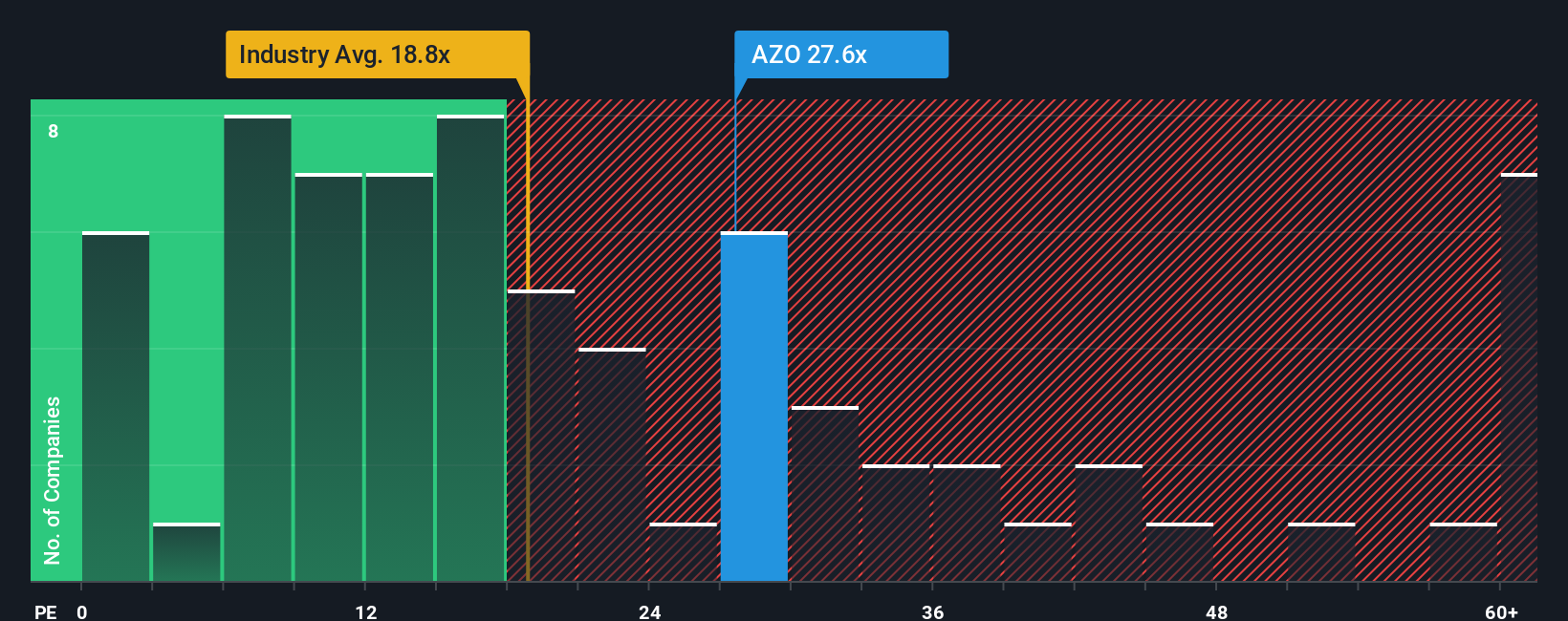

On earnings, the picture looks very different. AutoZone trades on a P/E of 23.1 times, comfortably above the US Specialty Retail average of 20.6 times and even above its own 19.9 times fair ratio, yet still cheaper than peers at 39.2 times. Is the market overpaying for quality, or underestimating risk?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own AutoZone Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a full narrative in just minutes: Do it your way.

A great starting point for your AutoZone research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Before you move on, set yourself up for the next potential opportunity by using our powerful Screener to uncover stocks that fit your strategy in minutes.

- Explore possible market mispricings by targeting companies that look inexpensive on fundamentals with these 916 undervalued stocks based on cash flows based on cash flows.

- Focus on one of the fastest evolving themes by scanning these 24 AI penny stocks shaping the development of intelligent technology.

- Strengthen your income-focused approach by examining these 13 dividend stocks with yields > 3% offering cash returns above 3 percent.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal