CRISPR Therapeutics (CRSP): Reassessing Valuation After a 13% Pullback and Strong Year‑to‑Date Gains

CRISPR Therapeutics (CRSP) has quietly pulled back over the past 3 months, even though the stock is still up sharply year to date. That disconnect is what makes the setup interesting now.

See our latest analysis for CRISPR Therapeutics.

After a strong run earlier in the year, the recent 90 day share price return of minus 13.03 percent and cooler short term moves suggest momentum is fading a bit. However, the year to date share price return of 32.13 percent and a 12 month total shareholder return of 33.32 percent still point to investors cautiously re-rating CRISPR Therapeutics as its gene editing pipeline and CASGEVY rollout evolve.

If this kind of volatility has you comparing ideas, it is a good moment to explore other innovative names in healthcare through healthcare stocks.

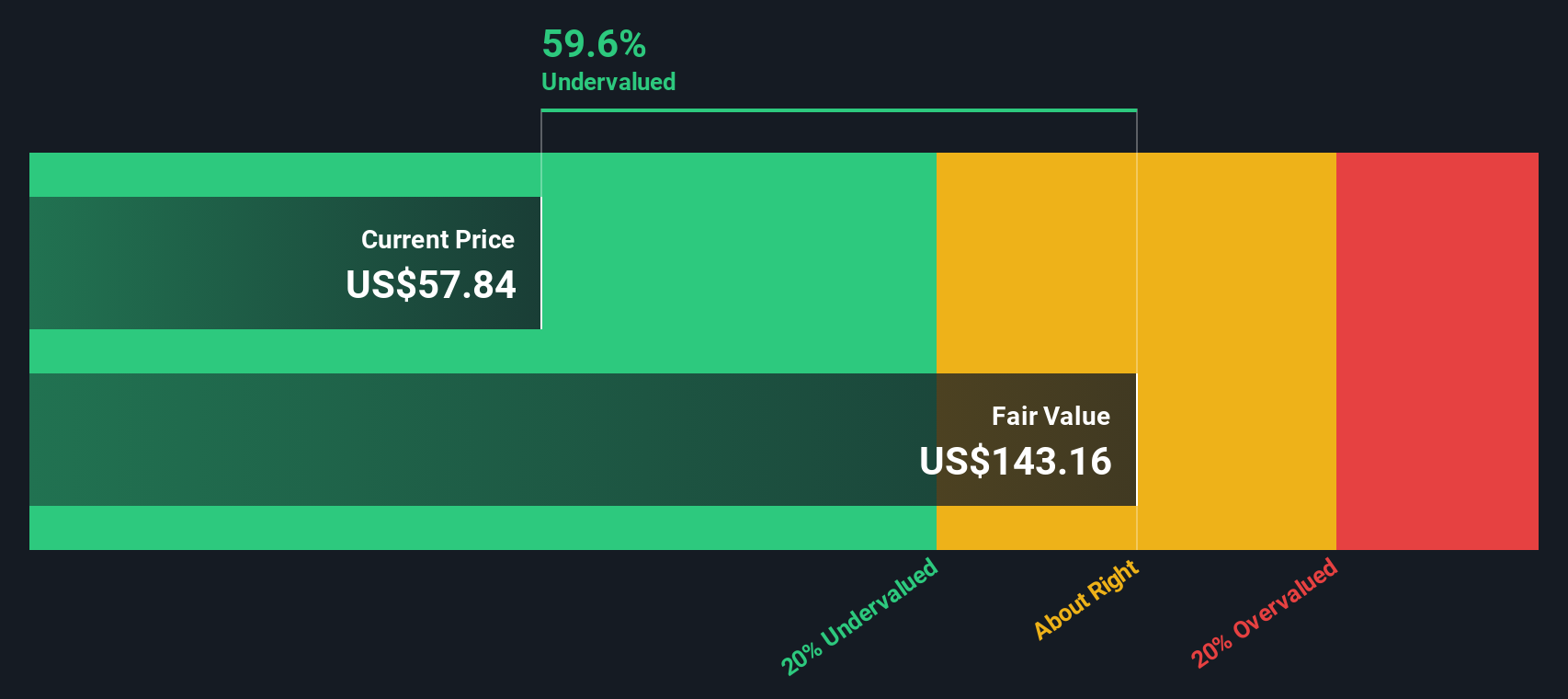

With shares still trading well below analyst targets despite rapid top line growth, the key question now is whether CRISPR Therapeutics remains meaningfully undervalued or if the market is already pricing in its next leg of growth.

Price to Book of 2.7x: Is it justified?

Based on price to book, CRISPR Therapeutics trades at 2.7 times its book value, a level the market currently treats as slightly expensive versus peers.

Price to book compares the company’s market value to its net assets on the balance sheet. This is especially relevant for early stage, loss making biotechs where traditional earnings based metrics are less useful. For CRISPR Therapeutics, this means investors are paying a premium over its accounting equity for access to its gene editing platform and pipeline potential.

Despite the stock looking a touch expensive against the broader US Biotechs industry average of 2.6 times, it screens as good value versus a much richer 20.2 times peer average. This suggests the market is not assigning a runaway premium to its story yet and may still be underestimating its long term optionality. Without a robust fair ratio to signal where the multiple could ultimately settle, the current price to book looks like a middle ground between sector caution and selective optimism.

See what the numbers say about this price — find out in our valuation breakdown.

Result: Price to book of 2.7x (ABOUT RIGHT)

However, significant clinical or regulatory setbacks for CASGEVY or other lead programs could quickly compress the valuation and challenge the market’s cautiously optimistic re rating.

Find out about the key risks to this CRISPR Therapeutics narrative.

Another View, Our DCF Lens

While the price to book ratio presents CRISPR Therapeutics as roughly fairly valued, our DCF model indicates a different perspective, suggesting a fair value closer to $125.93 compared with the current $54.74. If that gap narrows, it could be because expectations change or because the underlying story evolves in an unexpected way.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out CRISPR Therapeutics for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 913 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own CRISPR Therapeutics Narrative

If you see the story differently or want to dig into the numbers yourself, you can build a personalized view in just minutes, Do it your way.

A great starting point for your CRISPR Therapeutics research is our analysis highlighting 2 key rewards and 1 important warning sign that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop with a single opportunity. Sharpen your edge by scanning hand picked stock ideas on Simply Wall Street before the market wakes up to them.

- Capture growth potential early by reviewing these 3635 penny stocks with strong financials that pair tiny market caps with real financial strength.

- Position yourself for the next productivity boom by assessing these 24 AI penny stocks that may benefit from accelerating AI adoption.

- Explore value opportunities now with these 913 undervalued stocks based on cash flows where current prices differ from long term cash flow potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal