Assessing Nektar Therapeutics (NKTR) Valuation After a Volatile Year and Recent Share Price Pullback

Market context and recent performance

Nektar Therapeutics (NKTR) has quietly turned into a high volatility story stock, with shares up more than 200% over the past year even as the past month has been choppy.

See our latest analysis for Nektar Therapeutics.

That surge has come with a reality check, as the 30 day share price return of negative 23.22% and recent weekly pullback suggest some speculative heat is cooling even though the 1 year total shareholder return remains exceptionally strong.

If this kind of sharp biotech swing has your attention, it might be a good moment to scan other healthcare stocks that could offer a different balance of risk and opportunity.

With revenue finally growing again but losses still deep and the share price trading at a steep discount to analyst targets, investors face a familiar crossroads: is Nektar undervalued here or already pricing in a biotech turnaround?

Most Popular Narrative: 60.3% Undervalued

With Nektar Therapeutics last closing at $45.43 versus a fair value estimate of $114.43, the most followed narrative is firmly skewed toward upside potential.

Robust cash position after the recent equity raise extends runway into 2027, providing operational stability to advance late-stage assets and initiate Phase III trials without near-term dilution or financing risk, which supports earnings predictability and reduces financial leverage concerns.

Want to see what powers such a bold valuation? The narrative leans on sharp revenue shifts, margin transformation, and a future earnings multiple more often seen in market darlings. Curious which precise assumptions make that price tag add up?

Result: Fair Value of $114.43 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, the story could unravel if upcoming REZPEG data disappoints or if litigation outcomes and financing needs prove more painful than bulls expect.

Find out about the key risks to this Nektar Therapeutics narrative.

Another Angle on Valuation

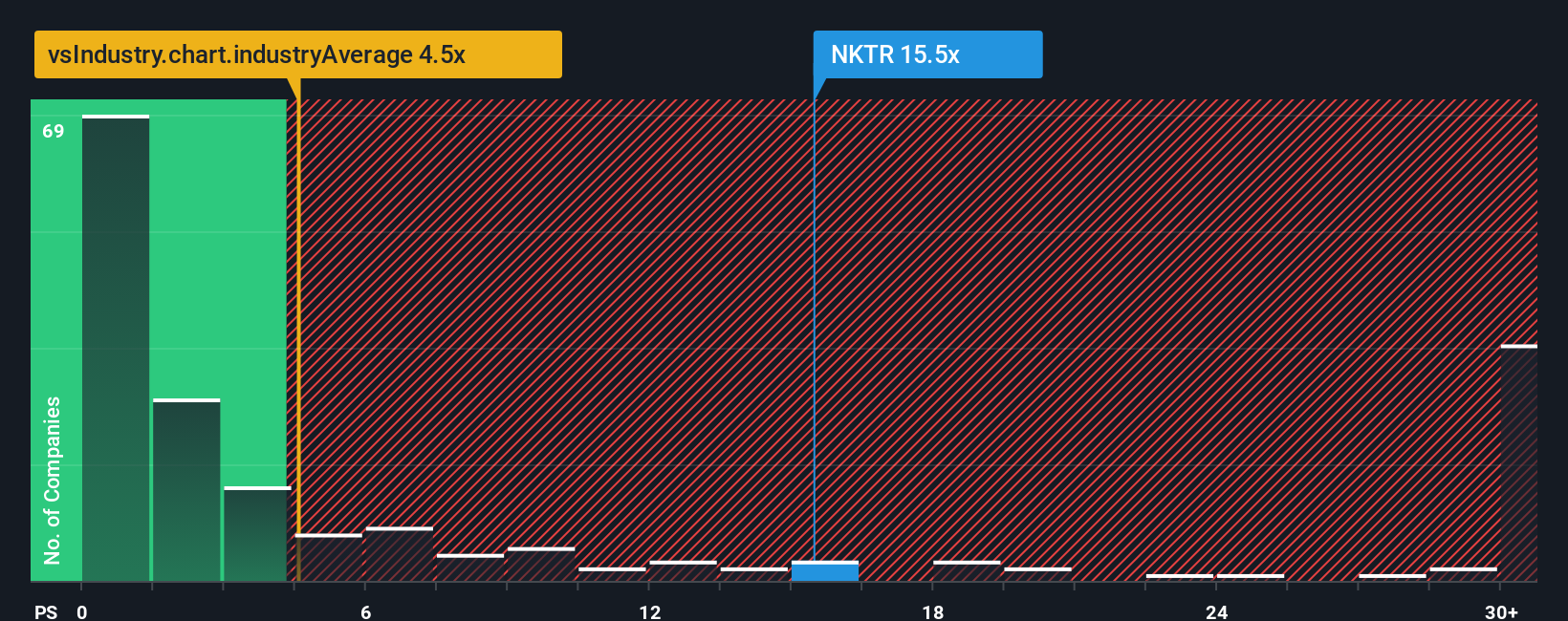

While the narrative model suggests Nektar may be 60% undervalued, its price-to-sales ratio of 14.8 times tells a sharper story. That is higher than both US pharma peers at 12.9 times and its own fair ratio of 6.4 times, which indicates potential downside if enthusiasm cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Nektar Therapeutics Narrative

If you see the numbers differently or want to stress test the assumptions yourself, you can build a full narrative in just minutes: Do it your way.

A great starting point for your Nektar Therapeutics research is our analysis highlighting 3 key rewards and 5 important warning signs that could impact your investment decision.

Ready for more high conviction ideas?

Do not stop at a single opportunity. Use the Simply Wall St Screener now to spot fresh stocks that match your strategy before the crowd reacts.

- Capture asymmetric upside with early stage names by scanning these 3636 penny stocks with strong financials that already show stronger fundamentals than the typical speculative trade.

- Position yourself for the next productivity boom by targeting these 24 AI penny stocks that merge real revenue traction with cutting edge artificial intelligence exposure.

- Lock in potential mispricings by focusing on these 914 undervalued stocks based on cash flows that trade below what their future cash flows suggest, before sentiment catches up.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal