DoorDash (DASH): A Fresh Look at Valuation After Recent Share Price Pullback

DoorDash (DASH) shares have been on a choppy ride lately, slipping about 3% in the last session but still sitting on strong year to date and one year gains that keep investors engaged.

See our latest analysis for DoorDash.

That pullback comes after a strong run, with the share price at $221.3 and a robust year to date share price return, while the three year total shareholder return above 300% shows momentum is still very much intact.

If DoorDash has you rethinking growth stories in this space, it is worth exploring high growth tech and AI stocks for more tech driven platforms that could be setting up for the next leg higher.

With shares still up strongly over the past year and trading at a sizable discount to analyst targets, the big question now is whether DoorDash remains undervalued or if the market has already priced in its next wave of growth.

Most Popular Narrative Narrative: 19.9% Undervalued

With the narrative fair value sitting well above DoorDash's last close of $221.30, the storyline leans toward meaningful upside if forecasts hold.

Strategic investments in AI and automation, such as enhanced search, personalization, logistics optimization, and autonomous/robotic delivery, are expected to lower fulfillment costs per order over time, driving sustained improvements in operating leverage and net margins.

Curious how aggressive growth, richer margins, and a lofty future earnings multiple can still pencil out as attractive value? The narrative maps a bold path from today’s profitability to much larger, more diversified earnings power. Want to see which assumptions really carry this valuation?

Result: Fair Value of $276.41 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, this upside depends on smooth execution, as rising labor and regulatory pressures or slower international adoption could quickly squeeze margins and derail growth expectations.

Find out about the key risks to this DoorDash narrative.

Another Lens on Valuation

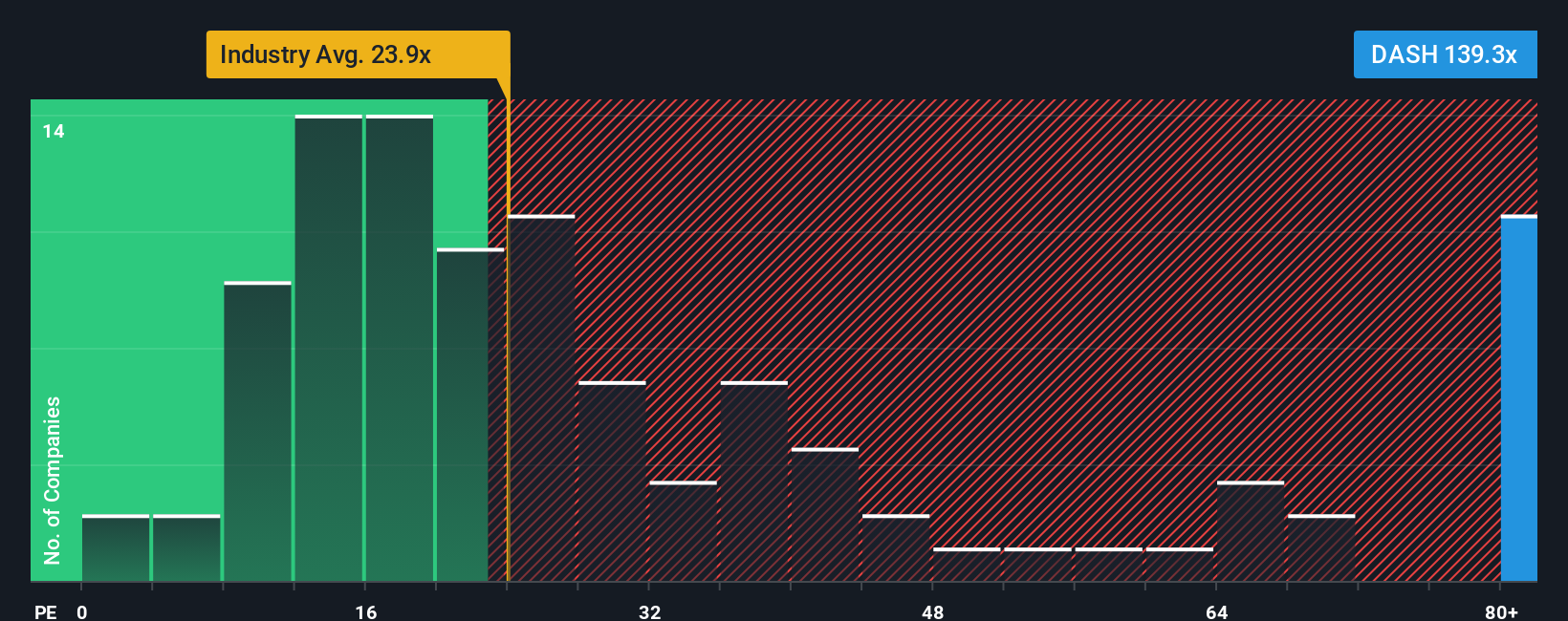

While the narrative points to roughly 20% upside, the earnings multiple paints a much hotter picture. DoorDash trades on a price to earnings ratio of about 110.5 times, far above the US Hospitality industry at 23.8 times and peers at 35.1 times, and even above a fair ratio of 50.1 times. This suggests meaningful valuation risk if growth stumbles or sentiment cools.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own DoorDash Narrative

If this view does not quite match your own, dive into the numbers yourself and build a tailored storyline in just a few minutes, Do it your way.

A good starting point is our analysis highlighting 4 key rewards investors are optimistic about regarding DoorDash.

Ready for your next investing edge?

Step up your strategy with hand picked stock ideas on Simply Wall St's powerful screener and avoid leaving high conviction opportunities on the table.

- Capitalize on mispriced quality by scanning these 914 undervalued stocks based on cash flows that look set to rerate as cash flows compound.

- Ride the next wave of innovation by targeting these 24 AI penny stocks poised to benefit from accelerating demand for intelligent automation.

- Lock in reliable income potential by focusing on these 13 dividend stocks with yields > 3% that can support long term portfolios through varying market cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Nasdaq

Nasdaq Wall Street Journal

Wall Street Journal